On Wednesday (11/23) federal regulators increased the amount of renewable fuels oil refiners will be required to blend into gasoline and diesel for 2017 up to 19.28 billion gallons. In what was seen as victory for the ethanol industry (and also corn producers), the EPA mandated a 1.2 billion gallon increase in renewable fuels over current levels. The amount of conventional biofuels (corn-based ethanol) required was raised to 15.0 billion gallons.

The question now is, “Will this mandated increase in conventional biofuels lead to even higher U.S. ethanol industry run-rates and by extension more demand for U.S. corn, which serves as the primary feedstock for ethanol?”

U.S. Ethanol Production & Corn-Ethanol Demand

To answer this let us first assess the current state of U.S. ethanol production, as well as the USDA’s latest forecast for 2016/17 U.S. corn-ethanol demand…

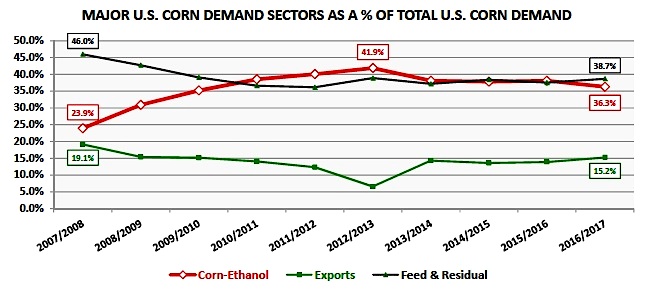

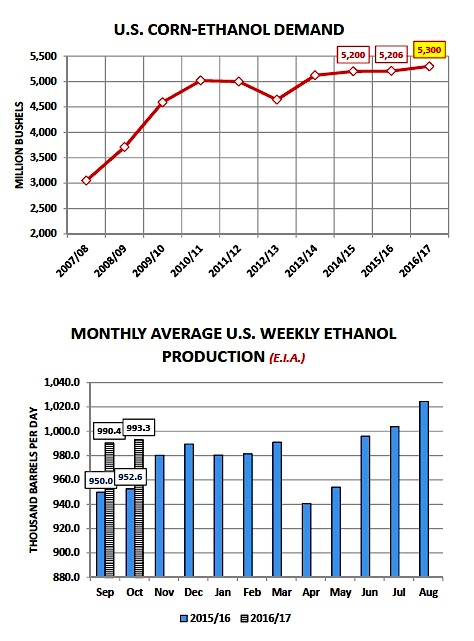

The E.I.A.’s most recent “Weekly Petroleum Status Report” showed U.S. ethanol production of 1,014 thousand barrels per day for the week ending November 18th, 2016. Thus far 3-weeks into November, weekly U.S. ethanol production has averaged 1,011 thousand barrels per day versus 988.3 thousand barrels day over the same time period in 2015, representing a 2.3% increase. More specifically as it relates to the corn market, current Crop Year weekly ethanol production for 2016/17 has averaged 996.5 thousand barrels per day versus 960.7 thousand barrels per day in 2015 (September 1st through the 3rd week in November). This equates to an even more impressive 3.7% increase.

What does this mean for U.S. corn-ethanol demand?

As of the November 2016 WASDE report the USDA was forecasting 2016/17 U.S. corn-ethanol demand of 5,300 million bushels versus 5,206 million bushels in 2015/16, a 94 million bushel increase or +1.8%. In theory then it could be argued that the USDA is currently underestimating 2016/17 U.S. corn ethanol demand by as much as 100 million bushels. A 3.7% increase in crop year weekly ethanol production versus 2015/16 (assuming that increase is maintained from Sep 1st, 2016 through August 31st, 2017) would suggest a U.S. corn-ethanol demand figure closer to 5,400 million bushels for 2016/17 versus its November estimate of 5,300 million.

That said why hasn’t the USDA raised its 2016/17 U.S. corn-ethanol demand forecast to reflect the current real increase in weekly ethanol production of +3.7%?

- I would contend the most obvious reason is the 2016/17 crop year is less than 3 months old. Therefore if the current pattern of higher weekly ethanol production proves sustainable for another 3 to 4 months, especially through the 1st quarter of 2017, the USDA will likely increase their usage estimate going forward. The first quarter of every calendar year historically has proven itself to be a very difficult margin environment for ethanol producers due to the seasonal downturn in gasoline demand. Lower gasoline demand equals lower ethanol blending, which in turn is typically associated with U.S. ethanol stock builds during Q1. The result has often been added pressure to both ethanol prices and ethanol plant margins, which proves necessary to reduce the incentive for ethanol plants to run at maximum capacity. The one possible offset this winter could be a strong U.S ethanol export market. This could neutralize the full impact of lower U.S. gasoline demand during the winter months.

- The other more difficult element when trying to assess the correlation between weekly ethanol production and the corresponding corn demand used to produce those gallons is what the industry refers to as the “ethanol yield.” The ethanol yield is the amount of ethanol produced from one bushel of corn. Other the last 5-years the average industry ethanol yield has improved substantially due to a variety of technological advances; however the key takeaway is simply this, U.S. ethanol producers are producing more ethanol with less corn. I would estimate the current average industry ethanol yield at approximately 2.85 gallons of ethanol per one bushel of corn. This would then suggest 2016/17 U.S. corn-ethanol demand of 5,375 million bushels (this assumes crop-year U.S. ethanol production of 15.32 billion gallons, which is the E.I.A.’s current average weekly ethanol production run-rate of 996.5 thousand barrels per day maintained for a 12-month period extending from September 1st, 2016 through August 31st, 2017).

HOWEVER if the average industry ethanol yield eventually proves to be closer to 2.88 gallons of ethanol per one bushel of corn, the 2016/17 U.S. corn-ethanol demand estimate drops to 5,318 million bushels, which would be just 18 million bushels higher than the USDA’s current forecast. The average industry ethanol yield is not a static figure, it will continue to improve. Herein lies the challenge as far as projecting just how much corn is actually being used to produce ever-increasing U.S. ethanol industry run-rates.

continue reading on the next page (corn price outlook)…