March corn futures closed up 14 ¼-cents per bushel week-on-week, finishing Friday at $3.81 ½, which represented the highest CH6 close since November 6th. January soybean futures also ended the week higher, closing up 8 ½-cents per bushel Friday afternoon at $9.06, which was the highest SF6 close since October 21st.

It was also the first time in weeks that either commodity has shown any ability to sustain even moderate recovery attempts, following what has invariably been a prolonged period of sideways to lower price action dating back to the latter half of August.

Early in the week the one story that continued to generate headlines and much speculation in corn and soybeans specifically was the Argentine election news and its potential impact on the corn market. More specifically, participants are digesting the newly-elected Argentine President Mauricio Macri and his new Argentine farming practices. March corn futures were unphased, rallying higher as some of the Argentine election news may have been priced in.

Macri will take office on December 10th and has already promised to eliminate immediately the 20% export tax on corn. The soybean export tax will be reduced by 5 percentage points to 30% with a plan purportedly in place to continue phasing it out by an additional 5% per year over the next 6 years. That said how might the Argentin election and these potential changes affect the future direction of Argentine corn and soybean production, as well as, the global export market for both commodities?

Let’s analyze the impact on the Corn market:

FACT – Argentina is already the world’s 4th largest corn exporter as of 2014/15 trailing only the United States, Brazil, and Ukraine…

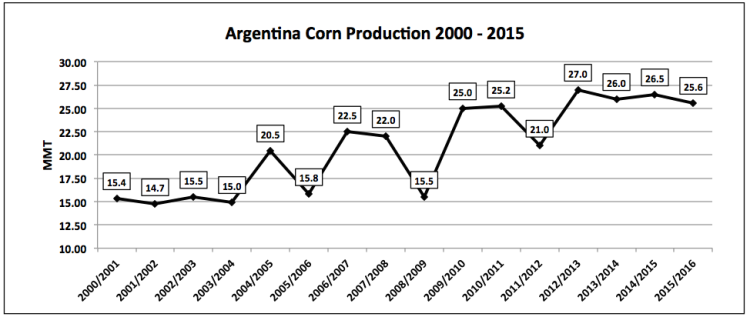

- I believe both the elimination of the 20% levy on Argentina corn exports, as well as the export quota system, which further hindered the producer’s ability to take advantage of higher global corn prices, will foster in a period of corn acreage expansion as soon as 2016/17. It’s been suggested by various private analysts that Argentina’s planted corn acreage could increase by up to 1 million hectares next crop year to approximately 4 million hectares total (or 9.9 million acres). The 3-year average corn yield in Argentina (2013-2015) is 7.98 MT/HA (or 127.1 bushels per acre). This would suggest 2016/17 Argentine corn production of 31.9 MMT, exceeding Argentina’s previous record production mark of 27 MMT in 2012/13 by 4.9 MMT (or 193 million bushels).

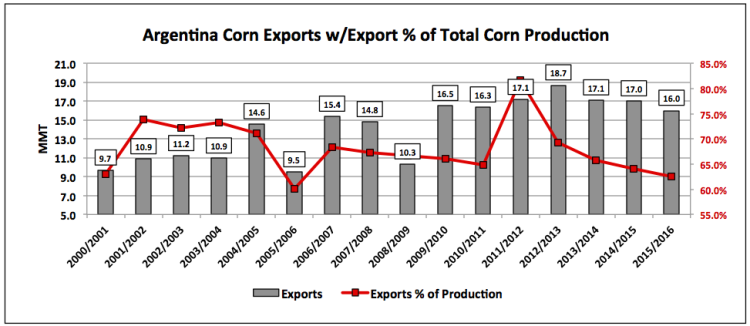

- How much additional corn would Argentina be able to export based on this anticipated acreage expansion? Over the past 10-years Argentine corn exports have averaged 68% of total crop year corn production. Therefore assuming Argentina’s corn acreage does expand in 2016/17 and Argentine corn production approaches 31.9 MMT, this would suggest corn exports of approximately 21.7 MMT (or 854 million bushels). At present the most corn Argentina has ever exported is 18.7 MMT in 2012/13. Therefore this would represent a net exportable corn increase of 3 MMT (or 118 million bushels).

- Who wins and loses if additional Argentine corn exports hit the world marketplace? This is where it gets complicated. If world corn export demand grows, it could be assumed that the additional corn would simply be digested without any consequence to competing world corn exporters. However the reality is over the last 5-years world corn export demand has varied considerably under a variety of different market conditions. For example, world corn exports averaged 133.4 MMT during 2013/14 and 2014/15. However this year’s 2015/16 world corn export forecast decreased to just 119.3 MMT, which is somewhat surprising given the substantial drop in world corn prices and where March corn futures are sitting. Therefore I’m inclined to believe additional Argentine corn exports means more competition for what still appears to be a relatively constrained global demand sector. What could help position Argentina more favorably than the United States in particular however could be Macri’s other campaign promise, which is to allow the peso to depreciate. This is where the Argentine election news has meat. This devaluation along with the elimination of the export tax would make Argentina’s corn very attractive in the world export market. In my opinion this poses as yet another significant obstacle to future US corn export growth.

continue reading on the next page…