- With only 13% of companies reporting thus far, S&P 500 EPS growth for Q4 2025 currently stands at 8.2%

- The tech sector continues to dominate, Despite a significant earnings-related slide from Intel, the Information Technology sector remained the market’s primary engine, lifted by an ongoing “AI supercycle” and strong results from names like Meta and Netflix

- Potential earnings surprises this week: Union Pacific, NextEra Energy, Texas Instruments, UnitedHealth Group, American Express and Regeneron Pharmaceuticals

- Peak earnings season for Q4 begins this week and runs through February 27

Headline whiplash impacted US equity markets last week. Investors who checked their portfolios on Tuesday saw a sea of red as the Cboe Volatility Index (INDEXCBOE: VIX) surged above 20. The catalyst? A frosty reception to President Trump’s renewed push to annex Greenland, paired with a sudden threat of 10% tariffs on eight European allies.1

For a moment, the market braced for a Greenland tax that threatened to ignite a fresh trade war with the EU.

However, the narrative shifted rapidly by Wednesday and Thursday. As news of a framework deal involving NATO leadership emerged and the immediate tariff threat was walk-back, the bulls came charging back.2

By Friday afternoon, the S&P 500 (INDEXSP: .INX) and Nasdaq were battling back toward positive territory for the week, proving once again that in 2026, geopolitical drama is often a “buy the dip” event rather than a structural breakdown.

Tech Lifts the Heavy Weight, Even as Intel Falters

The real hero of the late-week recovery was the Information Technology sector. Despite a jarring 16% slide from Intel (INTC) following a tepid outlook shared on their Q4 2025 earnings call, the broader semiconductor space and “Magnificent Seven” megacaps provided the necessary ballast.

Nvidia (NVDA) rose as reports surfaced that Chinese tech firms are clearing hurdles to order H200 chips3, while Netflix (NFLX) provided the earnings-driven momentum the market craved, and an analyst upgrade on Meta Platforms (META) as well as rollout of Threads ads boosted that name.4 The tech sector continues to be the primary engine of the world’s largest economy, fueled by an AI supercycle that analysts at J.P. Morgan believe will drive double-digit earnings growth (13 – 15%) for the next two years.5

Q4 2025 Scorecard: Growth Perseveres

We are now roughly 13% through S&P 500 reports for the Q4 2025 earnings season, and the early results as tracked by Factset6 suggest a “glass half full” scenario:

- Positive Surprises: 75% of S&P 500 companies have beaten EPS estimates, while this is below the 5 and 10-year average, keep in mind analysts uncharacteristically raised expectations leading into the season.

- Earnings Growth: The blended growth rate stands at 8.2%, putting the index on track for its 10th consecutive quarter of year-over-year growth.

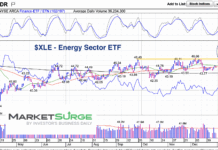

- Sector Leaders & Laggards: While Tech and Materials are leading the charge, the Energy sector remains the lone outlier, projected to report a year-over-year revenue decline.

While the Greenland saga dominated the news cycle, the corporate world was busy reporting the nuts and bolts of the economy. Notable earnings reports from last week include streaming giant, Netflix (NFLX) which delivered a blockbuster Q4, crossing the $325 million paid membership milestone and forecasting 2026 revenue of over $50 billion.7

Industrials results were a bit more mixed when GE Aerospace (GE) reported lower-than-expected results, causing shares to decline over 7% post-earnings.8 Meanwhile Procter & Gamble (PG) offered a defensive win for the bulls, rising 2.5% on solid consumer demand.9

The week ended with Intel reporting results that beat on the top and the bottom-line, but it was their disappointing outlook which served as a stark reminder that while the AI tide is rising, not every ship is floating equally high.10

Looking Ahead: Macro and Tech Earnings in Focus

The macro chaos of early 2026 isn’t over. With the Federal Reserve’s January 28 interest-rate decision looming and the Bank of Japan grappling with record-high yields, the Greenland calm may be temporary.

We also move into peak earnings season this week. Earnings results from heavy hitters, Microsoft (MSFT), Apple (AAPL), and Alphabet (GOOGL), will take the stage. Their commentary on the state of global trade and AI spending will likely determine if the S&P 500 can break its two-week losing streak and return to record highs.

Outlier Earnings Dates This Week

Academic research shows that when a company confirms a quarterly earnings date that is later than when they have historically reported, it’s typically a sign that the company will share bad news on their upcoming call, while moving a release date earlier suggests the opposite.

This week we get results from a number of large companies on major indexes that have pushed their Q4 2025 earnings dates outside of their historical norms. Six companies within the S&P 500 confirmed outlier earnings dates for this week, five of which are later than usual and therefore have negative DateBreaks Factors*. Those names are: Union Pacific Corp (UNP), NextEra Energy (NEE), Texas Instruments (TXN), UnitedHealth Group (UNH) and American Express (AXP). Only Regeneron Pharmaceuticals (REGN) has a positive DateBreaks Factor for this week.

Outlier Earnings Dates This Week

Academic research shows that when a company confirms a quarterly earnings date that is later than when they have historically reported, it’s typically a sign that the company will share bad news on their upcoming call, while moving a release date earlier suggests the opposite.11

This week we get results from a number of large companies on major indexes that have pushed their Q4 2025 earnings dates outside of their historical norms. Six companies within the S&P 500 confirmed outlier earnings dates for this week, five of which are later than usual and therefore have negative DateBreaks Factors*. Those names are: Union Pacific Corp (UNP), NextEra Energy (NEE), Texas Instruments (TXN), UnitedHealth Group (UNH) and American Express (AXP). Only Regeneron Pharmaceuticals (REGN) has a positive DateBreaks Factor for this week.

Q4 2025 Earnings Wave

This week marks the beginning of peak earnings season which extends through February 27, and anticipates over 1,000 company reports each week. Currently, February 26 is predicted to be the most active day with 852 companies anticipated to report. Thus far, only 53% of companies have confirmed their earnings date (out of our universe of 11,000+ global names). The remaining dates are estimated based on historical reporting data.

Sources:

1 “Trump says 8 European countries will face 10% tariff for opposing US control of Greenland,” Associated Press, Josh Boak, Emma Burrows, Daniel Niemann, January 17, 2026, https://apnews.com

2 Trump says he reached Greenland deal ‘framework’ with NATO, backs off Europe tariffs,” CNBC, Kevin Breuninger, January 21, 2026, https://www.cnbc.com

3 “China Tells Alibaba, Tech Firms to Prep Nvidia H200 Orders,” Bloomberg News, January 22, 2026, https://www.bloomberg.com

4 “Meta (META) Stock Is Up, What You Need To Know,” Yahoo Finance, Anthony Lee, January 22, 2026, https://finance.yahoo.com

5 “2026 market outlook: A multidimensional polarization, JPMorgan, December 9, 2025, https://www.jpmorgan.com

6 FactSet Earnings Insight, John Butters, January 23, 2026, https://advantage.factset.com

7 Netflix Q4 2025 Earnings Results, January 20, 2026, https://s22.q4cdn.com

8 GE AEROSPACE ANNOUNCES FOURTH QUARTER 2025 RESULTS, January 22, 2026, https://www.geaerospace.com

9 P&G Announces Fiscal Year 2026 Second Quarter Results, January 22, 2026, https://pginvestor.com

10 Intel Reports Fourth-Quarter and Full-Year 2025 Financial Results, January 22, 2026, https://www.intc.com

11 Time Will Tell: Information in the Timing of Scheduled Earnings News, Journal of Financial and Quantitative Analysis, Eric C. So, Travis L. Johnson, Dec, 2018, https://papers.ssrn.com

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.