The equity markets continue to climb higher with the S&P 500 and NASDAQ stock indices advancing into new record high territory.

The best gains of late have been recorded since the Friday morning speech by Fed Chief Jerome Powell that was interpreted as friendly to the financial markets. Friday’s rally carried over to today…

The important themes Powell underscored were that the economy is strong and that the Fed is setting monetary policy to support continued growth and a strong labor market while keeping inflation near the target of 2.0%.

Powell noted that overheating of the economy does not seem likely. Powell’s notes on the economy and Target’s CEO comment that “this might be the strongest consumer environment I’ve ever seen” undermines the notion that the growth rate of the U.S. economy is slowing.

The Citi Economic Surprise Index (measures actual data against Wall Street estimates and is a gauge of optimism about the economy) recently drifted into negative territory causing some concern. But strong retail sales and the jobless claims data showing the smallest number seeking unemployment insurance in decades along with the Fed’s assessment of the economy argue otherwise.

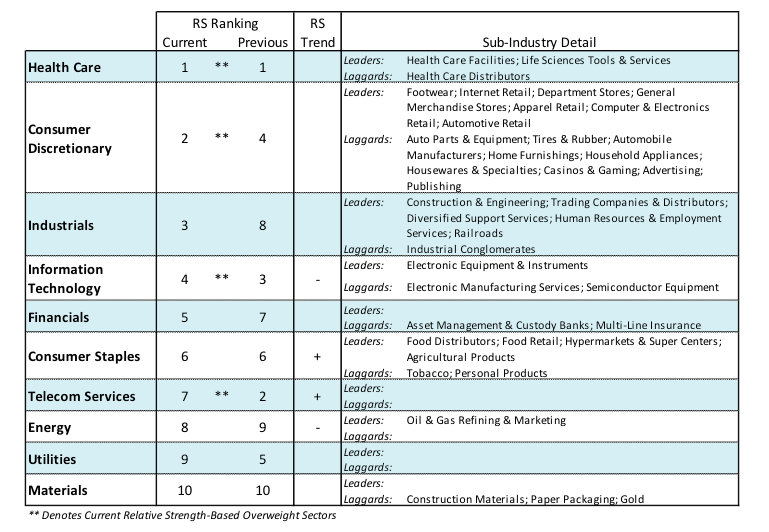

Nevertheless, as economic growth remains solid, investors will continue to grapple with ongoing trade tensions, high debt levels and more restrictive interest rates. This has led to a reduced appetite for risk, evidenced by the fact that the technology sector is losing relative strength while defensive areas have gained in recent months. Given the current backdrop, we think it’s wise to diversify into health care, which is the top sector within the S&P 500 Index in terms of relative strength and consumer discretionary, which has ascended to number two.

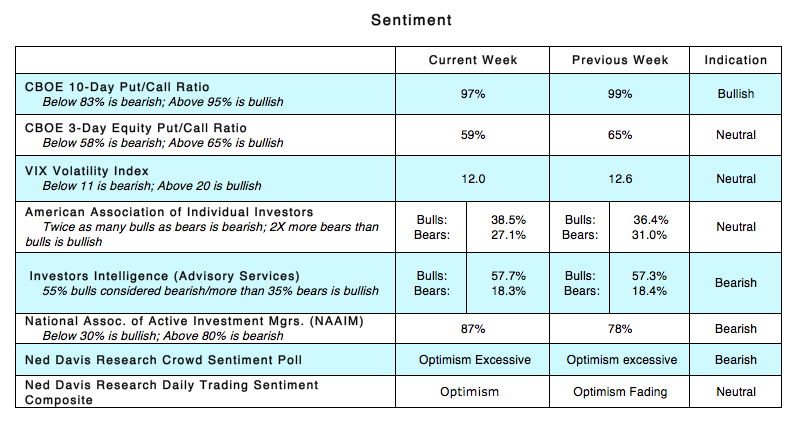

The technical condition of the stock market shows deterioration in the sentiment indicators while measures of stock market breadth remain neutral.

Investor psychology turned more optimistic last week. Using contrary opinion, this is a concern. The latest survey by the American Association of Individual Investors (AAII) shows a tilt toward more optimism with 38% bullish and 27% bearish. The shift in investor mood is also reflected in the latest report from Investors Intelligence (II), which tracks the opinion of Wall Street letter writers. The bullish camp within the report climbed to 57.7%, up from 47.1% in June. Readings of 55% and higher have been a reliable signal for increased caution historically. A reading above 60%, which last appeared at the January peak, suggests risks are elevated.

The widely followed Ned Davis Daily Trading Sentiment Survey Composite upticked last week and is approaching a level associated with excessive optimism. Stock market breadth, as measured by the percentage of stocks trading above their 200-day moving average, shows little improvement. Despite the S&P 500 breaking above the January high, 67% of stocks within this average are above their 200-day moving average versus 82% in January. We would be encouraged should the percentage of stocks above their 200-day moving average rise above 70% in the coming weeks. This would argue that breadth is significantly improving.

Additionally, a strong indication that a new leg up in the bull market is underway would occur with a session when upside volume overwhelms downside volume by a ratio of 10-to-one or more.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.