December corn futures are attempting to firm up into the end of October.

Let’s review current news, data releases, and market trends with a look to the week ahead (October 29).

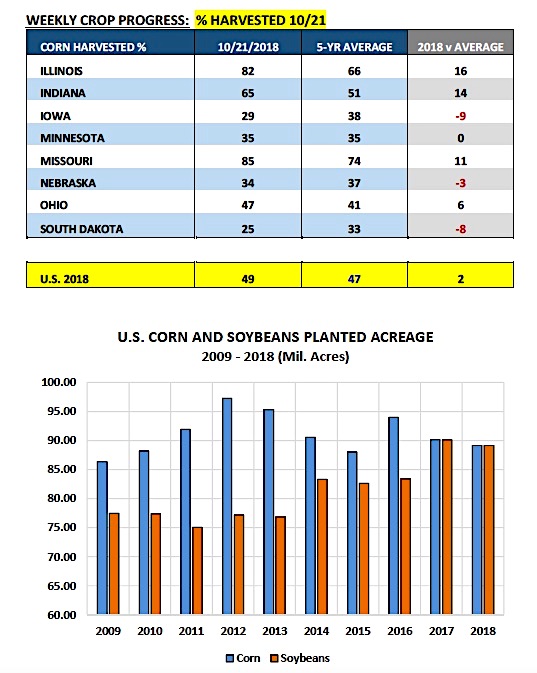

Monday’s Weekly Crop Progress report showed the U.S. corn harvest running just slightly ahead of normal with 49% reported harvested as of 10/21 versus 37% a year ago and the 5-year average of 47%.

Notable harvest delays continue to be found in the upper Midwest with Iowa’s corn harvest just 29% complete versus its 5-year average of 38%. Meanwhile South Dakota was 25% harvested versus 33% on average.

The question everyone seems to be asking is how many bushels has the U.S. corn crop potentially lost during the month of October due to excessive rains, high winds, and other variable weather conditions?

Right now I’m not seeing anyone (reputable) ready to take their national yield corn yield estimate below 180 bpa. This compares to the USDA’s October 2018/19 U.S. corn yield forecast of 180.7 bpa. Therefore the consensus seems to be that although October weather has undoubtedly affected the quality of corn in certain areas of the Corn Belt; it likely hasn’t led to a measurable decrease in the national corn yield.

If the U.S. corn yield falls -0.7 bpa in the November 2018 WASDE report (and harvested acreage remains unchanged at 81.767 million acres) total U.S. corn production would fall approximately 60 million bushels versus October. Also worth noting that in Monday’s Weekly Crop Progress report the USDA left the U.S. corn good-to-excellent rating unchanged week-on-week at 68% versus 66% in 2017.

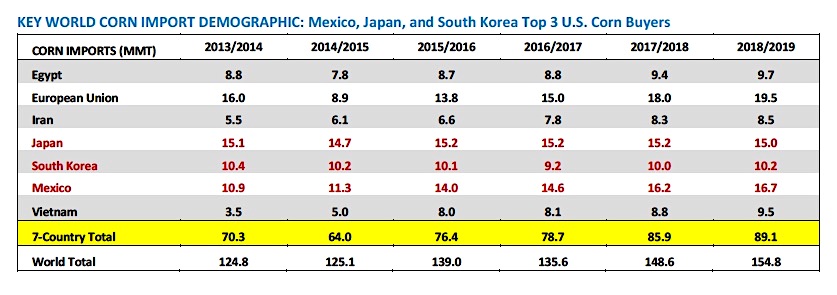

U.S. corn export demand continues to be a key driving force providing strong underlying price support in corn futures. U.S. corn export inspections for the week ending Thursday, October 18th totaled 37.4 million bushels. Current market year-to-date corn shipments improved to 308 million bushels, +72% above a year ago.

Below is a list of the top world corn importers. As it relates to the United States specifically the top 3 U.S. corn buyers are Mexico, Japan, and South Korea (in that order). Collectively they account for nearly 60% of all U.S. corn exports. In the USDA’s October 2018 WASDE report, 2018/19 U.S. corn exports were forecasted at a record high 2.475 billion bushels. If realized this would be only the 4th time in history U.S. corn exports have exceeded 2.4 billion bushels.

The U.S. continues to capitalize on Brazil’s 2017/18 corn exports falling over 30% (or 378 million bushels) from the previous crop year. Brazil (the world’s 2nd largest corn exporter) likely won’t reemerge as a significant threat to displacing current U.S. corn export business until they harvest their 2018/19 safrinha corn crop during Jun/Jul/Aug 2019. And that’s assuming safrinha corn yields rebound in 2018/19.

The U.S. v China trade war made headlines again this week after customs data showed China’s imports of sorghum down 77% from the same month a year ago.

The U.S. is the key supplier of sorghum to China. Also of note corn imports were down just over 83%. China’s tariffs on U.S. grains combined with high world price alternatives were identified as the key contributors to the sizable decrease in imports.

The “money flow” in corn has shifted considerably over the last 30-days with Money Managers net corn buyers of just over 161k corn contracts over that time period.

On 9/18/2018 the Managed Money position in corn was reported at a net corn short of -141,276 contracts. However as of the market closes on 10/16/2018 the Managed Money position had actually climbed to a net positive of +20,154 contracts. That swing in paper flow seems to be symbolic of the change in attitude regarding the direction in the national corn yield. That said will Money Managers continue to add new longs in November? It’s certainly possible and has happened in recent history (2014 and 2012); however from a seasonal price perspective it’s far more common for both the Managed Money buy paper and corn prices to shift to more of a neutral-to-sideways trading pattern.

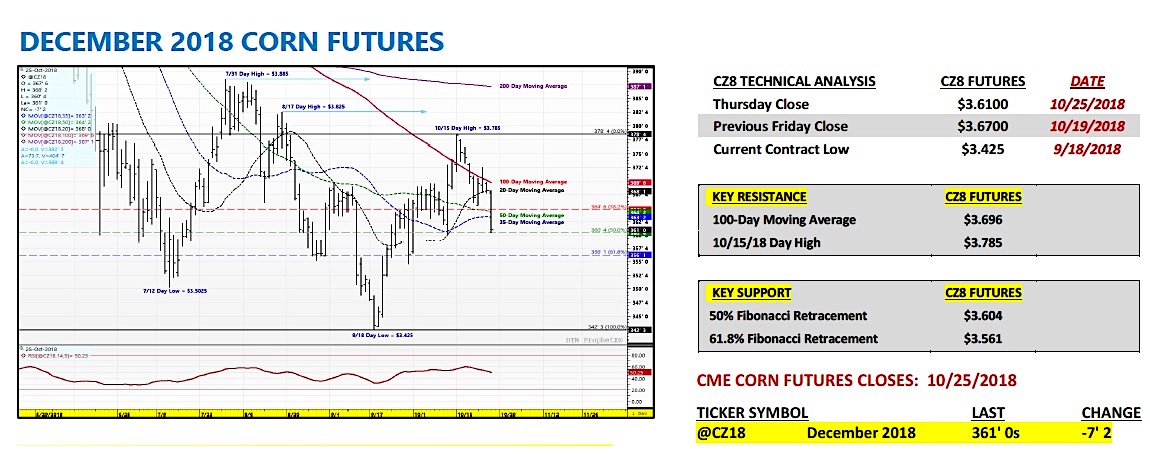

CORN FUTURES WEEKLY TRADING OUTLOOK

What do we make of the back and forth price action recently (and generally) with corn futures?

I think it’s important to note that both the 5 and 10-year price seasonals in December corn futures showed CZ rolling over (trading lower) on or near 10/23-10/24. Even the 15-year seasonal offered a similar pattern with the timing of the sell-off only slightly later, coming on 10/29. Therefore for those traders focused primarily on technicals, there was plenty of ammunition supporting Thursday’s downward price correction. Additionally despite challenging key topside price resistance at the 100-day moving average on Monday, Tuesday, and Wednesday, CZ18 FAILED to close above that level. This too was yet another strong technical indicator of a market bumping up against the upper-end of its current trading range.

Regarding the price action in corn futures in general, I would say we’re starting to see the realities of a late October, soon-to-be November corn market in a year where the only remaining debate is whether or not the final 2018/19 U.S corn yield estimate will exceed 180 bpa. No one notable is predicting some major November or January yield surprise. That said the consensus still believes, even following some unfavorable early October weather in the upper Midwest, the 2018/19 U.S. corn yield will be a record high by 3 to 4 bpa. That sort of thinking will likely continue to put a ceiling on rally attempts back to $3.75 to $3.80 CZ in the coming weeks.

Long-term…Corn Bulls can still find something to cheer about in the form of strong U.S. corn exports, as well, as the very real possibility that 2019/20 U.S. corn carryin stocks will be the lowest since 2016/17. However those potentially “supportive” market fundamentals will have a tough time creating sustainable upward price momentum during this time of the year.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service