A Fine Mess

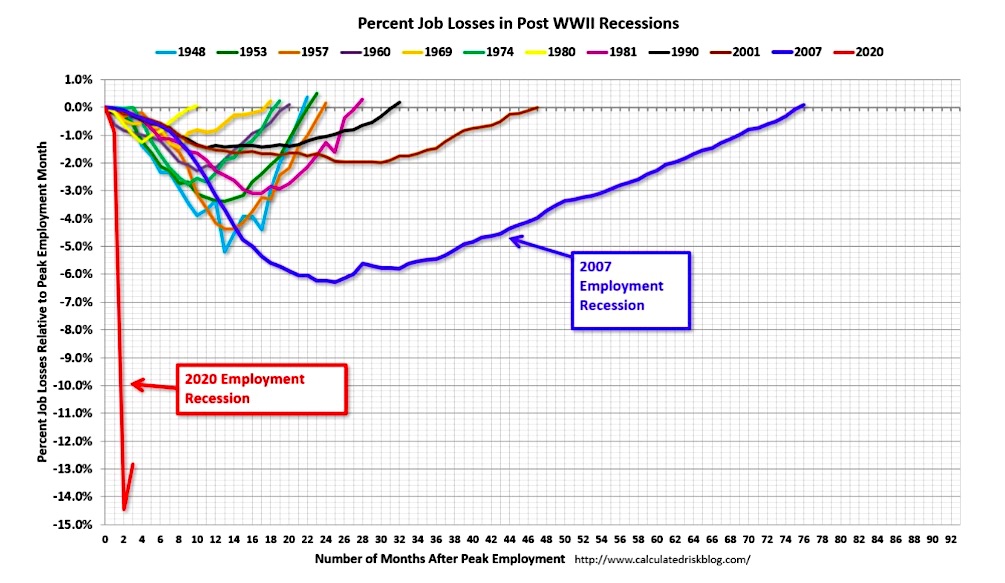

Even after the surprisingly positive payroll report for May 2020, the chart below illustrates the magnitude of our predicament. It also reflects the mischaracterizations being used to discuss the post-COVID19 economic circumstance.

Note that the last four recessions required longer periods consecutively for jobs to recover fully.

The amount of non-productive debt used to combat downturns compounds the pre-existing debt problem. It ensures that the economy will continue to struggle for years to get back to pre-COVID levels of economic activity.

“Much higher public debt levels will become a permanent feature of our economies and will be accompanied by private debt cancellation.” – Mario Draghi, March 2020, FT

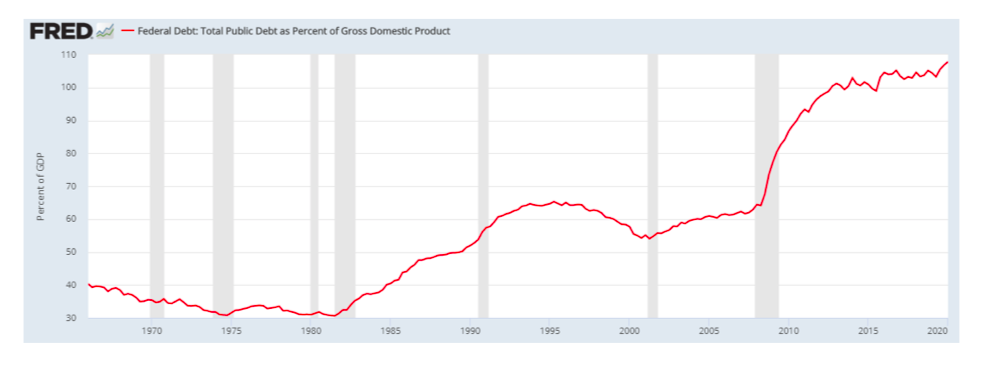

At $6 trillion in December 2001, then $11.5 trillion in June 2009, U.S. government debt has now ballooned to $26 trillion. Tragically, debt continued to pile up over the last decade despite economic recovery. It, in fact, was the economic recovery. Without that expansion of debt, there would have been little to no economic growth.

To characterize it otherwise as Fed and government officials have done is intellectually dishonest. When the debt-to-GDP graph below updates next, the ratio will be close to 120%. The pattern since 1980 is clear.

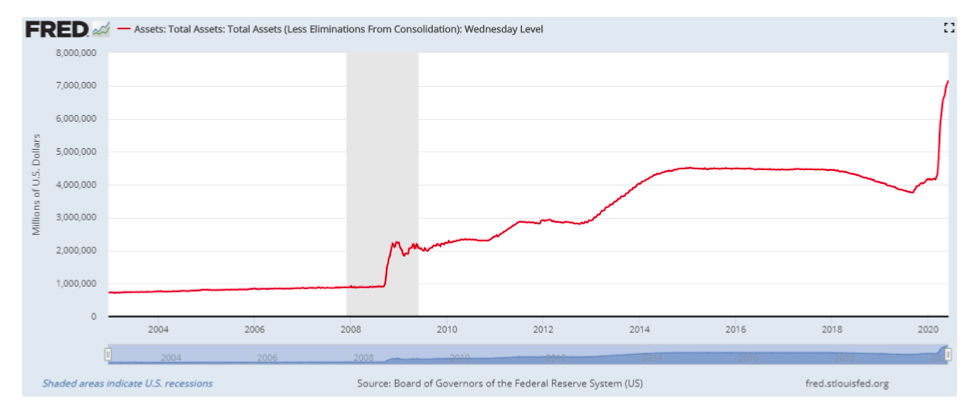

The Fed is extraordinarily accommodative in both their interest rate posture and their willingness to fund massive federal deficits.

They deliberately encourage everyone to borrow. That occurs with lower rates and expansion of the Fed balance sheet (QE) as shown in the chart below. They have also promised near-zero rates and QE for the foreseeable future. This is, indeed, a fine mess.

Evidence

Despite the information we present, the same talking points justify the same actions. The actions do not serve the best long-term interests of the public. The tools the Fed is employing destroys wealth for all but the top 1%.

The policies incite inflation, much of which is hidden by faulty government reporting. As detailed in a previous article, Two Percent for the One Percent, inflation erodes living standards for the broad population.

Even after years of botched policies that damage the organic economy, no one in Congress challenges the Fed’s counter-factual. Given the evidence from their inability to forecast even one or two quarters ahead, how do they know what they are doing works? How do they know the long-term implications of their policies will not be disastrous? The answer, of course, is they do not know.

Summary

As mentioned, based on this analysis using the trends of the past 40 years, the economy will not regain pre-COVID output levels until sometime in the 2030s. The implications of that scenario are weak GDP growth, poor labor market growth, and high market volatility, among many other unknowns. It might also imply continuing civil unrest and potentially war.

All of those in power appear to be complicit in advancing this agenda. Why not? They are rewarded handsomely for their compliance. That is how politicians and the corporate elite get wealthy from their positions of power.

Meanwhile, the rest of us watch and wait, hoping that someone will show up to represent the community in this injustice.

What the Fed is doing to save today will cause problems tomorrow. We have two choices; we can recognize the problem and force change by electing like-minded legislators. Or, we can stand aside. The latter, of course, only furthers behavior detrimental to our country.

Instead of cheering Fed actions today, consider what they are doing to the future.

If nothing changes, then the problem will eventually take care of itself. It will not be peaceful or pleasant, but it will come to a resolution. The outcome will not be favorable for investors or what was once the greatest economy in history.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.