One final key observation from the September WASDE report regarding the U.S. corn yield: NASS did lower its corn ear weight estimate slightly versus a month ago; however overall, 2016 ear weights are still projected to be record high (exceeding the current record from 2004).

Additionally, NASS is forecasting the 3rd highest ear count on record, trailing only 2014 and 2015. Historically it’s proven difficult to have both…I’m still anticipating additional decreases to ear weights in either the November or January WASDE reports. (Lower ear weights = Lower yield)

DECEMBER CORN FUTURES PRICE FORECAST

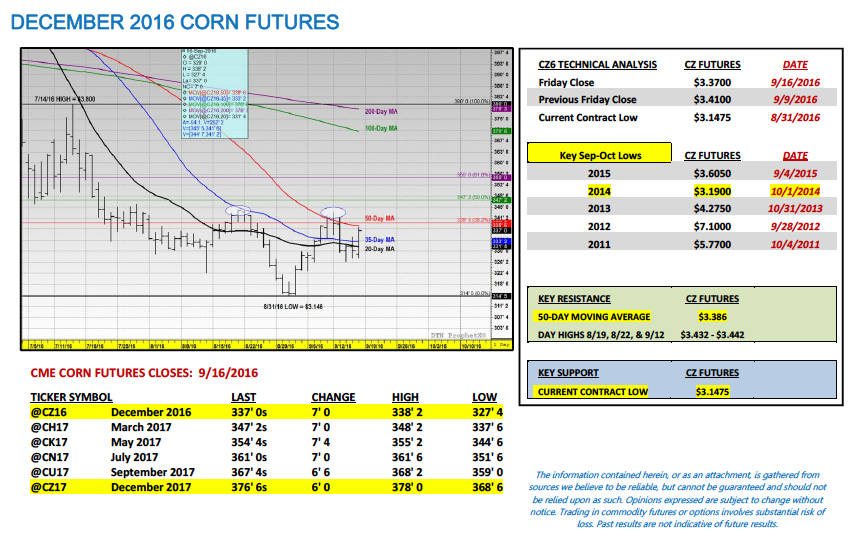

December corn futures closed on Friday at $3.37 per bushel, down 4-cents week-on-week. However all things considered it could have been much worse for Corn Bulls. On Wednesday CZ6 was in the process of carving out a day and week low of $3.26 ½ early in the session. It appeared a re-test of the current contract low of $3.14 ¾ from August 31st was inevitable. And then the selling pressure simply stopped. CZ6 closed back in green figures that same day and followed with a 7-cent higher close on Friday afternoon. What’s potentially providing price support on breaks below $3.30 CZ6?

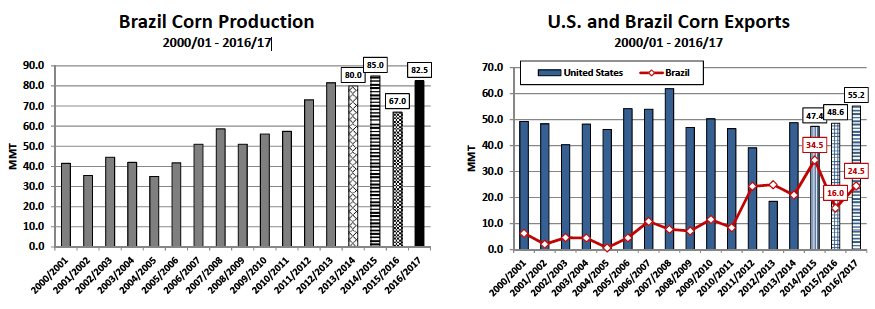

- USDA once again lowered Brazil’s 2015/16 corn production forecast in the September WASDE report, dropping it to 67.0 MMT versus 68.5 MMT in August. Relative to 2014/15 Brazil’s corn production estimate is now down an incredible 18 MMT or 709 million bushels. As a result Brazil’s year-on-year decline in corn exports is forecasted at 18.46 MMT or 727 million bushels. Brazil’s export loss continues to be the U.S.’s gain. In the USDA’s weekly export sales report for the week ending 9/8/2016, U.S. year-to-date corn exports for 2016/17 improved to 671.1 million bushels versus just 367.7 million a year ago (up 82 ½%).

- Friday’s Commitment of Traders report showed the Managed Money net show in corn being reduced to -146,940 contracts versus -180,893 contracts the week prior. Therefore Money Managers turned net buyers of nearly 34,000 corn contracts on the week despite what most in the market felt was a decidedly Bearish September WASDE report. Why then would the money shift back to buying corn if the U.S. corn S&D was still negative? The reality is it’s not uncommon for Money Managers to begin unwinding their net short positions after they believe the most Bearish fundamental aspects of a given commodity have already been digested and reflected in futures prices.

As this relates to the corn market specifically, if Money Managers perceive the U.S. corn yield is close to its current estimate of 174.4 bpa and U.S. corn ending stocks of approximately 2,400 million bushels are already priced into the current contract low from August 31st, their mentality will likely shift to one of reducing their net short positions. Even in 2014 (at present the only year the U.S. corn yield has exceeded 170 bpa in the January WASDE report), December corn futures rallied 69-cents off their harvest low of $3.19 on October 1st, recovering to a day high of $3.88 by November 13th.

Overall, I still expect December corn futures to meet strong resistance on continuation rallies above $3.40 next week. The 50-day moving at $3.38 ¾ hasn’t been breached on a closing basis since corn futures closed below that level on June 22nd. Therefore Monday’s session should tell us a lot about whether or a not traders can confidently say this year’s current contract low of $3.14 ¾ might hold through harvest.

Thanks for reading.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service