Is Your Bond Portfolio Too Plain Vanilla?

Exchange-traded funds (ETFs) make for an easy way to access a diverse portfolio of bonds with very minimal fees. The most widely owned Bond ETFs are filled with hundreds or thousands of securities that track a proven benchmark. They are transparent, liquid, and highly flexible vehicles with a proven track record of success.

Some of these top Bond ETFS / funds include:

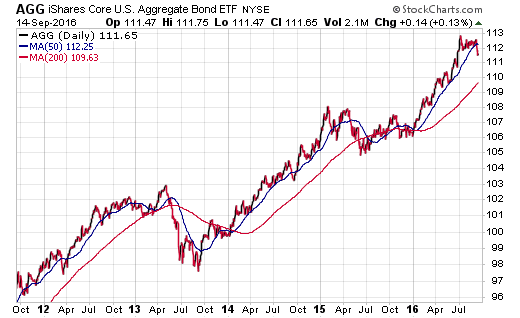

iShares Core U.S. Aggregate Bond ETF (NYSEARCA:AGG) – $41 billion in assets.

Vanguard Total Bond Market ETF (NYSEARCA:BND) – $32 billion in assets.

iShares Investment Grade Corporate Bond ETF (NYSEARCA:LQD) – $32 billion in assets.

All of these Bond ETFs share common traits. These traits include a high degree of diversification, low fees, investment grade credit quality, and moderate to high sensitivity to interest rates. These types of funds are typically used as core holdings, with a large percentage of an ETF investors’ wealth tied to their performance.

More From David: Are Treasury Bonds Over-Owned & Over-Loved?

Time to Reassess?

These traits have been advantageous in a falling interest rate environment and continue to offer a meaningful counterbalance to stocks and other higher risk asset classes. Nevertheless, there are drawbacks to strictly adhering to a plain vanilla, investment grade bond allocation. Besides the obvious underperformance in a rising rate period, these tools also generally have lower yields than more credit sensitive holdings.

In my opinion, investors who have ridden the wave of performance in these generic indexes should be looking to moderate or reduce their enthusiasm for future returns. They may even consider carving out a portion of their fixed-income exposure for more dynamic opportunities or reducing their interest rate risk by substituting funds with a lower effective duration.

One way to accomplish this feat is by using sector-focused bond ETFs for tactical fixed-income exposure. There are a number of ways to enhance a portfolio through areas such as emerging markets, junk bonds, bank loans, convertible bonds, mortgage debt, and even municipal bonds. Each of these sectors offers varying benefits and opportunities that are tied to their structure.

For instance, we recently allocated a portion of our income client portfolios towards bank loans via the First Trust Senior Loan Fund (FTSL). This move allows us to diversify the bond sleeve of our portfolio towards low duration, low credit quality debt instruments with attractive fundamentals in a rising rate or inflationary environment. It instantly enhances the total yield of our accounts and shifts our stance to overweight credit. I consider this type of position a tactical opportunity to be paired with typical core fixed-income exposure.

Similar adjustments can be made with municipal bonds for tax-sensitive accounts or emerging market bonds to gain greater international exposure. The opportunities are limitless to fine-tune your asset allocation and broaden your scope away from the mundane. My advice is to use the screening tools at a free resource such as ETF.com or ETFDB.com to compare and contrast the differing options in each sector of the bond market.

If that style doesn’t suit your tastes, but you are still wary about interest rate risk, there are other strategic avenues available as well. Moving down the duration ladder to a fund with a more conservative mandate may help alleviate this stress. Of course, this will likely lower your effective yield in conjunction with minimizing price volatility. Such is the trade-off in risk versus reward that the bond markets offer.

There is a wide array of choices in the short-term bond ETF category. The three most popular funds by asset size are:

Vanguard Short Term Bond ETF (NYSEARCA:BSV) – $18.5 billion in assets.

Vanguard Short-Term Corporate Bond ETF (NASDAQ:VCSH) – $14 billion in assets.

iShares 1-3 Year Credit Bond ETF (NYSEARCA:CSJ) – $11.3 billion in assets.

All of these options have an effective duration of less than three years and very low expense ratios.

The Bottom Line

The strength of ETFs has always been their robust menu of readily available options for every type of investor. Those that believe in thinking outside the box can create a customizable allocation to bonds that suits their goals and risk tolerance over the next several years. Taking a more hands on approach can allow for greater flexibility, enhanced income, or risk avoidance.

Thanks for reading.

Twitter: @fabiancapital

The author of his clients may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.