The Dow Jones Industrials fell 3 percent overall last week, while the S&P 500 fell around 2 percent. The Russell 2000 showed some relative strength falling just 1 percent.

The poor performance was underscored by an announcement by President Trump on Thursday that the U.S. will impose tariffs on steel and aluminum imports starting this week.

Stocks are bouncing to start the week, but this concern will likely linger for a while.

Investors and stock traders are concerned that U.S. companies will have to pay more for steel and aluminum in cars and trucks, likely passing the increased costs on to consumers. The president responded by saying that our industries have been “decimated” by unfair trade practices and long term this tariff will level the playing field and is bullish for American companies, their workers and the American people.

There will be inevitable retaliation by foreign governments that will hurt U.S. exports and not be good for stocks but Commerce Secretary Wilbur Ross anticipates the retaliation will be minimal.

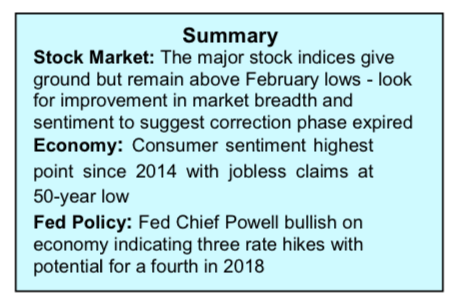

Investors are also dealing with the possibility of higher inflation, higher interest rates and the possibility of a more aggressive monetary policy. Federal Reserve Chief Powell has indicated there will be three 25 basis point rate hikes in 2018 with an outside chance of a fourth. Economic growth continues to be solid and employment strong.

Although uncertainty over trade and interest rates captured all the headlines, the weak technical underpinnings of the stock market also played an important role in last week’s decline.

Looking beyond the uptick in volatility that is expected to be a persistent theme in 2018, we would need to see several technical developments to conclude the correction phase has run its course. Before stocks break out from the current trading range, we need to see improvement in stock market breadth and investor psychology. Bullish breadth would be reestablished when the percentage of industry groups within the S&P 500 that are in defined uptrends rises to 72% from 56% as of the close last Friday. Additionally, only 33% of S&P stocks are trading above their 50-day moving average and this needs to improve to 60% or more to support the prospects the current decline has run its course. After seeing multiple days of downside volume overwhelming upside volume by more than 9-to-1 as stocks moved lower in early February, we are looking for two days where upside volume outpaces downside volume by 9-to-1 or more to suggest momentum has shifted and is now a tailwind for stocks.

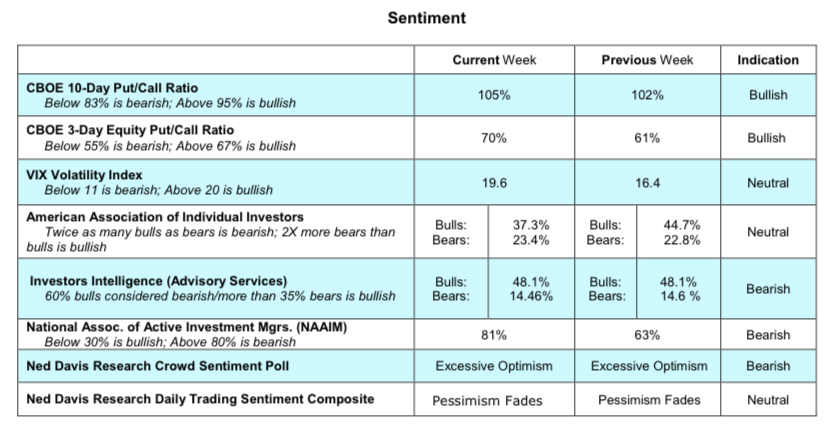

In terms of sentiment, we are concerned that there has not been a meaningful increase in investor pessimism despite the large increase in volatility this year. The element of fear is nearly always found at an important market low and something that is missing in the present example. Trading range with support at 2600 and resistance 2800 using the S&P 500 Index.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.