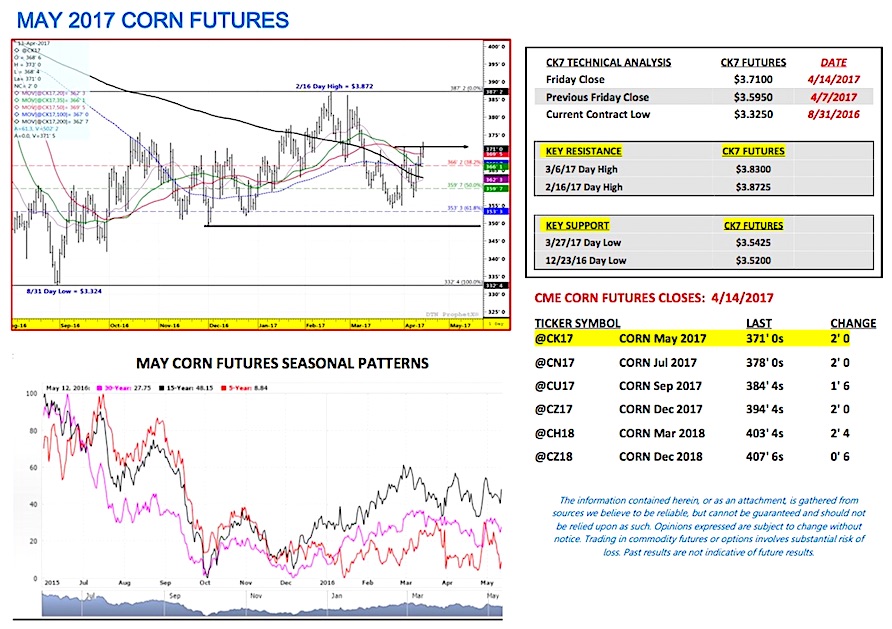

May corn futures moved higher this week, closing up 11 ½-cents per bushel week-on-week, finishing on Thursday (4/13) at $3.71.

Corn futures managed to build on Monday’s 7 ½-cents higher close throughout the week despite what was initially viewed as a potentially Bearish April WASDE report released on 4/11.

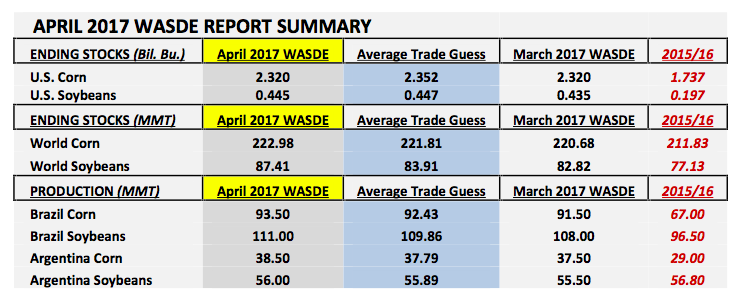

APRIL 2017 WASDE REPORT SUMMARY

The USDA’s April 2017 WASDE report didn’t offer much in the way of price supportive news for either corn or soybean futures. 2016/17 U.S. and World balance sheet adjustments and the immediate market reaction were as follows:

CORN

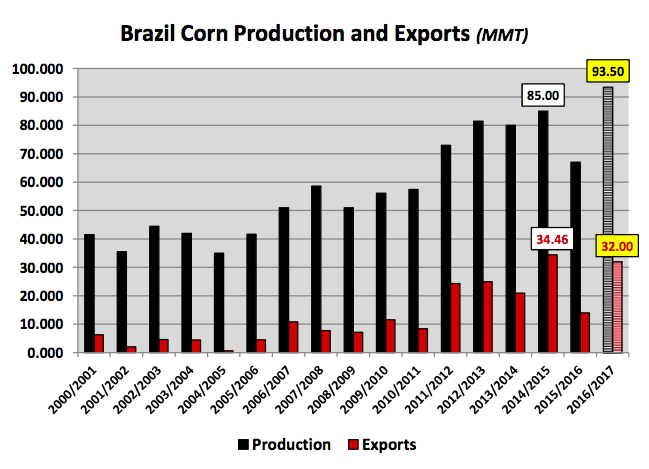

- In corn the USDA left 2016/17 U.S. corn ending stocks unchanged versus a month ago at 2.320 billion bushels versus the average trade guess of 2.352 billion bushels. However 2016/17 WORLD corn ending stocks improved to a new record high of 222.98 MMT versus the average trade guess of 221.81 MMT and 2015/16 stocks of 211.83 MMT. Also of note Brazil’s 2016/17 corn production forecast was raised to 93.5 MMT versus the average trade guess of 92.43 MMT and 2015/16 production of 67.0 MMT. Brazil’s 2016/17 corn export estimate moved up to 32 MMT versus just 14.0 MMT in 2015/16.

- Corn futures sold-off on Tuesday (4/11) shortly after the numbers were released at 11 a.m. CST with May corn futures trading down to a day low of $3.62 ¼; however this was well above the recent March 27th day low of $3.54 ¼. Furthermore CK7 came off its day low fairly quickly finding adequate price support from the 200-day moving average of $3.63 ¼ and the 20-day moving average of $3.61 ¾. May corn would eventually close down just a ½-cent per bushel Tuesday afternoon, finishing at $3.66 ½.

- LASTING MARKET IMPACT OF THE APRIL WASDE REPORT ON CORN FUTURES = minimal: The USDA’s revised corn S&D figures offered traders essentially nothing new in the form of additional Bearish pricing information. Arguably the most price negative aspect of the April WASDE report was the larger than expected increase to Brazil’s 2016/17 corn production projection. That said in reality approximately 65% of that total production estimate still remains exposed to weather with some of the early “safrinha” corn planted in Mato Grosso just entering pollination. Therefore Brazil’s 2016/17 corn production forecast could easily be altered over the next two months due to less than ideal growing conditions during this key pollination phase.

SOYBEANS

- In soybeans the USDA increased its 2016/17 U.S. soybeans ending stocks estimate 10 million bushels month-on-month to 445 million bushels versus the average trade guess of 447 million. Additionally 2016/17 WORLD soybeans ending stocks were raised to a new record high of 87.41 MMT versus the average trade guess of 83.91 MMT and 2015/16 stocks of 77.13 MMT. A percentage of the WORLD ending stocks increase was attributed to Brazil’s 2016/17 soybeans production forecast improving to 111.0 MMT versus the average trade guess of 109.86 MMT and 2015/16 production of 96.5 MMT.

- Soybean futures traded sharply lower immediately after the report came out on Tuesday (4/11) trading down to a day low and new 12-month low in May soybeans futures of $9.29 ¾. However in a similar fashion to corn, soybean futures staged a comeback late, finishing the session down just 2 ½-cents per bushel, closing at $9.39 ¼.

- LASTING MARKET IMPACT OF THE APRIL WASDE REPORT ON SOYBEAN FUTURES = minimal: Initially there was little argument the USDA’s U.S. and World S&D adjustments were the most Bearish for soybeans. The combination of material increases to both U.S. and World ending stocks (World stocks in particular, which increased 4.59 MMT month-on-month) ignited what proved to be momentary, yet considerable selling pressure. That said May soybean futures ability to recover late, closing just slightly lower Tuesday afternoon, also suggested traders had already to a large degree discounted soybean futures prices in advance of the April 11th WASDE report. This was represented by a 72 ¼-cents per bushel break in May soybean futures from 3/20 (day high of $10.08 ¾) through 4/4 (day low of $9.36 ½). Point being traders expected the April WASDE report to be perceived as Bearish and positioned well beforehand as evidenced by Money Managers shedding nearly 127,000 soybeans longs from 3/7 through 4/4.

May Corn Futures – Key Price Considerations & Takeaways:

May corn futures (CK7) closed on Thursday (4/13) at $3.71 finishing up 11 ½-cents per bushel week-on-week. Corn futures caught a bid post-April Wasde Report.

- Technically, Corn Bulls have to be very happy with this week’s price performance. After several consecutive closes below the rolling 100-day moving average in May corn futures (currently at $3.67 per bushel), corn futures proved stable enough to push back over that key resistance level on Wednesday afternoon. Additionally on Thursday May corn futures also closed back over the 50-day moving average at $3.69 ½. Key closes over what had been strong areas of price resistance should lead to continued Managed Money short-covering in corn futures early next week.

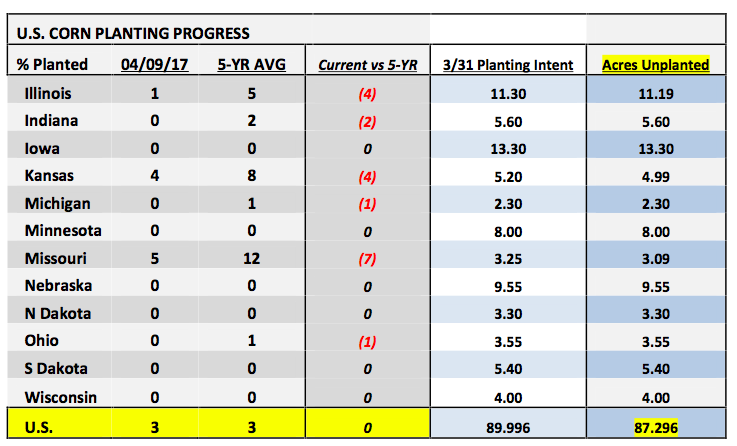

- Fundamentally, the U.S. and World supply and demand balance sheets continued to project burdensome ending stocks profiles for 2016/17, which in turn will likely carryover into the 2017/18-crop year. That said what we saw this week was traders focusing less and less on the “theoretical” forward S&D based on “trend-line” yield assumptions and a greater desire to start pricing in what the market knows today. And what traders see at present is an extremely wet forecast for the U.S. Midwest and the possibility of corn planting delays specifically in the Eastern Corn Belt. In truth…it’s way too early to suggest this is a real market concern; however with Money Managers short in excess of -150,000 corn contracts as of 4/4 it won’t take much of a weather-related “scare” to generate some Managed Money buying.

- LOOKING AHEAD TO JULY CORN FUTURES: In the April 1st through June 30th timeframes in both 2015 and 2016, July corn futures eventually rallied back over $4.00 per bushel. In 2015 July corn futures rallied up to a day high of $4.15 on 6/30. In 2016 July corn futures rallied up to a day high of $4.39 ¼ on 6/8. Both crop years were similar to 2017/18 in that “on paper” large carryin stocks, adequate planted corn acres, and perceived U.S. corn ending stocks in excess of 1.8 to 1.9 billion bushels were already being considered during those timeframes and yet corn futures still managed sizable rallies during the month of June. Corn Bulls need to continue to be patient with July corn futures closing at $3.78 per bushel on Friday, 4/13.

Additional Chart:

Thanks for reading.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service