First off, let’s review the action in the IPO market last week. The calendar was packed last week with 9 deals scheduled to price. But in a sign that the market is starting to get a little bit more picky, after a very active Spring and Summer delivering a big supply of IPOs and IPO pops, a number of the scheduled deals could not price due to “market conditions” or for a lack of demand.

First off, let’s review the action in the IPO market last week. The calendar was packed last week with 9 deals scheduled to price. But in a sign that the market is starting to get a little bit more picky, after a very active Spring and Summer delivering a big supply of IPOs and IPO pops, a number of the scheduled deals could not price due to “market conditions” or for a lack of demand.

The deals that did price seemed to be well covered and attracted strong demand. But they were met by a lack of bids when they opened for trade, opening well below their IPO price. Several continued to trade down throughout the day.

Amplify Snack Brand (BETR) priced it’s IPO at $18, $2 above the initial pricing range, a sign of very strong demand for the deal (the deal was reportedly 25 times oversubscribed) but opened at $17.00 and traded as low as $15.53. Even if there are a lot of questions around BETR valuation and potential, this is something very unusual to see such a “hot” deal trade down or even flat and a clear sign of fatigue in the IPO market.

Planet Fitness (PLNT) and Sunrun (RUN) deals, while reportedly well covered prior to the pricing also opened below their IPO price, PLNT was priced at $16.00 but opened for trade at $14.50 and traded as low as $13.75, it managed to find some buyers Friday though and closed the week in positive territory at $18.25. RUN priced at $14 but opened at $13.06 and quickly traded down; it traded down as low as $8.23 – almost $6 or 40% below pricing. RUN closed the week at $10.14.

Aimmune Therapeutics (AIMT) and Zynerba Pharmaceuticals (ZYNE) were the only IPOs delivering strong performance closing the week respectively up 44% and 73%, biotechnology remains a favorite sector for IPO investors.

Several factors participate to explain the action this week.

The overall “risk-on” tape was generally weak in the market this week which also partly explain the weakness in the IPO market.

IPOs sit on the more risky side of the risk curve and when investors are fearful and decide they want to cut down their risk exposure liquidity can dry up very fast in the IPO market. In broad general terms, when you are busy selling some of your established holdings to pare down on risk, your appetite to buy into new ventures with no price history is close to zero.

In the Spring 2014 the overall market went through a “risk-off” and deleveraging period as a result liquidity almost completely vanished for the IPO market for a while, I will illustrate the effect with a collage of charts from IPOs priced just prior:

Spring IPOs: CSLT, BRDR, PCTY, DPRX, VRNS, COUP, AKBA, MDWD, DRNA

When investing/trading IPOs heightened liquidity risk should always be considered in your assessment.

If big institutional investors sidestep IPOs you are left with traders, funds or investors that are only in the order book with the intention of flipping their shares and generally weaker hands. When the IPO market is “hot” and all deals have been “working”, as has been the case in recent months, you tend to see a lot more of these participants in the IPO order book. If you get to the point where the number of investors there for a quick trade outnumber fundamental investors, you end up seeing similar price action to this past week.

IPOs are priced arbitrarily and have no history of price support, so from a trading point of view I always strongly recommend to avoid broken IPOs (IPO opening/trading below IPO price). Wait for them to trade back above the IPO price before considering a long trade, as the IPO price will often act as huge level of resistance.

When an IPO breaks its IPO price you are only left with participants that are trapped and losing money, that tends to weigh on price.

From a fundamental perspective broken, forgotten IPOs that drift down to a ridiculously low price can sometimes offer a great long term investment opportunity – but that is a different discussion.

Generally avoiding IPOs trading below IPO price will keep you out of trouble, like buying RUN at $12 because at $2 below the IPO price it seems like a bargain and then watch it trade down to $8 in rapid fashion.

This week two IPOs of note to consider:

While the poor showing from IPOs last week will certainly cool down the appetite for offerings, this week 2 deals should attract some significant interest and I expect them to perform well (all other things being equal, depending on market conditions).

Global Blood Therapeutics

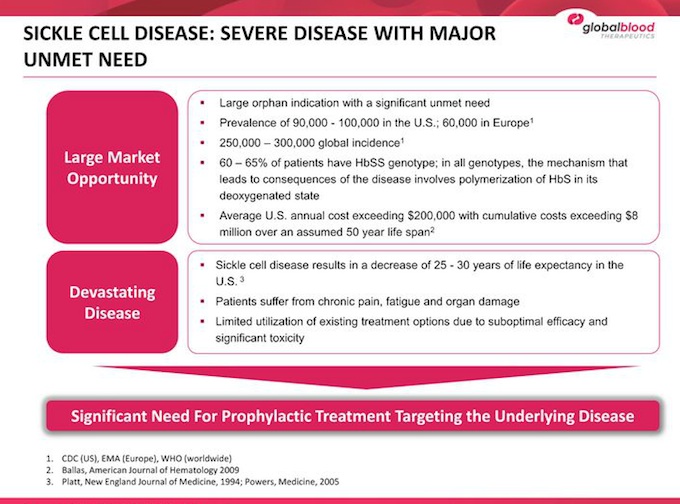

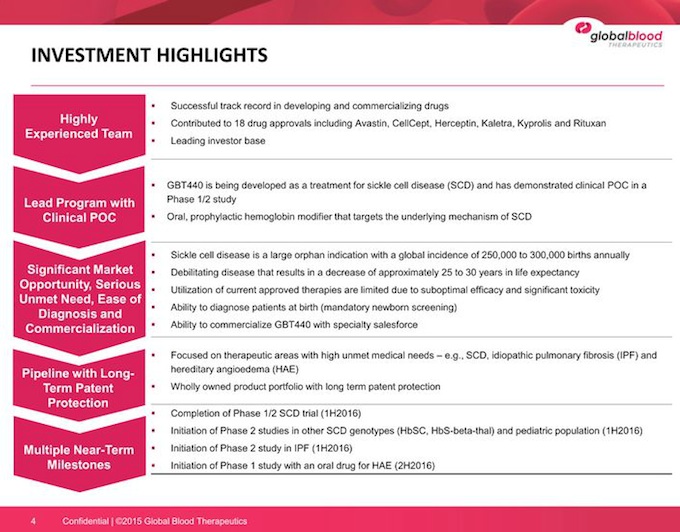

Founded 3 years ago, Global Blood Therapeutics (GBT) is a biopharmaceutical company dedicated to discovering, developing and commercializing novel therapeutics to treat grievous blood-based disorders.

GBT is developing the initial product candidate, GBT440, as a once-daily, oral prophylactic therapy for sickle cell disease, or SCD, and is currently evaluating GBT440 in both healthy subjects and SCD patients in a randomized, placebo-controlled, double-blind Phase 1/2 clinical trial.

SCD is a disease marked by severe pain “crises,” recurrent hospitalizations, multi-organ damage, and early mortality. GBT440 targets the underlying mechanism of red blood cell sickling, which we believe provides the potential to treat SCD rather than only its associated symptoms. In addition to GBT440 for the treatment of SCD, GBT plans to explore the treatment of more indications, notably hypoxemic pulmonary disorders and hereditary angioedema.

Like many biotechnology early development stage ventures GBT has no revenues, and currently the future of GBT rides on a single drug development, so a high risk, VC type investment.

Nevertheless SCD has now been proven to be a valuable indication to go after as exhibited by the $5.5 billion market capitalisation of Bluebird Bio (BLUE). BLUE, also a development stage biotechnology company with no revenues, is hoping to cure SCD using gene therapy and has shown some early encouraging results in a handful of patients.

It is interesting to note that GBT main venture capital backer is Third Rock Ventures who was also the early and main backer of Bluebird Bio (Nick Leschy the current CEO of BLUE is an ex Third Rock partner.)

This drug, if successful, could offer a lot of hope to SCD patients that currently have very few treatment options. GBT is scheduled to present some new data at the ASH conference in the Fall that should serve as a catalyst for the stock.

Shares to be outstanding post IPO: 27,808,457 shares

Price Range:$16.00 – $18.00 – Pricing scheduled for Tuesday night, trading Wednesday.

Established in 1972, Houlihan Lokey (HLI) is a leading global independent investment bank with expertise in mergers and acquisitions (“M&A”), financings, financial restructurings and financial advisory services.

Through offices in the United States, Europe, Asia and Australia, HLI serves a diverse set of clients worldwide including corporations, financial sponsors and government agencies. Houlihan Lokey advises clients on critical strategic and financial decisions employing a rigorous analytical approach coupled with deep product and industry expertise.

Houlihan Lokey’s three primary business practices: Corporate Finance (encompassing M&A and capital markets advisory), Financial Restructuring (both out-of-court and in formal bankruptcy or insolvency proceedings) and Financial Advisory Services (including financial opinions and a variety of valuation and financial consulting services).

Sample of transactions where Houlihan Lokey was involved:

Since 2008, the financial crisis and increased regulations, boutique investment banks have been steadily gaining market shares from the major investment banks. A number of them have come public in recent years and performed well, one of the most recent example Moelis & Company (MC) who came public last year, also Evercore Partners (EVR) IPO in 2011.

Houlihan Lokey is a growing investment bank, and a lot of HLI’s business is riding on the current wave of M&A and bond issuance. One could argue that we are potentially nearing a peak in that department but so far it shows no sign of slowing down, as corporate balance sheets are generally healthy and companies keep being in acquisition mode as a way of finding new avenues of growth. Also on the other side of the coin, restructuring is also a domain of expertise of HLI.

Shares to be outstanding post IPO 65,212,700 shares

Price Range:$22.00 – $24.00 – Pricing scheduled for Wednesday night, trading Thursday.

IPOs also scheduled for the week of August 3rd:

Conifer Holdings Inc. (Nasdaq: CNFR) – Michigan-based insurance holding company formed in 2009, offering insurance coverage in both specialty commercial and specialty personal product lines.

Conifer Holdings Inc. (Nasdaq: CNFR) – Michigan-based insurance holding company formed in 2009, offering insurance coverage in both specialty commercial and specialty personal product lines.

Shares to be outstanding post IPO: 8,907,609

Price Range:$11.00 – $13.00 – Pricing scheduled for Tuesday night, trading Wednesday.

IPOs offer a lot of opportunities but also come with their own set of risks and are generally riskier than stocks with a long history as a public company. One should expect very wide trading ranges, lower liquidity and much higher volatility from IPOs than the rest of the market. In my opinion, one should always factor that into your assessment before trading or investing in IPOs.

For complete information on this week’s IPOs refer back to each company’s SEC offering prospectus: https://www.sec.gov/search/search.htm

Thanks for reading and have a great week.

Twitter: @JFinDallas

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.