The equity market rallied for the second week in a row last week with the S&P 500 Index gaining more than 50 basis points. This week has started on a similar note for U.S. equities.

The popular stock market averages have recovered more than 50% of the February correction.

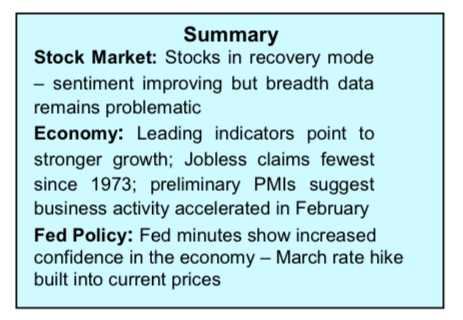

Investor concerns about rising inflation expectations, Federal Reserve monetary policy and rising bond yields were catalysts to the February correction. So where are stocks at now?

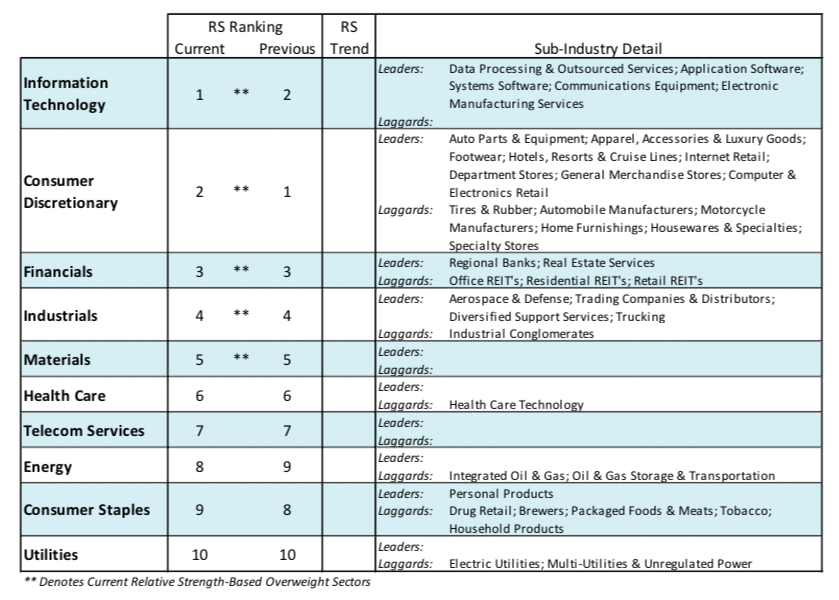

The leadership continues to be growth sectors while defensive areas including utilities, consumer staples and telecom show virtually no improvement in relative strength. The fact that defensive sectors are lagging while aggressive growth areas continue to lead is considered a favorable development as defensive sectors typically begin to outperform aggressive sectors prior to the stock market experiencing a significant correction. Additionally, bear markets generally occur during times of recession.

In the current environment, there are no signs of an economic downturn. The market instead has pulled back on fears of too much growth rather than too little.

The Federal Reserve has indicated that it expects inflation to pick up but does not appear to be concerned about the economy overheating. The focus of attention this week will be on the Federal Reserve’s new chairman, Jerome Powell’s commentary before Congress on Tuesday. Expectations are that Powell will continue on the current path of monetary policy with the first rate hike to be initiated at the March 20-21 meeting. We will also be watching gross domestic product data on Wednesday and consumer spending and core inflation data on Thursday.

Entering the new week, bonds remain oversold with pessimism widespread and excessive. Despite a heavy offering calendar from the U.S. Treasury, the yield on the benchmark 10-year Treasury note fell to 2.87% from 2.95% earlier in the week. We believe that the financial markets have discounted the prospects for three 25 basis point increases in 2018. Fed policy would likely turn unfriendly should the unemployment rate drop below 4% and/or the economy exhibit signs of overheating with the core CPI inflation rising to 2.5%.

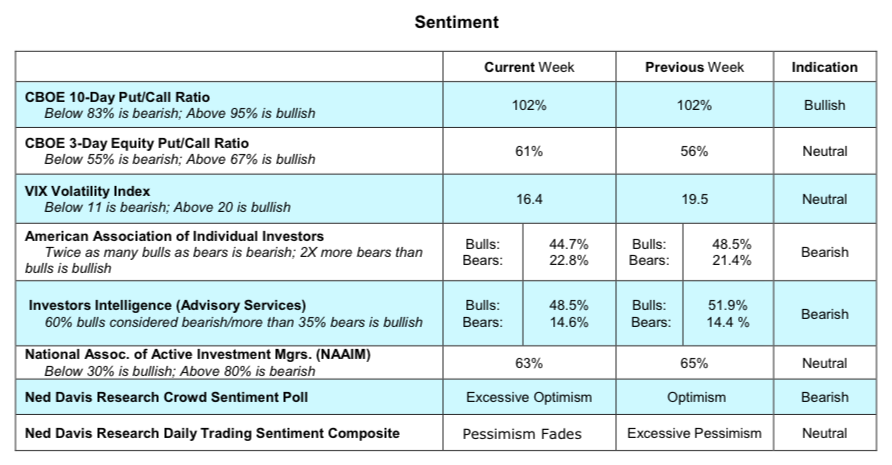

Technically, the current rally in stocks has been accomplished on unusually low volume with little improvement in breath. Despite the rally, only 51% of S&P stocks are trading above their 50-day moving average while the percentage of S&P groups in defined uptrends has fallen to just 60% from 80% in January. The fact that downside momentum has yet to be broken suggests stocks will slip into a trading range environment near term versus a quick return to new highs. We would expect to see two sessions where upside volume exceeds downside volume by a ratio of 10-to-1 or more for confirmation that the February correction has run its course.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.