The broader stock market indices closed the week at yearly highs as traders continued to bid equity higher. The reversal has been much stronger than most expected and has put the bulls in good position.

That said, the market will likely need to take a prolonged breather at some point, as the velocity of the rally has been intense.

But the US stock market gets too much attention. There are many notable things happening under the market’s surface and across sectors and asset classes. And this may tip the market’s hand at when that pullback is about to occur.

Let’s dive in – Enjoy this week’s “Top Trading Links.”

MARKET INSIGHTS

Option Traders look for Q2 upside in Biotech – Joe Kunkle

A catalyst for real estate – Danny Jassy

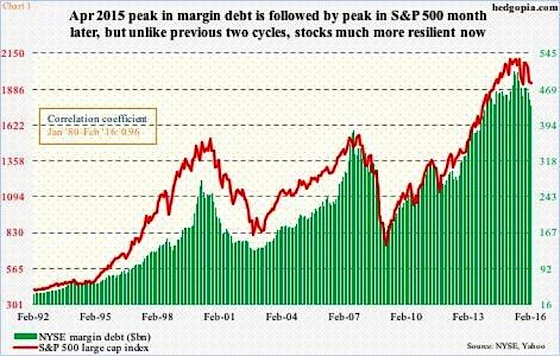

Margin Debt as a percent of disposable income reaches the 2000 high – Paban Raj Pandey

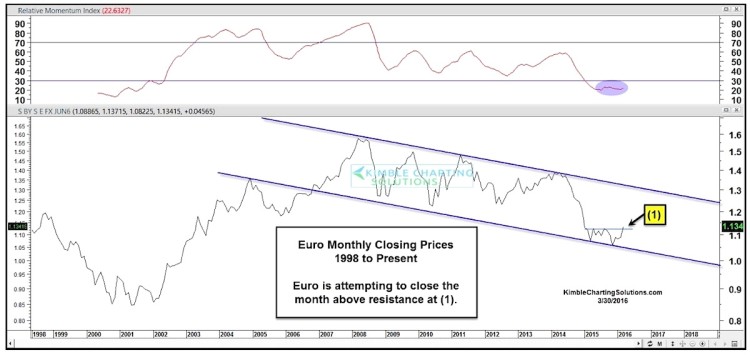

The euro is attempting a major breakout – Chris Kimble

Are we seeing a generational peak in corporate profit margins? – Jesse Felder

22 Bad Trading Habits – Steve Burns

The more unique your portfolio, the greater it’s potential – Patrick O’Shaughnessy

On the principle of polarity – JC Parets

Approach financial media with a dose of skepticism – David Fabian

NEWS AND RESEARCH

Snapchat adds new messaging features – Buzzfeed

What happened when Nigeria created the world’s largest business plan competition – Priceonomics

Mass surveillance silences minority opinions – Washington Post

Do we already have a cure for V/R induced motion sickness? – engadget

How the brain processes emotions – MIT

Chicago’s pension nightmare – Pension Pulse

The heart vs the mind – brainpickings

Thanks for reading and be sure to check back next weekend for another round of “Top Trading Links”.

More from Aaron: “Currency Hedged ETFs Decline As Dollar Falls“

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.