By Jeff Wilson

By Jeff Wilson

After discussing some simple terms and definitions on options here, the next step is to discuss some Options strategies that can be used into the upcoming earnings season. I’ve spoken to several traders who own stock of companies and who want to do something to protect or maximize their stock holdings into an earnings report but not sure how to do it or what strategies to use.

Here’s a typical thought process: “Do I sell 1/2 and let the other 1/2 ride? But I’m going to regret it if it pops after the report” Stock traders only make money when the underlying stock price moves in the direction they want it to move.

A stock can either go sideways, up or down. If the price doesn’t change or it goes the opposite direction, stock traders lose money (on a sideways move, loss is due to commissions). So based on those odds, there is a 1/3 probability that the stock trader is right in predicting the move.

Enter the flexibility of options trading vs stock trading. If traders utilize options properly, they can make money in two of three ways, thereby greatly increasing the probability of profits.

With this in mind, let’s get straight to some options strategies into earnings season. Coming into and right before an earnings report is released, the implied volatility (IV) of the options increase (more on that here). In the hours of regular trading after a report is released, the IV of the options starts to decrease, slowing moving towards the mean of its historical volatility (HV). So if you own at least 100 shares of a company that is reporting and you don’t know what to do with it, you can take advantage of this artificially inflated premium in the options contract by selling 1 call option against your stock holding. This strategy is called a covered call. You are basically selling an inflated call option to someone who thinks that the stock will also rise and will pay you an inflated price for it because that call buyer thinks that the stock will rise over the strike. For more, read Brad Tompkins in depth article on the covered call strategy.

There is of course risk both upside and downside to consider. To the upside, the maximum gain is capped by the strike price of the call you sold. Take the example of NFLX (Netflix) right before its 1/25/12 earnings report. Click to enlarge.

If you had sold the 100 call strike you would have given the call buyer the right to buy your shares at $100/share regardless of how much higher the stock is trading above 100 (Although technically, it would have been bought from you at 105.25 since you also took in 5.25 in premium). You can see that it traded from around 112 to 130 during the week that it reported earnings (see NFLX daily chart below) and this shows the upside risk that selling a call can present to a trader.

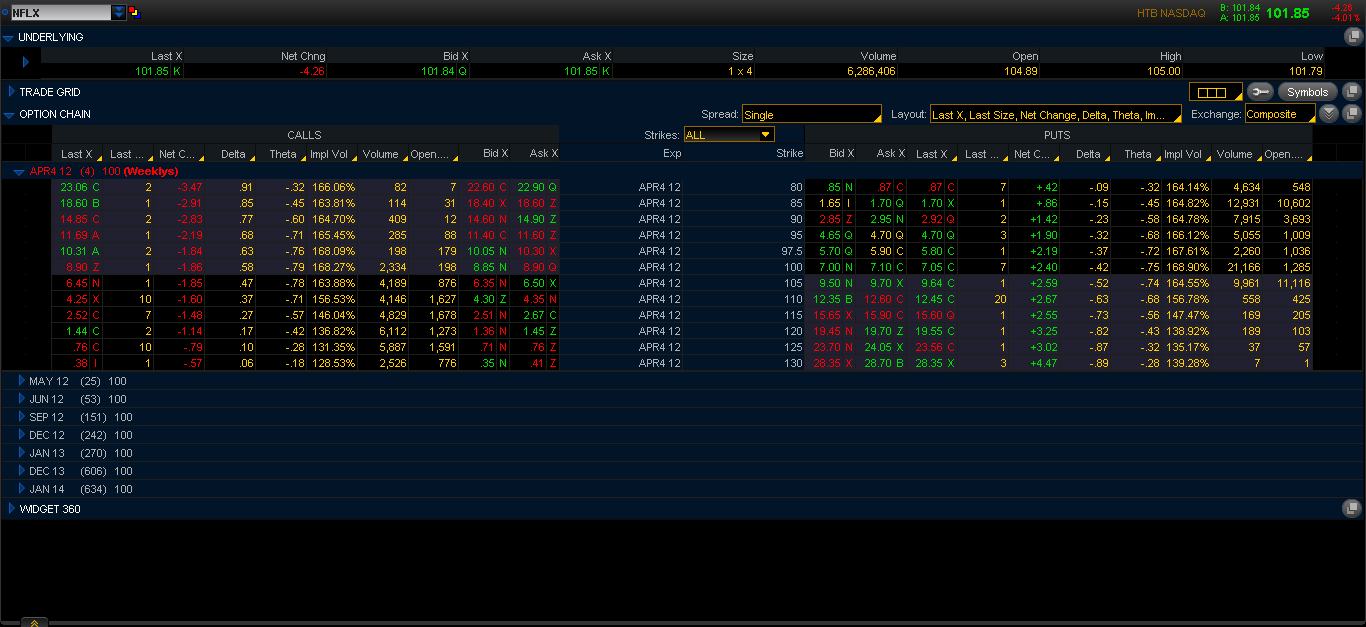

In addition, the amount you took in by selling the call is the maximum downside protection you have. You are open to losses if the stock moves more than the premium you took in. Here’s a good example of this again using NFLX earnings on 04/23/2012. Click to enlarge.

If you sold the 105 strike call for 6.35, your total downside protection would be current stock trading price (101.85) minus 6.35 which would be 95.50. Now see where NFLX traded after the earnings report where it traded roughly around the 85 price level which is more than $10 below the theoretical breakeven level of the covered call. Click graphic to enlarge.

Another example of utilizing options in conjunction with stock is called a collar. It’s actually a covered call along with buying a put. Recall in the example above that a covered call provides limited downside protection. With the collar strategy, the put solves that problem. In conjunction with selling a call, you are also buying a put that provides you downside protection in the event that the stock price trades and closes below that price. Due to the added put, this strategy is more conservative compared to the covered call. However, do keep in mind that since the IV of the stock options are “juiced” into binary events such as earnings reports, you are buying the put at inflated prices. This is offset to a certain extent by selling the inflated call option. You can put this insurance protection strategy on at a low cost and sometimes for nothing or even a credit depending on the strikes you choose.

I know some traders who leg into this position by first buying the put a few days before the earnings report thus decreasing the effect of increased IV and then selling the inflated call right before the report. While this strategy can work, keep in mind that the stock can move substantially away from the current price into the earnings report thus affecting the pricing of the call option you intend to sell.

Keep an eye out for Part 2 where I will discuss earnings strategies involving options only. Thanks for reading and have a great week.

———————————————————

Twitter: @cerebraltrades and @seeitmarket Facebook: See It Market

No position in any of the securities mentioned at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.