The Markets

The Dow Jones Industrials (INDEXDJX:.DJI) and S&P 500 Index (INDEXSP:.INX) soared to new highs Monday on the back of improved prospects for passage of tax reform legislation.

The markets are overbought and this could be a ‘sell the news’ event in the near-term. But, the stock market clearly is smitten with the idea.

The Senate passed early Saturday a tax reform package paving the way for lower corporate taxes. The aim of the tax reform bill is to enable both big and small business to grow and hire. Consensus estimates are that tax reform will boost 2018 S&P 500 earnings by $10 and add nearly 90 basis points to GDP growth.

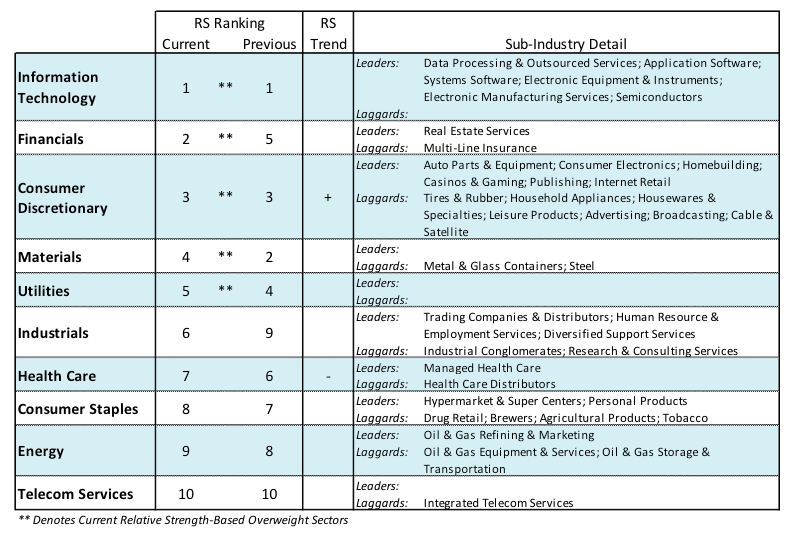

The proposed tax changes also help explain the rapid sector rotation last week away from technology stocks into the financial sector. Tech companies gain a large portion of the sales and income from overseas operations while the financial sector benefits primarily from an expanding domestic economy. The rotation out of tech to the financials is seen as a positive development as the financials have a long history as market leaders.

Economy and Interest Rates

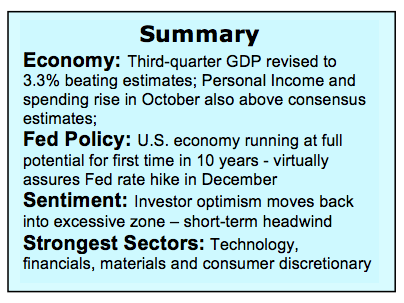

The U.S. economy is outpacing economists’ forecasts. For the first time since 2007 the U.S. economy is running at full potential, according to the Congressional Budget Office. This confirms the bullish signals provided by the Citicorp Economic Surprise Index. The index tracks economic data relative to expectations and has leading tendencies for both the economy and the stock market. Consensus estimates for fourth-quarter GDP growth stretch from 2.50% to 3.50%. The economic reports due this week include the November non-farm payroll data. Consensus estimates are that the economy generated 180,000 new jobs and the unemployment rate remained at 4.1%. This should have little influence on the Fed’s decision to raise interest rates when they meet on December 12.

Stock Market Technicals

The weight of the technical indicators points to a continuation of the bull market well into 2018, albeit with increased volatility.

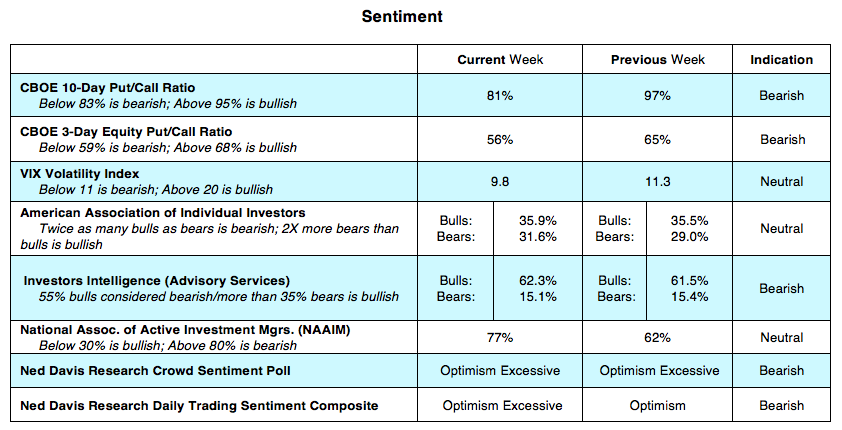

The broad market has fully recovered from the weakness seen in the third quarter. Virtually all areas of the stock market are now in gear with the primary trend. The Dow Transports soared nearly 6.0% last week closing at new record highs confirming the new highs by the Dow Industrials. Additionally, the percentage of S&P 500 stocks trading above their 50-day moving average soared to 76% last week from 63%. Sentiment indicators, however, show investor optimism in the excessive zone. This would suggest that the trend of the market into year-end will not be without some sharp swings in both directions. Nevertheless, the clear message from the Tape is that the path of least resistance is to the upside. Short-term support is near the brief lows on Friday at 2604.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.