This continues to be a time where investors don’t want to get too aggressive on the long side. We are in a wait-and-see mode.

Both the S&P 500 Index and Nasdaq 100 Index are trading into an area of price resistance that is accompanied by a momentum divergence.

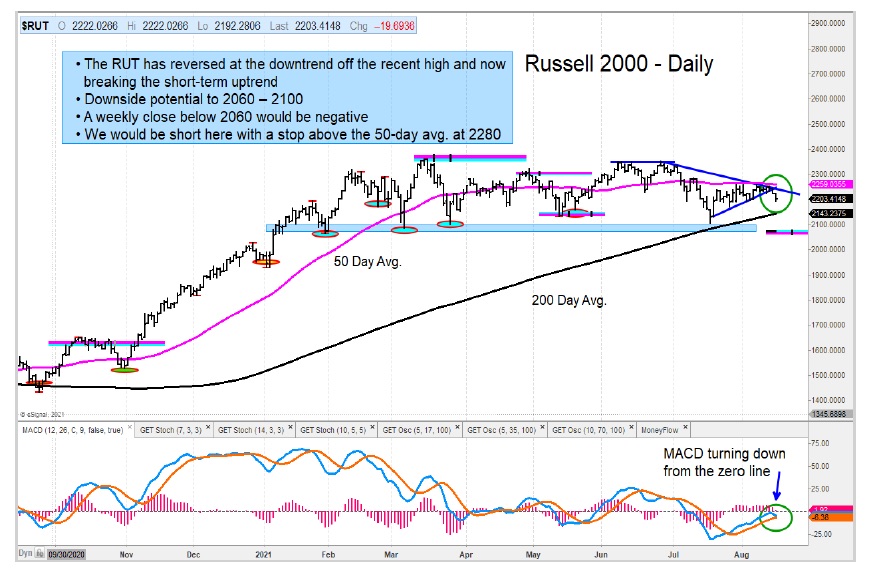

I am outright bearish on small cap stocks and the Russell 2000. The index has reversed from its two-month downtrend. This looks like a distributive top forming.

The Mid-Cap Index (MDY) is stuck between a support and resistance zone. I am on alert for a break either way.

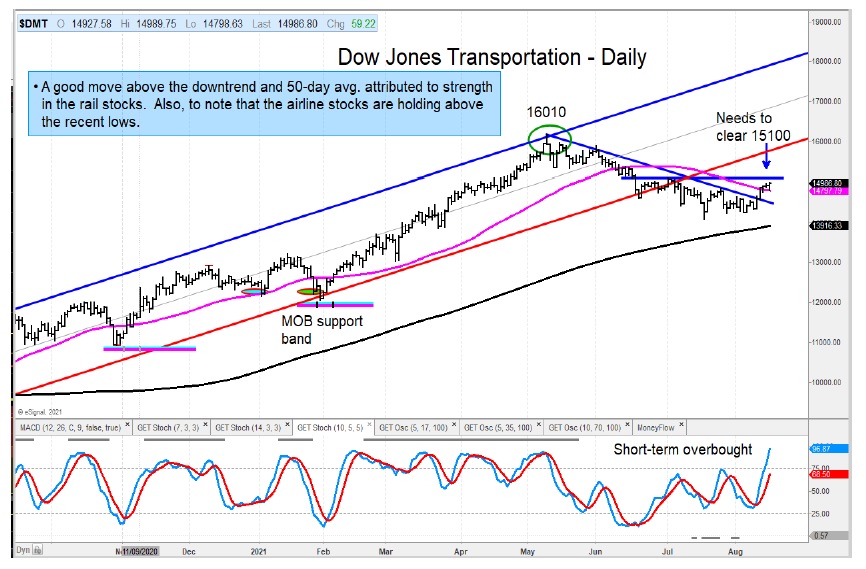

We saw strength in the Dow Transports in recent days with the help of the rails moving higher. The airlines are holding above their recent lows. I need to see if the index can break above near-term resistance at 15100.

The author or his firm have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.