U.S. December corn futures have been showing weakness for some time now, as supply concerns continue to weigh on traders.

Prices dipped again last week, but bulls hope that the market is beginning to fully price in this year’s crop. Let’s discuss what’s happening in the corn market and review the week ahead.

Weekly review, news, and highlights for the week ahead – November 20:

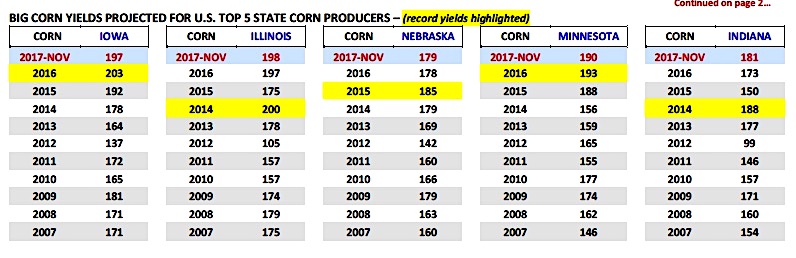

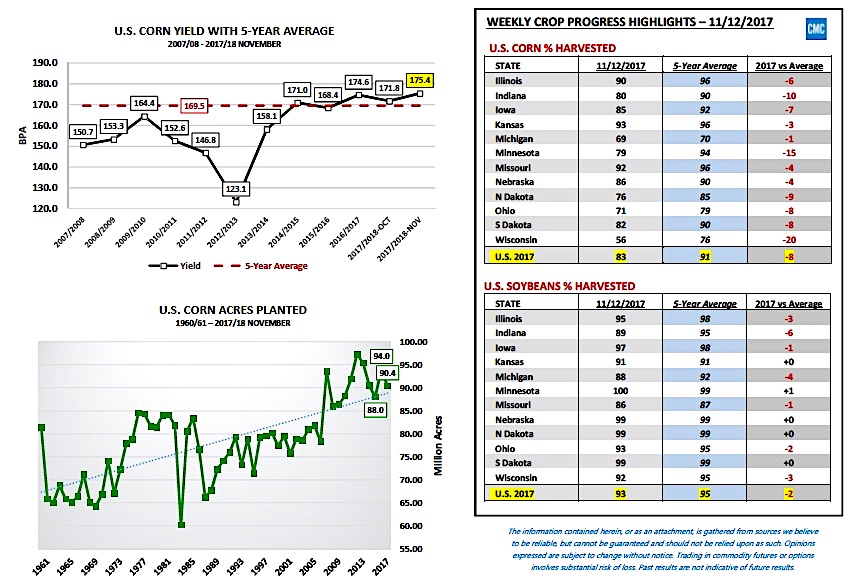

- Monday’s Weekly Crop Progress report showed the U.S. corn harvest improving to 83% complete as of November 12th, which compares to 92% a year ago and the 5-year average of 91%. Minnesota’s corn harvest increased to 79%, up 19% from the previous week; however still well behind its 5-year average of 94%. Minnesota’s current corn harvest percentage would suggest farmers still need to pick approximately 1.68 million corn acres (2017 Minnesota planted corn acreage was estimated at 8.0 million acres in the USDA’s June Acreage report). That said I wouldn’t be surprised to see some corn still standing in Minnesota until after the Thanksgiving holiday on 11/23. Other notable state harvest percentages…Iowa’s corn harvest was reported at 85% versus 92% on average with South Dakota 82% harvested versus 90% on average. Harvest delays in the upper Midwest this Oct/Nov have been the result of weather, high corn moistures, and big yields (more volume = more corn to dry). Corn moistures out of the field have been running in the 20-22% ranges in Minnesota, which in turn need to be dried down to approximately 15%. Dryer capacity has therefore also been a limiting factor.

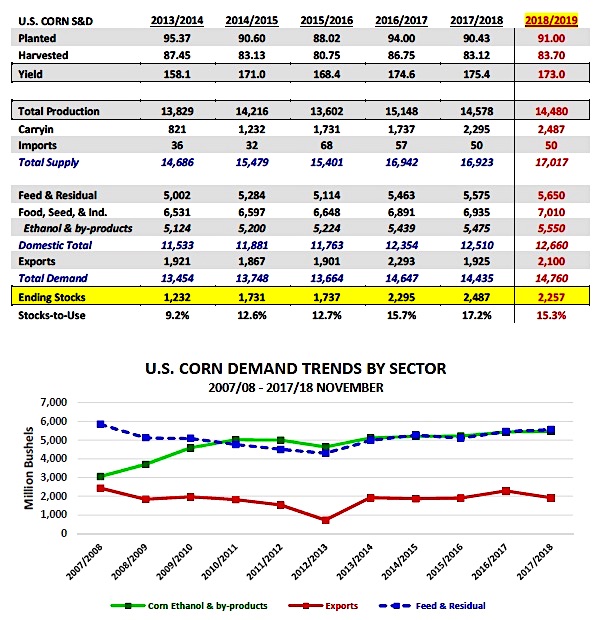

- Disappointing U.S. corn export demand continues to add yet another Bearish sentiment to corn futures. Monday’s weekly export inspections figure for corn totaled just 14.8 million bushels versus the average trade guess of 23.6 million bushels, this for the week ending 11/9/17. Crop year-to-date corn inspections improved to 233.4 million bushels versus 427.6 million bushels a year ago (down 45.4%). That said, despite another week of slow corn inspections/sales figures, the USDA increased their 2017/18 U.S. corn export projection to 1.925 billion bushels in the November 2017 WASDE report (+75 million bushels versus October). I’m struggling to justify the USDA raising their export forecast at this time based on actual export sales/inspections figures thus far into the marketing year. Of note current 2017/18 U.S. corn export inspections now represent just 12.1% of the USDA’s revised marketing year forecast, well below the average percentage preferred to realistically achieve the USDA’s new export target.

- Early private forecasting models for the 2018/19 U.S. Corn Supply and Demand balance sheet are already suggesting the increasing probability of U.S corn ending stocks exceeding 2.2 billion bushels for the 3rd consecutive crop year. That’s only occurred one other time in history and that was from 1985/86 through 1987/88 (and even that time period’s ending stocks were somewhat misleading/exaggerated due to Commodity Credit Corporation corn forfeitures).

This too then is providing additional price pressure on corn futures. Analysts are anticipating a slight increase in U.S. planted corn acreage in 2018 (Informa pegging 2018/19 U.S. planted corn acreage at 90.46 million acres; others are closer to 91.0 million). That along with massive carryin stocks and a trend-line yield of 173 BPA will likely require RECORD corn demand in 2018/19 just to keep U.S corn ending stocks below 2.3 billion bushels. And right now U.S corn demand remains very uninspiring. Therefore one could easily make the argument that 2018/19 U.S. corn ending stocks could again approach 2.5 billion bushels (after applying a more conservative total U.S. corn demand projection). That said the potential 2018/19 U.S. corn S&D makeup is something that Corn Bulls will likely be battling for the next several months, as far as sustaining rallies of substance.

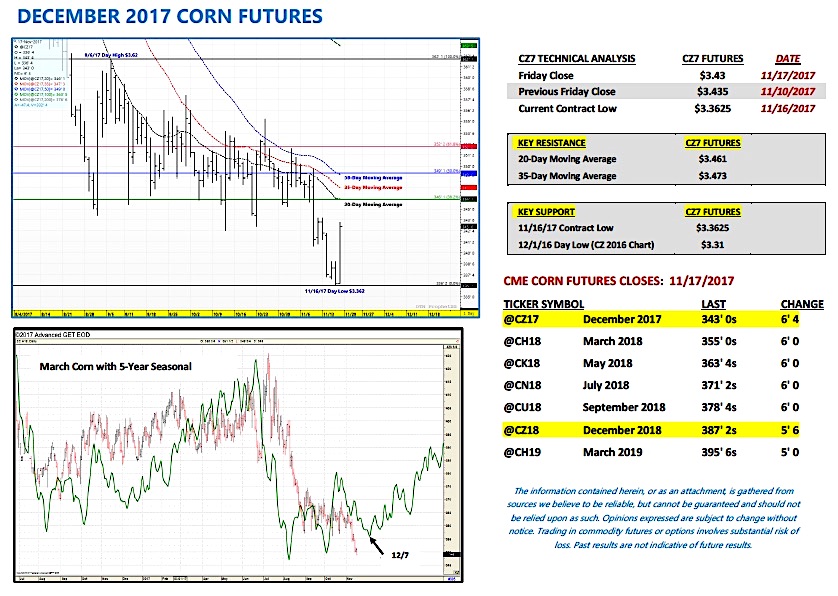

December Corn Futures (CZ7) Short-Term Outlook

December corn futures established a new contract low this week breaking to a day low of $3.36 ¼ on Thursday, 11/16. This week’s breakout move lower was a result of traders continuing to digest the USDA’s November 2017 WASDE report. I would assume the Bullish fear is that the USDA could once again increase the U.S. corn yield in the January 2018 WASDE report (the USDA does not adjust the yield in the December report). With 2017/18 U.S. corn ending stocks already just shy of 2.5 billion bushels (30-year high), I’m not sure anyone wants to be the first to buy corn, assuming the market has bottomed…even at current price levels. We’re seeing this mentality play out from Money Managers who are already short in excess of 200,000 contracts. And yet I see no panic or sense of urgency from them to liquidate those positions even as their short position exposures reach new record levels (short -230,556 contracts as of market close on 11/14).

The number I hear floating around for Dec corn futures, as far as the next downside price target, is $3.31. This corresponds with the 2016 Dec corn futures day low on December, 1st. I think $3.31 to $3.30 is certainly in play given the S&D, which then suggests a break in March corn futures down to $3.41 to $3.42 (assuming an 11 to 12-cent spread) as possible.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service