The NASDAQ Composite Index broke a three-week losing streak gaining 1.1% last week while the S&P 500 Index and the Dow Jones Industrial Average extended losses for the fourth straight week.

Information technology was the best performing sector, increasing by 2.10% versus a loss of 0.6% for the S&P 500 Index.

The main contributors to the recent pullback in the equity markets are last week’s announcement that the number of first-time filers for unemployment benefits was slightly higher than expected which has likely dampened recovery sentiment. Ruth Bader Ginsberg’s death may have created apprehension that the Phase 4 Stimulus Package would be set aside while our elected officials battle over the Supreme Court nominee. Federal Reserve Chairman Jay Powell has warned that the economic outlook would be hurt without the additional Federal Government stimulus.

Additionally, rising trade tensions between the U.S. and China, the possibility of a delay of presidential election results on November 3 as well as fears of a covid resurgence in Europe added to the uneasiness in the markets. The market has reacted with a four-week pullback, which has been led by weakness in the mega-cap stocks that comprise roughly 22% of the S&P 500 Index.

Reasons for optimism

Currently there are about ten states that have significant lockdowns still in place which contributes to the unemployment numbers. However, the past week several major cities have initiated Phase 3 opening plans where restrictions are loosened on all restaurants, bars, hotels and other businesses. There is still about $130 billion in loans in the small business Payback Protection Program that has not been distributed and only a small percentage of the $600 billion in the Federal Reserve’s Main Street Lending Program to support medium to large businesses has been allocated due mainly to red tape.

As this money finds its way into the hands of businesses, we can expect to see an improving labor force. While a full economic recovery may be years away, reducing unemployment will continue to move the economy in the right direction.

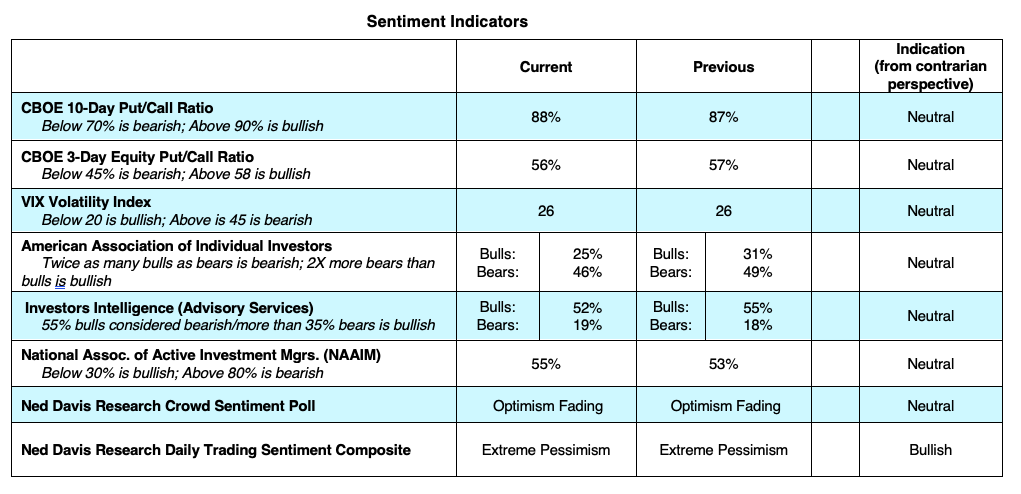

Technical indicators remain neutral

The sentiment indicators we look at suggest investor psychology is moving in the direction of excessive pessimism, a bullish development for the markets. Call option buying, which has been excessive over the past month, has begun to slow down substantially. Pessimism can also be seen in the data from Investors Intelligence that shows an ongoing contraction in the bullish camp and in the Ned Davis Daily Trading Sentiment Composite that has moved to excessive pessimism as of Friday night’s close. We are not seeing the euphoria that signals a significant market pullback.

On the flip side, we are seeing a deterioration in the performance of the broad market. The current pullback began with the selling of the mega-cap tech stocks but has now rotated into broader-based selling as the economic data discouraged investment into cyclicals. Both the S&P 500 and the NASDAQ closed below their respective 50-day averages last week.

The Path Forward

We have a healthy list of unknowns – resurgence of the virus during flu season, a delayed outcome of the presidential election, trade, government stimulus package in jeopardy, a weakening economy, and the dominance of a handful of stocks leading the market. But the Federal Reserve continues to reiterate their commitment to support the financial markets until they are confident the economy is far along the road to recovery. They plan to keep interest rates close to zero through 2023 and until the labor market achieves a high level of employment and they expect inflation to average 2%. Investors may want to consider good quality corporate bonds or municipal bonds for yield and to help reduce portfolio volatility. I expect volatility will be with us as the second half of the year winds down but with interest rates set to stay low for several years, I believe the path of least resistance for equities remains to the upside.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.