U.S. equities are trying to consolidate the solid gains made last week… a week in which all major sectors gained ground.

The Employment Report for February was announced on Friday which showed very strong jobs growth. And the stock market responded in kind with a big rally.

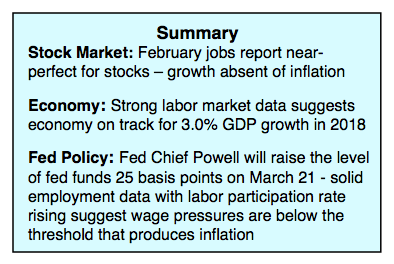

Nonfarm payrolls increased by 313,000 in February which beat consensus estimates. Additionally average hourly earnings increased .2% as expected which brought the year-over-year increase down to 2.6% from 2.8%. The non-farm payroll data cannot be understated as it suggests the U.S. economy is moving in a higher gear while at the same time the subdued wage growth is giving investors no reason to believe the Federal Reserve will need to be more aggressive.

Additionally, the fact that President Trump accepted an invitation to meet with North Korean leader Kim Jong-Un may have added to investor optimism. The tariff on aluminum and steel news was softened by the announcement that Mexico and Canada will be exempt as well as the possibility that other countries may be as well.

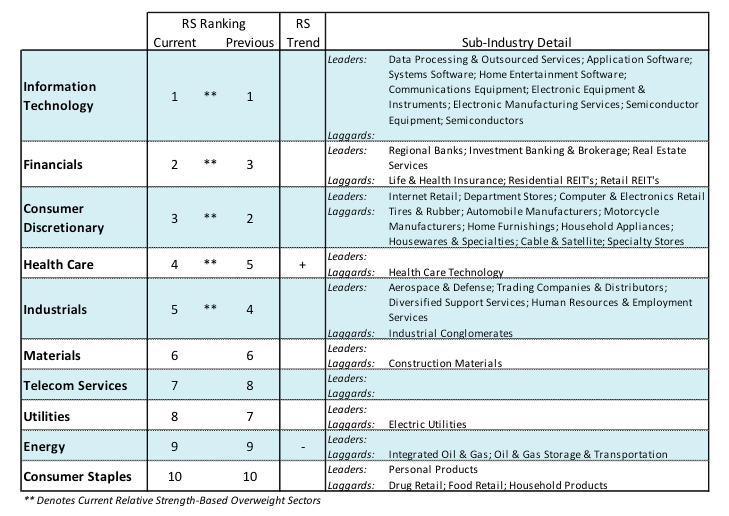

Defensive sectors of the equity market failed to gain a foothold during the January / February correction. During prolonged corrections in the stock market, defensive sectors typically rise to the top of the relative strength leader board. In the present example, leadership has remained with S&P 500 sectors closely aligned to the economy, including the industrials, financials, technology, consumer discretionary, and materials. With the economic data positive, we suggest staying with the strongest sectors as opposed to taking a more defensive stance.

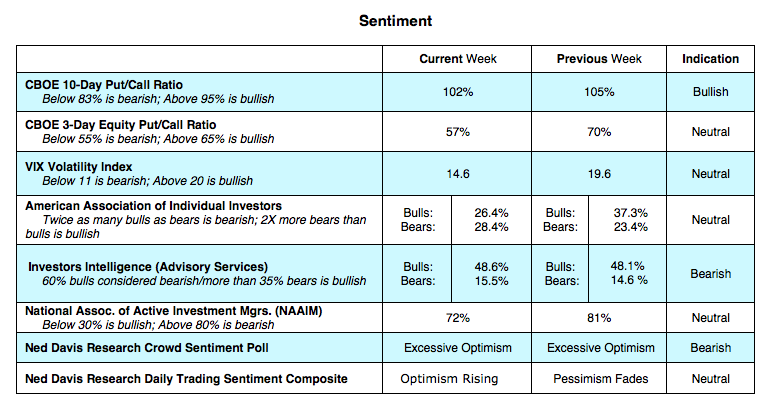

The technical picture has brightened. Improvement was seen by the rise in the percentage of groups within the S&P 500 that are in defined uptrends which expanded to 64% from 56%. A reading of 72% or more would argue that most areas are back in gear with the primary trend. The percentage of S&P stocks trading above their 50-day moving average also improved, climbing to 56% but needs to improve to 65% to have solid bullish implications. The March rally has not provided the strong expansion in upside volume versus downside volume that often signals the beginning of a new leg up in the bull market is underway. Measures of investor sentiment are slowly improving but, from a contrary opinion standpoint, there has not been enough purging of the bulls during the correction phase that typically turns on the green light.

Bottom line, stocks continue to be bolstered by strong corporate earnings and a solid economy. A surge in market breadth would suggest a new leg up in the bull market is underway.

CHARTs

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.