The Dow Jones Industrial Average, heavily weighted with companies with global exposure, finished more than 500 points lower last week. And is trading lower to start the week ahead also…

Large multi-national corporations continue to grapple with concerns of a strong dollar and escalating trade tensions.

Increased tariffs create the potential for higher prices and slower global economic growth. Over the past week, the U.S. announced higher tariffs on imports from Europe, China and other countries. Other countries have retaliated with tariffs on U.S. goods. The U.S. is a net importer not a net exporter of Chinese goods giving the U.S. the negotiation advantage. China sold the U.S. $500 billion in goods last year while the U.S. sold it $150 billion.

This situation exists with other nations as well. Commerce Secretary Wilbur Ross reiterated last week that the new tariffs are the only way to achieve more fair and reciprocal trade practices to insure the future growth and prosperity of U.S. companies.

The small-cap stocks, a group that is more reliant on the domestic economy, suffered a modest weekly decline with the NASDAQ Composite up about 12% for the year and the Russell 2000 Index up about 10% for the year. We can expect continued volatility surrounding tariff announcements in the coming weeks but believe this will be offset by the continuation of economic growth.

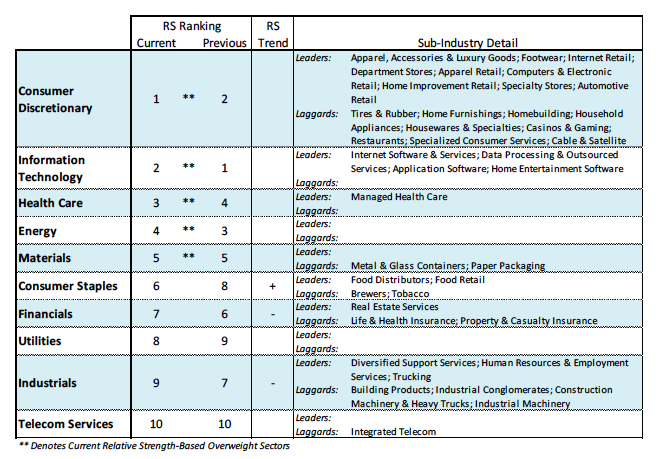

Earnings are up by double digits. Consumer confidence and business confidence remain at the highest levels in more than a decade with the labor market continuing to tighten. Tax cuts and reduced regulations offer additional support against trade challenges. Next week’s economic data is likely to point to a growing economy. The bottom line is that improving U.S. economic conditions are offsetting trade concerns. Defensive sectors of the market are showing improving relative trends the past two weeks, including health care, consumer staples and utilities.

The technical condition of the stock market favors a wide-swinging trading range as market breadth, seasonal tendencies and investor sentiment are seen as headwinds. Although the stock market has remained resilient in the face of a more aggressive Fed and rising trade tensions, the support has come from a small group of stocks within the technology sector.

The broad market, however, has languished with seven of the 10 S&P 500 sectors down on the year. Ned Davis Research reports that the 10-top stocks account for 12% of the total market cap. Seasonal factors also suggest stocks are likely to find upside progress to be slow. The market has a history of struggling into mid-term elections and August and September are the weakest months of the year for stocks. Investor sentiment, which is used as a contrary opinion indicator, shows high optimism but short of what is considered excessive. Sentiment also extends to earnings expectations that are unusually high. Second-quarter profit reports will begin to flow in a few weeks and represents a risk to the market. As a result, we anticipate that the equity markets will remain in a trading range as we move deeper into the summer months.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.