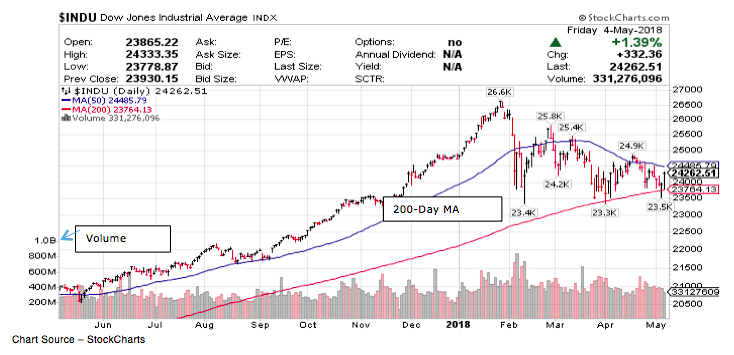

Last week the Dow Industrials and S&P 500 recovered from periods of weakness early in the week to finish on Friday virtually unchanged.

And thus the roller coaster continues…

Market Summary / Update

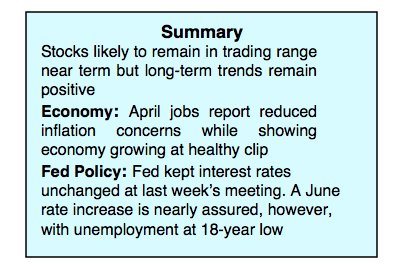

The April jobs report announced last week showed the economy added fewer jobs than expected even though unemployment declined to an 18-year low. Corporate earnings announcements have continued to impress with a record share of S&P companies posting stronger-than-expected results. Given that earnings will continue to be reported this week and with the market oversold, Friday’s rally is likely to continue over the very near term.

Nevertheless, the positive economic news including tax cuts, deregulation and repatriation of capital is being offset by investors continuing concerns over fears of a trade war with China, the likelihood of a tightening monetary policy, a rising dollar, slower global growth and the midterm elections. This struggle argues for stocks to remain in a trading range over the next few months.

Stock Market Technical / Sentiment Indicators

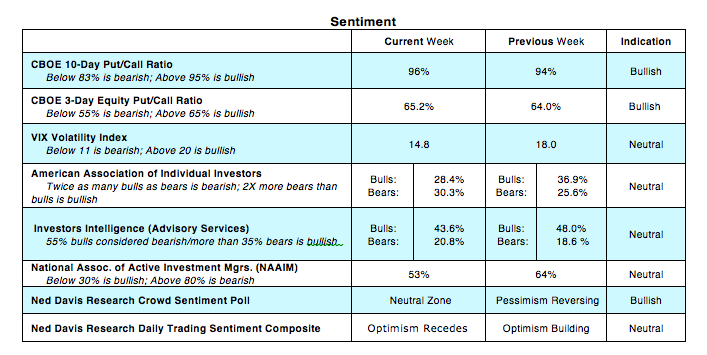

The technical indicators showed modest improvement last week offering support for further rally attempts entering the new week. Investor psychology showed signs of moving deeper into the pessimistic mode, a bullish indication from a contrary opinion standpoint. The demand for put options expanded (investors buy puts in anticipation of lower stock prices) and surveys of sentiment among individual investors show an increasingly cautions and skeptical mood.

This is also true of professional investors, as measured by the survey from the National Association of Active Investment Managers (NAAIM), which shows a reduction of their allocation to equities. From a contrary opinion perspective this is seen as a positive short-term development. Looking further out, stocks are entering a seasonally weak period that extends into October. Historically these seasonal pressures occur with more reliability in mid-term election years.

The bottom line is that to have a measure of conviction that the consolidation / correction phase has run its course will rely heavily on breadth improving with 70% of S&P issues trading above their 50-day moving average and/or two sessions where upside volume exceeds downside volume by a ratio of 9-to-1 or more.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.