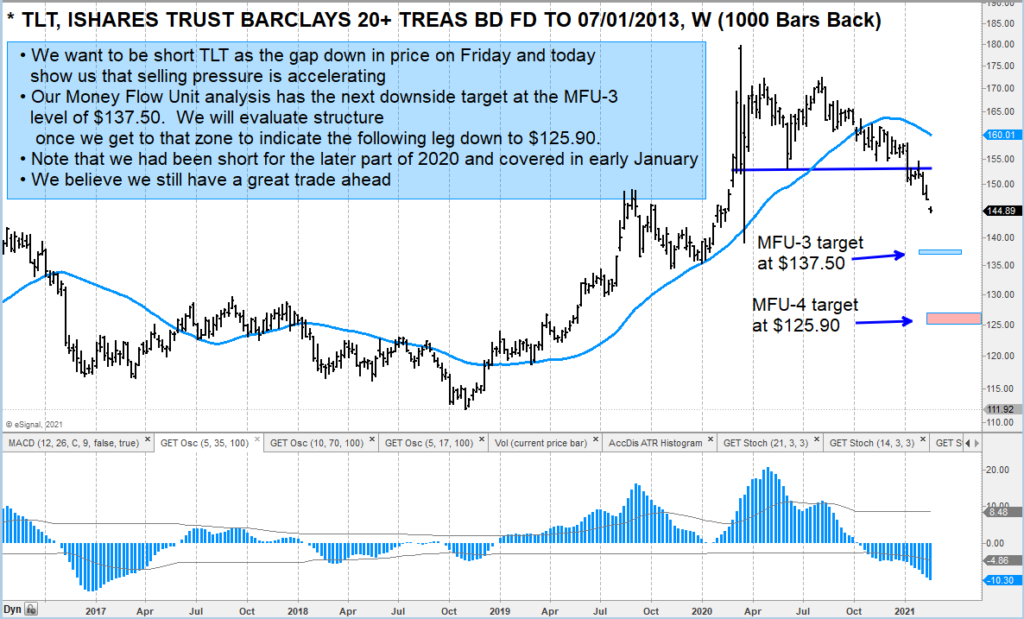

The 20+ Year Treasury Bond ETF (TLT) gapped down for the second day in a row, indicating an increase of selling pressure.

This price action has triggered a sell signal and created new downside price targets (indicated on the chart below)

Please note that the MFU-3 price target may generate a sizable bounce higher as that is what typically happens into that target. We would need to watch and evaluate the price action from there before determining the likelihood of the MFU-4 price target.

Note that the probability of an MFU-3 target being hit is 70 percent. And the MFU-4 is achieved 25 percent of the time.

$TLT – Long-Term Treasury Bonds ETF Chart

The author or his firm may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.