The equity markets rallied for the third week in a row last week pushing the S&P 500 Index and Dow Jones Industrial Average to levels last seen in mid-December.

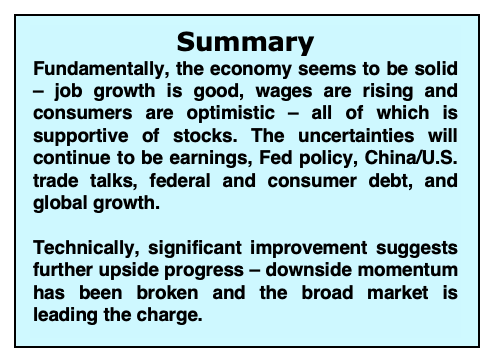

Support for the strong advance has been a reversal in Fed policy from two or three rate hikes in 2019 to a possible pause in rate increases this year.

The markets were also boosted in early January by an exceptionally strong December jobs report that helped relieve the notion that the economy could slip into recession. We have been experiencing the “January effect” of the market’s worst-performing stocks in December becoming the best-performing stocks in January.

Additionally, last week we also witnessed what appear to be positive trade talks with China. After four rate hikes in 2018, the fed funds futures market is currently pricing no change for the target rate, currently at 2.25% to 2.50% for the remainder of 2019. Economists surveyed by the Wall Street Journal last week see a 25% chance of a recession this year, noting trade tensions with China, global growth, and uncertain Fed policies as possible triggers.

Federal Reserve Chief Jerome Powell has indicated that incoming economic data would be their guide as to policy going forward. If inflation continues to stay low, the Fed does have the ability to cushion the economy against slower growth that could lead to a recession.

Fourth-quarter profit reports begin to flow this week and with reduced expectations this should not be a threat to the current rally. Investors will be more interested in the future guidance that will set the tone for earnings growth in 2019.

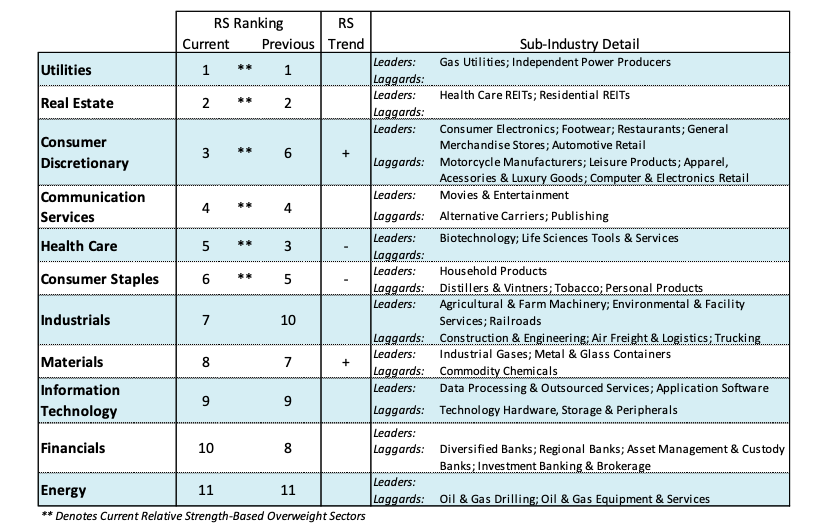

Given estimates that the U.S. economy will grow 2.5% or more in 2019, we recommend investors focus on the consumer discretionary sector that replaced consumer staples last week in the top five S&P 500 sectors in terms of relative strength. There was also considerable improvement in the industrials relative strength and we are expecting confirmation from materials and the energy sectors that a shift in leadership away from defensive sectors toward cyclicals is underway. Sector analysis will be increasingly important in 2019 as opposed to passive investment strategy.

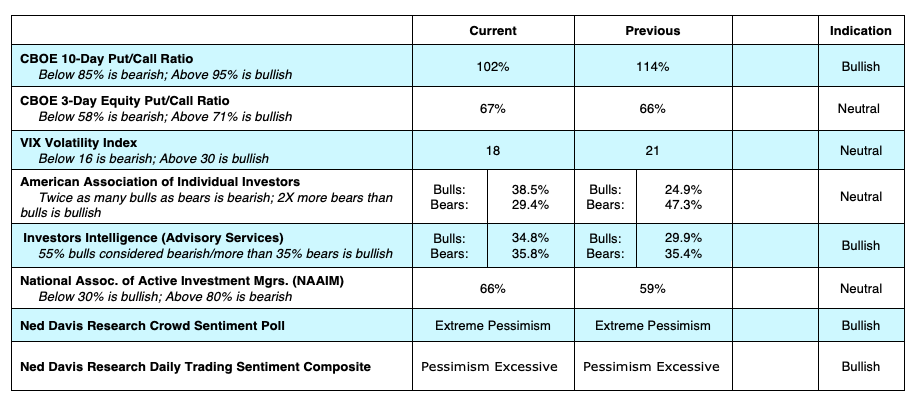

The technical indicators argue that the lows for the cycle are in place. The most significant change has occurred in the performance of the broad market. This is seen by the outsized rally by the small-cap Russell 2000 index that is up 14% from the December 24 low. Since late December, the stock market has experienced two sessions where upside volume has overwhelmed downside volume by a ratio of 10 to 1 or more. This is a positive development indicating that the downside momentum has been broken and the broad market is leading the charge. Further evidence of improvement in stock market breadth is found by the fact that 90% of stocks are trading above their 10-day moving average. Measures of investor sentiment show a movement away from the extreme pessimism found on Christmas Eve, but there is no evidence that optimism has returned to pre-October levels. While we are encouraged by the improvement in the stock market’s technical condition it does not come without a caveat that historically there is almost always a retest of the lows.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.