The S&P 500 and the NASDAQ hit new record highs last week but more stocks were down than up.

Typically, the opposite should be true. In a healthy rising market, the majority of stocks, groups and sectors should be rising along with the averages.

Deteriorating market breadth was exhibited on Friday with roughly 200 stocks in the S&P 500 up and almost 300 down. On the New York Stock Exchange, twice as many stocks were down then up.

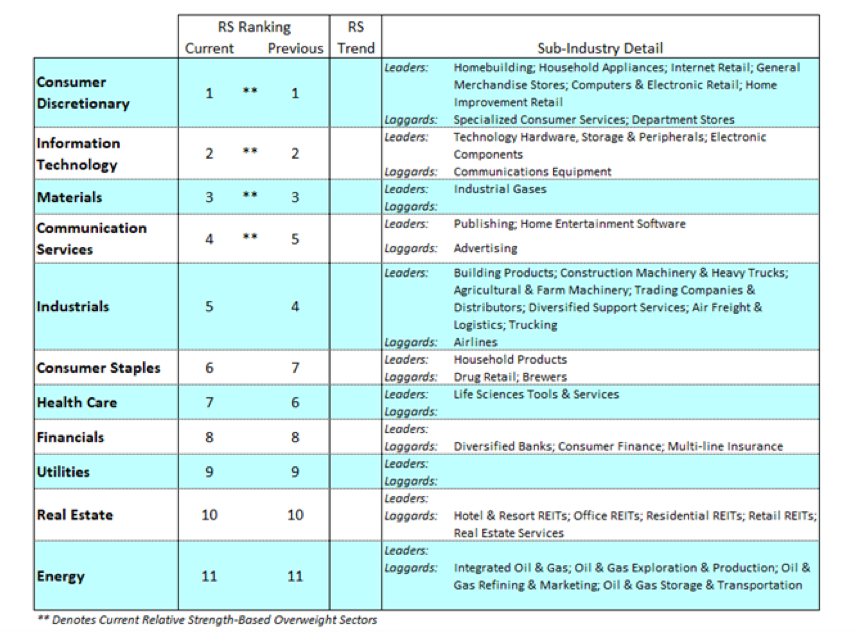

Information technology was the best performing sector of the week, +3.40% versus an increase of .70% for the S&P 500.

The market is divided between sectors that do well in a coronavirus environment like technology and consumer discretionary (Amazon, Target and Walmart) and sectors that are suffering from the effects of the pandemic.

Early August saw a broadening out of the market as there were signs of the beginning of a rotation out of the technology stocks and into the cyclicals and small-cap stocks.

Economic numbers were improving and business activity rebounding.

But over the past 10 days that rotation has stalled. For the market to enjoy a new leg up in the bull market, there should be a rotation into cyclical and value stocks as this would be evidence that the economy is improving and moving in the direction of a recovery in 2021.

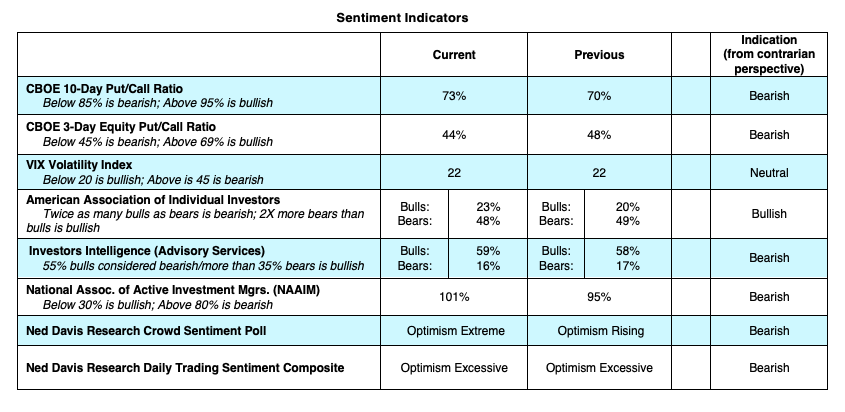

Investor sentiment has moved deeper into the excessive optimism zone, a contrarian stance.

– The CBOE reports the lowest demand for puts versus calls in more than a decade.

– The Ned Davis Daily Trading Sentiment Composite and Crowd Sentiment Poll moved into the excessive optimism zone where historically short-term returns have been muted.

– Wall Street letter writers, as measured by Investors Intelligence, show a jump in bulls last week to 59.5%, the highest level since the January 2020 peak at 59.4%. The percentage of bears in the survey was the fewest since March 2018.

– Last week individual investors deposited a record $5 billion into domestic equity funds, the highest in nine weeks and confirmation that sentiment is excessively optimistic.

Stock Market Valuations: Currently, the price of stocks relative to earnings and sales, points to valuations that are stretched. But the earnings yield of the S&P 500 (earnings per share for the most recent 12 months divided by the average of current prices) on Friday was 3.7% compared to the 10-year Treasury yield at .64% making stocks look more fairly valued.

Economic Backdrop: At the July 28-29 meeting of the Federal Open Market Committee, the participants observed that “uncertainty surrounding the economic outlook remained very elevated with the path of the economy highly dependent on the course of the virus.”

It was also noted that the longer-term effects of the pandemic associated with possible restructuring in some sectors of the economy could slow the growth of the economy’s productive capacity for some time. They renewed their commitment to use all the tools in their tool box to support the financial markets until the economy shows signs of stabilization.

The Bottom Line: An accommodative Federal Reserve and interest rates likely to remain low for years suggests stocks should offer investors opportunities for both growth and income.

Near term, however, some headwinds have surfaced. The current rally has become very narrow based, and investor optimism is excessive and widespread, which from a contrarian viewpoint raises the odds of a pullback. The market is also entering September, which historically is a challenging month for stocks.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.