I’ll kick this blog off by stating that I do not have a position in Tesla (TSLA) stock.

And really, that is why I’m writing this post… to explain the catch 22 around trading a stock “like this”.

What do I mean, “like this”?

Last night I shared a MarketSmith chart via twitter (a tweet) analyzing the current setup for TSLA. The chart was built with Investors Business Daily’s product suite. I’m also an Investors Business Daily (IBD) partner – you can gain access here. Promo over…

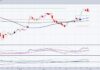

You can see that tweet below. Looking at the chart, the stock closed Monday right on $250 support. It’s weak no doubt (RS 11) but it’s also oversold. Not a bad short-term trading setup. Note that I spend a majority of my time in the financial markets as a “trader” and not a long-term investor.

BUT, as much as I try to stay focused on tuning out the noise, it’s nearly impossible for me to trade a stock “like this”. It carries a great deal of “headline” risk. And even a short-term trade can go south on a bad headline of a reeling company.

The stock is up 5 percent this morning (at the time of this writing), so the technicals are playing out with a nice bounce off support… and for traders that don’t mind that added risk (or feed off it), this trade setup was there for the taking.

If the bounce wants to go higher, it has gap resistance between $274-$281, then a falling 50 day moving average currently at $307. For traders looking for a short opportunity, the falling 50 day may be a place to take a stab. Or alternatively on a strong break of support. Either way, stops are mandatory with a stock “like this”.

$TSLA Tesla down almost 20% last 5 trading sessions. RS down to 11. #IBDpartner

$250 support is important for bulls. Trading heavy but getting near-term oversold. @MarketSmith — https://t.co/zm4F25Sd39 pic.twitter.com/pj9MmDmjtm

— Andy Nyquist (@andrewnyquist) October 9, 2018

Thanks for reading.

Twitter: @andrewnyquist

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.