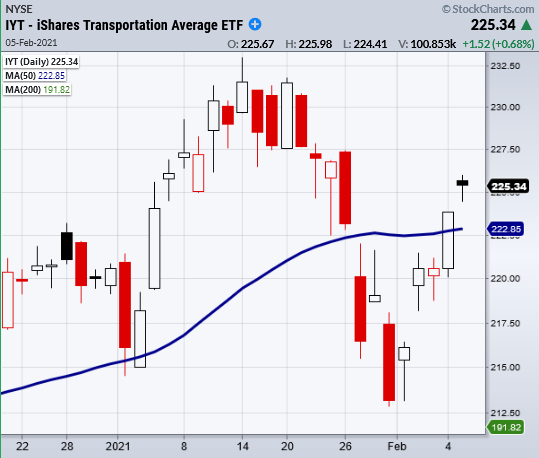

The transportation sector (IYT) has entered back into a bullish phase.

A bullish phase is when the price is over the 50-day moving average, and the 50-DMA is over the 200-DMA.

The Transportation Sector ETF (IYT) is now back in line with the rest of its Economic Family members who as a whole, give a clear way to see market direction.

Here is a quick rundown of where the other Family members sit.

The Russell 2000 ETF (IWM) made all-time highs.

The Retail Sector ETF (XRT) is now consolidating after going through some wild swings created from stocks like GameStop (GME) and other popular Reddit picks.

The Regional Banks ETF (KRE) is sitting at monthly highs with price resistance to clear at 59.86.

The Biotech Sector ETF (IBB) made new all-time highs.

And lastly, the Semiconductors Sector ETF (SMH) sits in the middle with highs at 246 and price support at 223.72.

Each ETF was specifically chosen to show a different but essential piece of the market. But knowing what to watch is 10 times more useful when paired with a basic guiding tool. That is where the simple moving averages come in.

Right now is a perfect bullish situation with all the Family members sitting above their 50-DMAs. Even though IYT triggered a warning when it broke its 50-DMA, it soon recovered.

The main point is to watch if members are moving together or breaking off into their own direction based on their price relative to their moving averages. This is not only useful for key sectors, but also useful when viewing specific stocks.

You can easily see strength or weakness by what phase a security is in.

Circling back to the transportation sector and its recent turn to caution back to bullish, this becomes a focus on whether or not this rally sustains.

The Transportation Sector ETF (IYT), simply put, must hold its 50-DMA or bullish phase to keep the market strong.

If you find phases useful, consider learning about all 6 and how to use them in Mish’s Book (Plant Your Money Tree).

Watch Mish make an appearance on Fox Business (Making Money with Charles Payne) with some great stock picks!

Mish also covers 25 stocks from this week’s earnings reports. Sectors covered include Healthcare, Pharma, Solar, Industrials, FAANG, Tech, Financials, and E-Commerce. Here you will find great actionable information for momentum and value traders alike. Some featured stocks to watch are:

AMZN GOOGL BABA PFE XOM UPS COP RACE MTCH MCK SWI VIAV PBI PYPL QCOM SNE BSX HUM BIIB EBAY (SLAB TM GILD BLL ZEN)

Trading insights on important stock market ETFs:

S&P 500 (SPY) New highs

Russell 2000 (IWM) New highs

Dow (DIA) 312.71 resistance.

Nasdaq (QQQ) New highs.

KRE (Regional Banks) Support 53.26. Resistance 60

SMH (Semiconductors) 246.79 resistance. Support 223.08

IYT (Transportation) Confirmed back into a bullish phase over the 50-DMA at 22.95

IBB (Biotechnology) New Highs

XRT (Retail) 75.28 support.

Twitter: @marketminute

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.