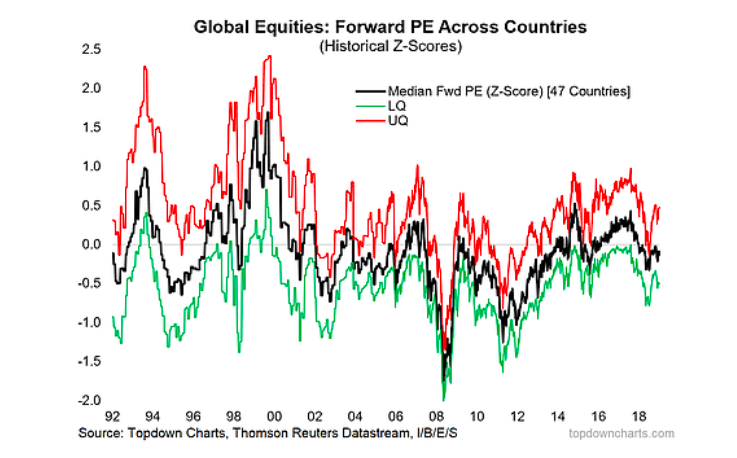

8. Global Equity Valuations (continued)

It is worth noting the spread between the upper quartile (more expensive) and lower quartile (cheaper), which goes to highlight how relative value across countries and regions is definitely there to be found.

Anyway, the key here is that global equity valuations are not at rock bottom, but in a general sense are on the cheap side.

“In the wake of the global equity market correction it’s becoming easier and easier to find a bargain. Valuations have already reset to some of the previous major market lows. While global equities could get cheaper yet, the probability is increasingly in favor of long term investors at these levels.”

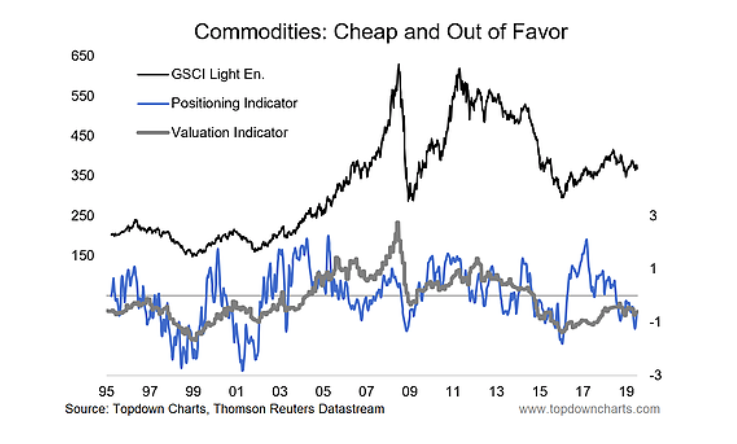

9. Commodities: I am increasingly intrigued by the action in commodities. My indicators continue to show cheap “valuations” for commodities as an asset class (in the aggregate sense), and still relatively light positioning. It’s true that cheap valuations can get cheaper and traders can get shorter, but when these conditions show up, probability favors the bulls in the medium term.

Tactically, the US dollar looks to be rolling over, and EM/China are in easing mode. The main question mark is global growth…

“Beset by numerous headwinds and cross-currents last year, commodities ended 2018 looking un-loved and undervalued. As with the previous chart, there’s always room to go lower, but as long as the global economy avoids recession and if China/EM do ultimately stabilize and improve the case for commodities starts to look very good. And it’s often that you see commodities tend to do well later in the cycle. As the window starts to close for US dollar strength, that could be the final element to fall into place for commodities (and EM).”

10. China A-shares: At the turn of the year Chinese equities were trading at rock bottom valuations, and subsequently rallied over 20% (as I like to say: valuations often have a habit of speaking for themselves – especially at extremes).

At this point valuations are more on the neutral side (sitting around long term average for China A-shares ex-financials). So it’s no longer a value play as such, but rather some kind of bet on policy and politics (i.e. that they implement more stimulus and/or that we see a resolution to the trade war — both are scenarios in their extremes which would likely drive material upside here).

“Last but not least is China again (our China stimulus chart was number 10 last year, and it remains very important), this time China A-shares in particular. A lot went wrong for China last year, and in my mind that simply sets the stage for things to go at least less wrong, if not right for China this year. Trump has helped make China A-share valuations great again (cheap again). All that’s required now is a catalyst and I can see multiple candidates.”

These charts were originally featured in the 2018 End of Year Special Edition – click through for a one-off free download of the full report.

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.