Yes, we said it. The bear market is here. Whether you want to stick with the literal definition of a close below 20% or are satisfied with the fact that most of the world’s equity markets are selling off and resetting their multiples to levels that are more commensurate with higher interest rates.

We are happy that Canada is outperforming, but after June we can no longer claim “in-the-green” superiority like we had earlier this year. Since we are in a bear market, it is important that we look at the anatomy of a drawdown like this to inform us of how to position ourselves going forward.

Stage 1 – Valuation reset

Valuations of any asset are based on its forecasted future cash flow or earnings, discounted into today’s dollars. The discount rate depends on the risk-free rate and a premium for the future uncertainty of those flows. For bonds this premium tends to be smaller but does rise if default risk escalates. For equities, which enjoy upside of earnings surprises, the premium is much higher as the future uncertainty is greater. If a recession looms, the discount rate goes way up, affecting both.

In today’s world, the risk-free rate is rapidly changing as central banks embark on a tightening program to combat inflation. Should we use 1.5%, 2.5% or 4%? Ultimately, it will depend on the path of inflation. But there is a rising recession risk … should we now reduce our estimates of risk free? It’s hard to know. Simply put, the discount rate has gone up faster than we have seen in generations given the quick onset of inflation and the high level of uncertainty over the coming quarters.

In today’s world, the risk-free rate is rapidly changing as central banks embark on a tightening program to combat inflation. Should we use 1.5%, 2.5% or 4%? Ultimately, it will depend on the path of inflation. But there is a rising recession risk … should we now reduce our estimates of risk free? It’s hard to know. Simply put, the discount rate has gone up faster than we have seen in generations given the quick onset of inflation and the high level of uncertainty over the coming quarters.

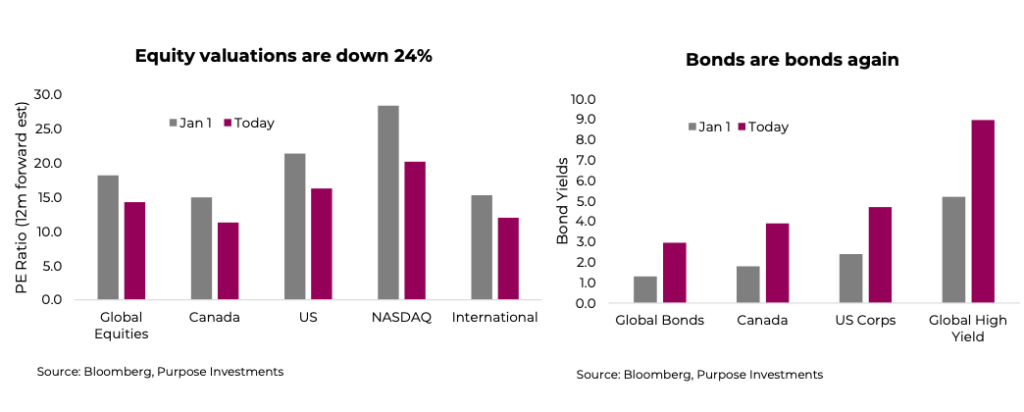

Why have valuations reset materially? On average the price-to-earnings ratio globally has fallen about a quarter. That’s meaningful and brings the S&P 500, for example, into a range that a Shiller CAPE disciple would even start to get interested in. We won’t call it a screaming buy, especially if you view the ‘earnings’ to be at risk of revisions (see next stage). Our view is that valuations have reset for two main reasons: interest rates, and expectations for downward earnings revisions. At least the froth is now out of the equity market. But will valuations stop here, or over-correct and become even cheaper?

A valuation reset for bonds too

Yields were ridiculously low during the pandemic uncertainly. However, yields started to rise way back in 2020 after the major economic shock. They just accelerated in 2022, so the bond market has been in decline for two years now. Yields are no longer ridiculously low, they are not even low, they are normal again or … dare we say juicy?

From a valuation reset, the bond market may be the more relatively attractive asset class. But this really comes down to defining the more imminent and longer recurring threat: inflation or recession? If inflation continues, bonds are still at risk. But if a recession is developing, bonds should outperform equities. The good news is that with today as a starting point, valuations in both asset classes are much improved, bettering the future expected returns even in an uncertain world.

We believe the valuation reset is largely done … but revisions are up next.

Stage 2 – Revisions

Whether it was a natural cycle, or the tightening of financial conditions, consumer behaviour is reverting to pre- pandemic patterns. Consumer confidence is in the dumps due to the market drop and inflation, and high energy prices are not helping.

We see several signs of slowing global economic activity. Copper has been falling quickly. Housing activity in Canada and the U.S. has started to slow materially, largely due to higher mortgage costs. This is now starting to show up in prices, and the Homebuilders index is off 34% year-to-date.

From Credit Suisse June monthly survey of real estate agents – ‘The adjustment to higher rates appears to be happening more rapidly than in prior cycles as the change in traffic was more abrupt and we’re now already seeing a reaction on pricing.’

Manufacturing activity, based on PMI surveys, is slowing after running really hot to catch up and alleviate many backlogs or shortages. Meanwhile leading indicators are declining. The data has been softening. Let’s not forget the U.S. economy contracted in Q1 and based on the Atlanta Fed’s GDP Now (a measure that attempts to capture how the economy is doing in almost real time), Q2 is negative as well. If Q2 comes in below zero as GDP Now is suggesting, that would be a technical recession for the U.S. economy: two consecutive quarters of negative GDP growth. While the economy is slowing, however, it is too early to say it is heading into a contraction.

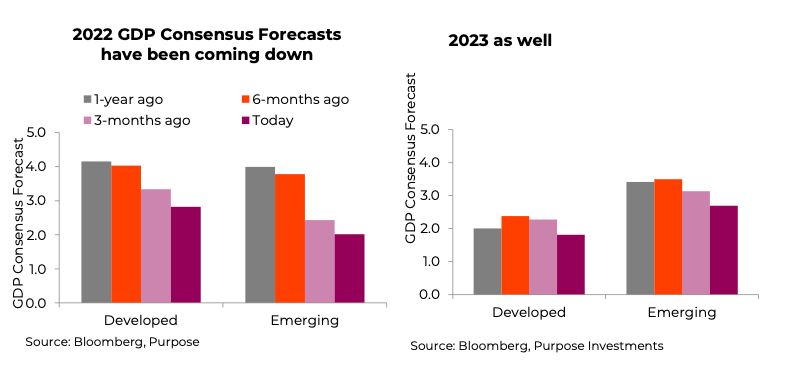

Make no mistake, GDP forecasts are being revised lower. Consensus expectations for 2022 growth has been trending lower, more so in emerging economies given the events in Easter Europe. These trends will likely continue to come down as we move through the second half of 2022.

The good news is few market participants observe economic forecasts, perhaps due to a patchy success rate at forecasting the turning points. Investors focus on company earnings, and they may be set to see downward revisions as well.

Margins keep rising

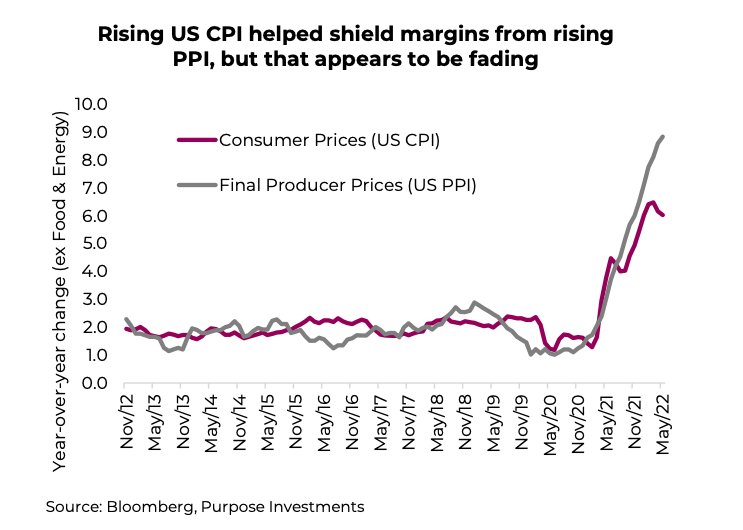

Let’s start with margins, which we did get wrong. We thought cost pressures would crimp margins near the end of 2021. There is no denying that corporate costs are on the rise: shipping costs, wages due to a tight labour market, commodity prices, the list goes on. However, we underestimated the ability of companies to pass this on very quickly into higher prices, which most of us consumer have become keenly aware … but able to pay. Everyone’s got their inflation story from restaurants to vacations.

While the pace of increases in consumer prices (CPI) have abated, producer prices (PPI) are still rising. CPI is starting to come down as the efforts to combat inflation are working.

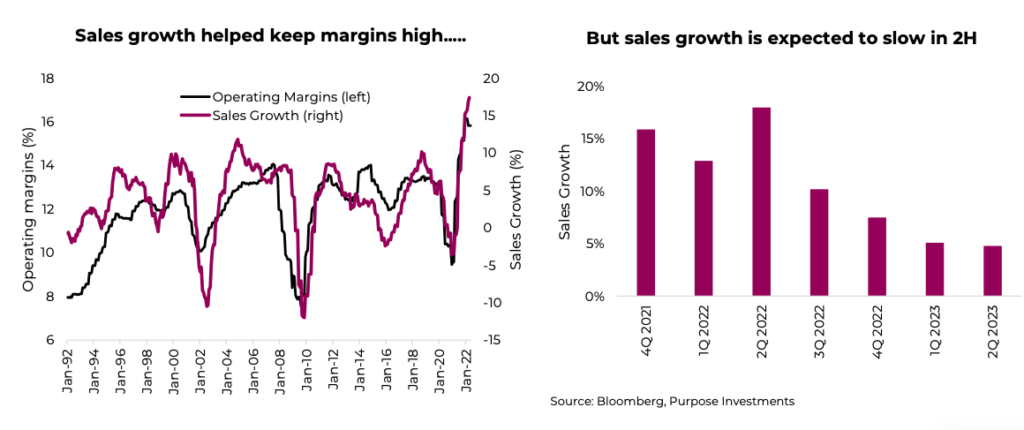

Demand is softening. Costs, using our proxy of PPI finished goods, will come down too but it is a lagging indicator. And during this lag, margins are at risk. It does get a bit more concerning since margins are sitting at all-time highs (as far back as our data goes). The lifeblood of margins is sales growth. Now this can come in the form of greater output in units or rising prices, or simultaneously as has been the norm over the past few years. The risk now is even based on current consensus analyst estimates, sales growth is poised to decelerate in the second half of 2022 and into 2023.

Slowing economic growth, begets slowing sales growth which leads to margin compression. What does this mean for earnings forecasts? Perhaps they may be too optimistic. Current forecasts have S&P 500 operating earnings growing on average 12.5% across the second half of 2022 and first half of 2023.

We believe earnings forecasts will come under pressure in the months ahead, even as early as this coming earnings season. Expectations are simply too high and downward revisions are likely.

Stage 3 – Recovery

Stage 1 and Stage 2 paint a pretty bleak picture, but don’t forget how far markets have already fallen. Has much of this been priced in? Probably a good amount, but we don’t think all. Remember, much of this is by design. Markets went too far, inflation got too hot, and now the central banks of the world are tightening to slow economic growth and tame inflation. What we are experiencing – recession talk, markets reacting negatively – is precisely what is supposed to happen.

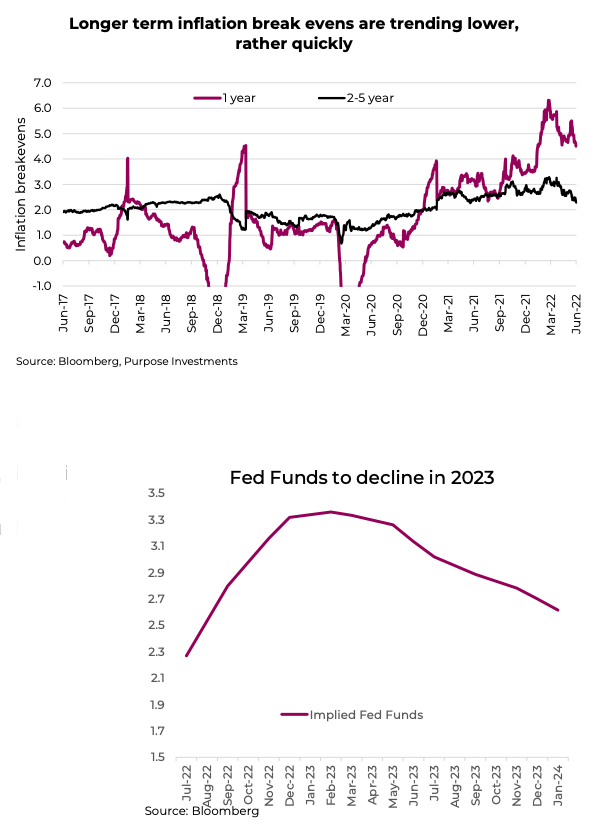

As the economic data cools, it will increasingly show up in the inflation data. The bond market is keenly aware of this and break-evens, as the market’s measure of inflation, have started to come down. The amount of inflation priced into the bond market in the 2–5-year range is now back down to early 2021 levels.

We are not saying that inflation risk is gone; the future path of rents and wages remain very uncertain

and could accelerate. Even if inflation retreats, it will likely not get all the way back down to pre-pandemic norms that the markets had become so accustomed. The inflation risk is starting to decline, though, and that is good news.

If inflation begins its long retreat in the second half of 1.0 2022, that will be in part because economic growth is 0.0 cooling. This will open the door for central banks to -1.0 slow or cease their rate hiking paths. This has already shown up in the Fed Funds futures market. Futures have the U.S. Federal Reserve moving their rate from the current 1.5% to 3.5% in Q1 of 2023, but then cutting rates back down to 2.75% by the end of 2023.

Whatever the path, as soon as inflation pressures ease, financial conditions should begin to ease as well. Whether we can avoid a recession during this adjustment will be the conversation in the second half.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.