It’s not quite the second quarter earnings season yet; that kicks off on July 15 with some of the big banks. In the meantime, investors will be tuned in to important results from the automakers next week, when thirteen global car companies release their monthly production, deliveries and/or sales numbers.

These interim reports always serve as a good sneak-peak for what’s to come in quarterly earnings reports.

Double Whammy for Automakers – Tariffs Plus a Still Shaky Consumer

It’s been a turbulent year for US automakers as tariffs on parts made outside of the US have increased the costs for cars overall, during a time when some US autos have struggled to gain market share from foreign competitors.

Earlier this month, President Trump doubled previously implemented tariffs on steel and aluminum imports to 50% from the 25% that took hold in March. This negatively impacted automakers. This is in addition to a 25% tariff on imported car parts that went into effect on May 3.

And despite a reimbursement program designed to give automakers some relief on the latter tariffs while they set up facilities domestically, many of these companies have had to reduce workforces or increase prices to stay afloat.1

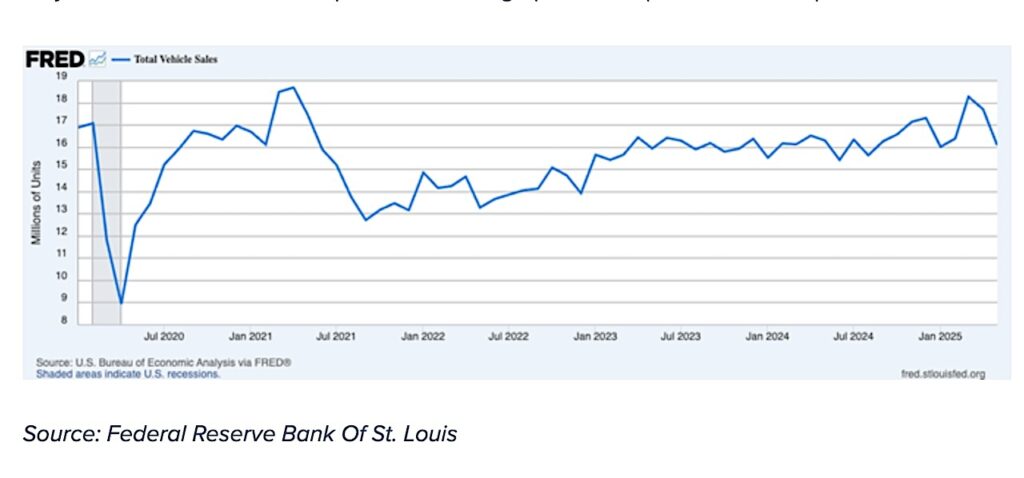

At the same time, US consumers are holding back on large ticket purchases like autos, appliances and abodes. In May, Total Vehicle Sales came in at 16.092 million units, a decrease of 9.2% from April’s results of 17.716M units.2 The rush in buying that started ahead of tariff implementations has visibly slowed. Similarly, overall US Retail Sales for the month of May fell 0.9%, more than anticipated, due in large part to the pullback in auto purchases.3

Reports to Watch Next Week

Note: that all dates are unconfirmed and based on historical reporting dates.

June 30, 2025

- Toyota Motor Corporation: Sales, Production, and Export

- Honda Motor Co. Ltd.: Production and Sales

- Subaru Corp.: Monthly Production and Sales

- Mazda Motor Corporation: Production and Sales

July 1, 2025

- General Motors Co.: US Sales

- Tata Motors: Sales

- NIO Inc.: Delivery Update

July 2, 2025

- Tesla, Inc.: Production & Deliveries

- Rivian Automotive, Inc.: Production

- Hyundai Motor Company: Monthly Sales

- Kia Corporation: Monthly Sales

July 3, 2025

- Ford Motor Company: Sales

- Volvo Car: Sales

The Bottom-Line

The upcoming interim reports from global car companies will be a crucial early indicator of how recent tariffs and shifts in consumer spending are impacting the US auto industry. With increased tariffs on imported parts and a noticeable pullback in large purchases by consumers, the financial results from these automakers will offer a vital preview of the broader economic effects, particularly within a sector directly targeted by new trade policies.

Sources:

1 “Trump is giving automakers a break on tariffs,” NPR, Danielle Kurtzleben and Tamara Keith, April 25, 2025, https://www.npr.org

2 Total Vehicle Sales, US Bureau of Economic Analysis, June 6, 2025, https://fred.stlouisfed.org

3 Advance Monthly Sales for Retail and Food Services, United States Census Bureau, June 17, 2025, https://www.census.gov

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.