Key Takeaways for Investors:

– The S&P 500 has rallied to a new high, but evidence that risks are receding has been mixed.

– Improved momentum and index level breadth would help, as would better sector-level trends and global rally participation.

– Continued strength from broker/dealers would suggest that the recent rise in bond yields may be sustainable (and evidence of an improving macro economic backdrop).

S&P 500 Index

The S&P 500 has returned to record territory, and this time it has been joined by the Dow Industrials (which have finally confirmed the new highs in the Transports). Given that the most bullish thing stocks can do is go up, new highs alone are not a reason for concern. New highs are more likely to be followed by more new highs than they are to be followed by significant (and lasting) weakness. As investors we tend to anchor to the last in a series of new highs, not the new highs that emerge along the way.

With that as the backdrop, we can look for evidence that supports the view that new highs are sustainable in the current situation. From an index-level perspective, an upturn momentum and a continued increase in the breadth of the rally (as measured by the percent of stocks trading above their 200-day averages) would suggest that risks are receding and the rally could continue.

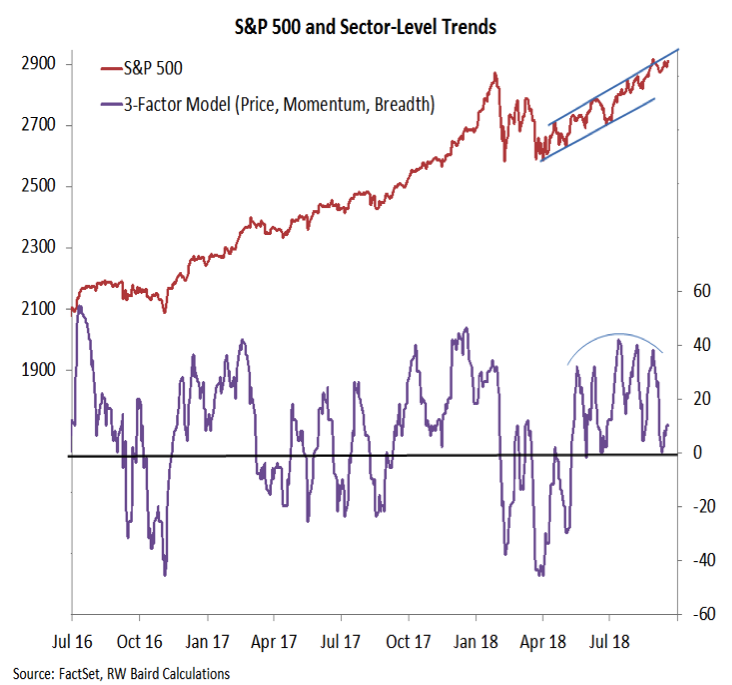

The most recent index-level rallies for the S&P 500 have come with a deterioration in sector-level trends (this chart is included in the weekly Market & Sector Trend Summary published on Monday mornings). While trends have deteriorated, and this indicator has made lower highs, the lows that have held over the course of the second and third quarters remain intact. Without a further break-down in sector-level trends, sustained weakness in the S&P 500 may be unlikely. Additionally, a rebound in sector-level trends could help fuel index-level strength.

Of more significance than the moderation in sector-level trends is the degree to which global breadth has deteriorated. Fewer than half of the markets within the All-Country World Index have 200-day averages that are rising. The strength being seen in the U.S. is not being broadly echoed around the world. In fact, the U.S. accounts for 120% of the YTD gain in the MSCI World Index (h/t @BullandBaird).

History suggests that this degree of global weakness typically leads to further weakness in global stocks. Evidence that more markets around the world are getting back into rally mode would suggest that risks in the U.S. are receding, as the strongest rallies are global in nature. The best case would be the emergence of a global rally of sufficient strength to produce a breadth thrust (the absence of which we have chronicled).

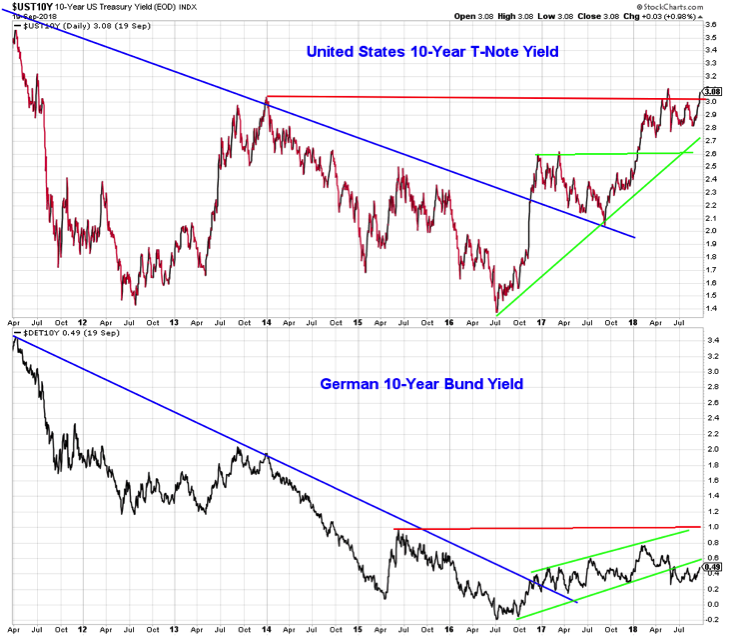

With the macroeconomic backdrop (especially in the U.S.) remaining on reasonably firm footing, a further modest rise in bond yields would be encouraging evidence that risks have receded. After moving sideways for most of 2018, the yield on the 10-year T-Note has moved back toward the multi-year high it recorded in May. German Bund yields had been moving lower since peaking in February. More recently, however, they have risen off their lows and have echoed the rise in U.S. yields. If German yields can sustain an advance, it could help support U.S. yields. This would help confirm our thesis (outlined in this week’s Macro Update) that the economy is poised to see a sustained acceleration in growth.

Strength in the Broker/Dealer index could lead to further rallying on the S&P 500 and would support the view that the recent rise in bond yields is sustainable. The XBD has made a series of lower highs from both a price and momentum perspective since early 2018. Since mid-year, it has been trending lower relative to the S&P 500. While it made a new price low earlier in September, this was accompanied by a positive divergence from a momentum perspective.

Evidence of a sustainable rally is still tentative however. A price rally that carries above the 200-day average and the July highs (and is accompanied by higher highs from a momentum perspective) would be evidence of a change in character that could suggest overall market risks are receding.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.