TripAdvisor (TRIP) traded 22% higher on Wednesday morning, after reporting earnings that beat Wall Street consensus.

The company reported earnings per share of $0.30 and total revenue of $364 million, compared to analyst expectations of $0.16 and $361 million. According to CFO Ernst Teunissen, the company’s earnings for 2018 should continue to improve.

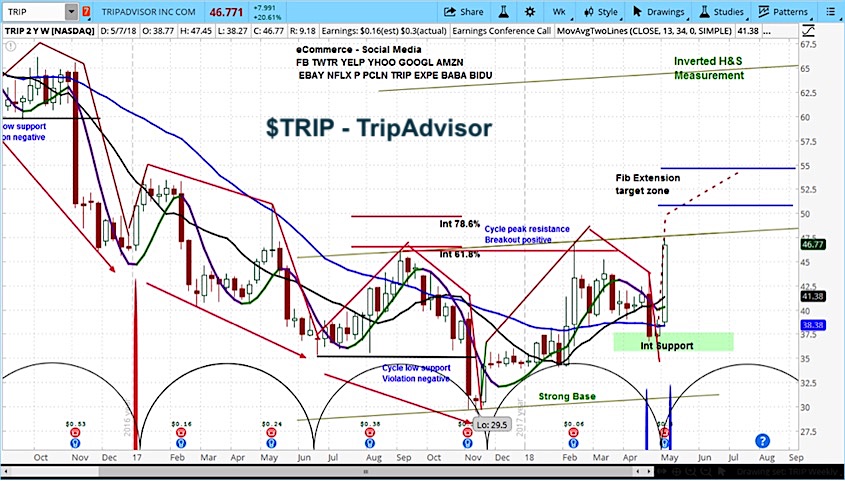

In analyzing the chart for this stock, we can see that the stock has begun the rising phase of a new market cycle. This cycle started above the low of the previous cycle and is thus bullishly configured. We had previously shown a base being formed.

With an upward acceleration from support, the stock likely has further to go. Our near term target is $55.

I would also like to draw your attention to the inverted head and shoulders pattern, which supports our bullish call. Having broken the neckline, our intermediate term target is $65.

Note how the stock market cycles drive the head and shoulders pattern.

TripAdvisor (TRIP) Stock Chart with Weekly Bars

For an introduction to cycle analysis, check out our Stock Market Cycles video.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.