A rise in geopolitical tensions helped spark the decline in the equity markets last week. Large-cap averages like the S&P 500 Index (INDEXSP:.INX) traded more than 1.0% lower while small-cap indices suffered the most with the Russell 2000 Index (INDEXRUSSELL:RUT) falling nearly 3.0%.

Although much of the credit for the decline was given to the North Korea situation, the deteriorating underlying technical condition perhaps played a larger role.

New highs by the Dow Industrials (INDEXDJX:.DJI) in August disguised the fact that the average stock was making little headway or losing ground since mid-July. Very often deteriorating market breadth precedes weakness in the popular US equity averages. The anemic performance by the broad market occurred at a time when investor optimism was spiking. Additionally, stocks had entered in what has been historically the weakest three-month period (August-October) for equities. This combined with the fact that the S&P 500 has not experienced a 5.0% correction in 14 months (the longest stretch in 20 years) it could be argued that the stage was set for a stock market pullback or correction.

A sustained rally will likely require improvement in the broad market accompanied by a steep rise in investor pessimism.

Looking further out, the longer-term fundamentals remain in place to allow for a scenario that equity prices will turn higher later in the year. This is supported by the fact that the expansion of corporate profits and revenue should continue into 2018.

The largest threat to the stock market is considered to be a significant rise in interest rates. This appears unlikely given the latest inflation data that shows pricing pressures receding on many fronts.

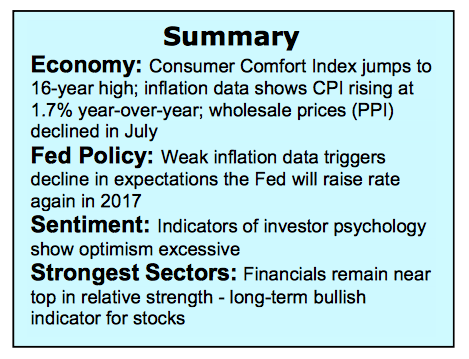

The Consumer Price Index (CPI) crawled up 0.1% in July, its first increase in three months. The Producer Price Index (PPI) declined 0.1% versus expectations of 0.2% increase. Given the inflation numbers the Federal Reserve is likely to move cautiously in raising rates. The fed funds futures market now gives a December rate hike a 25% probability, down from 50% last month.

The stock market technicals continue to point to caution near term. Although the large-cap indices remain in close proximity to the recent highs, conditions below the surface have been deteriorating since late July. This is seen by the fact that the number of issues hitting new highs failed to expand as the S&P and Dow hit new highs earlier in August. Last week witnessed a spike in the number of issues hitting new lows. Should the new low list continue to expand it would suggest the current decline is more than a pullback.

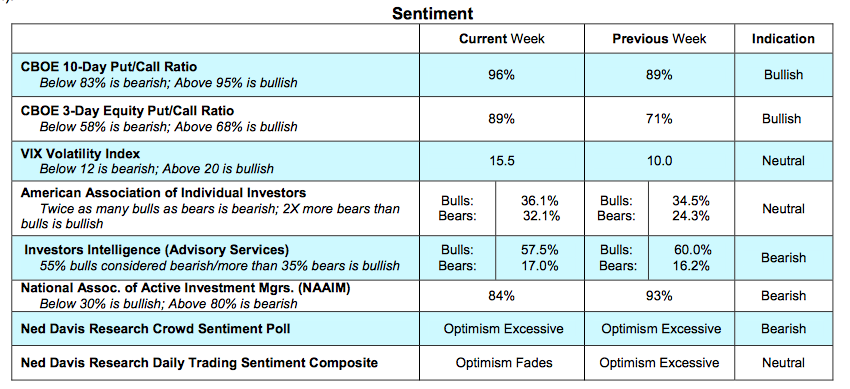

Before the decline runs its course we will likely see an oversold condition accompanied by a reversal in investor psychology. Evidence that this could be underway was seen in the jump in the demand for put options last week. For confirmation that investor psychology has moved from optimism to pessimism we would need to see the bulls in the Investor Intelligence data fall below 48% and the ratio of bears/bulls climb to 2X or more in the survey from the American Association of Individual Investors (AAII).

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.