U.S. Treasury Bonds have been beaten and battered for several months now as inflation concerns have taken center stage for investors.

But perhaps we are due for a pause in the action… a counter-trend rally.

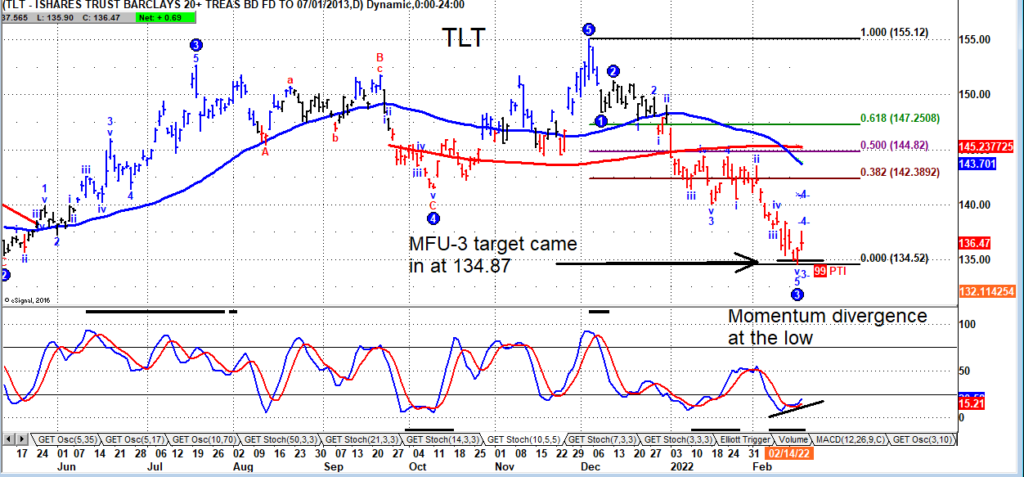

I like taking the Long-dated U.S. Treasury Bond ETF (TLT) here for a trade. We have a reversal higher off the MFU-3 price support, also with a momentum divergence at the lows.

I’m thinking of an initial target at the 38.2 fibonacci level of $142 for partial profits.

A move above that level will likely lead to a 50% retracement level of $144, which lines up with the 200-day in red. A close below the recent low at 134.50 area would stop me out of this trade.

$TLT 20+ Year Treasury Bonds ETF Chart

The author or his firm have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.