By Brad Tompkins

By Brad Tompkins

In our last article discussing Trading a Put, we saw how options can be used to protect against losses in a portfolio. We’ll expand that topic with a slightly different twist to see how options may be used to not only provide downside protection, but deliver additional income as well. Seems too good to be true to have someone pay you to own portfolio insurance? Nothing is free or without tradeoffs, but Covered Calls are the most popular option strategy for good reason.

Definition – Covered Call, Writing a Call, Buy-Writes

Recall from our introductory article in this series how a Call Option is a contract giving the Call buyer the right to purchase 100 shares of the underlying security at the option expiration date for its specified strike price. The cost of the Call is referred to as its premium. We know the value of the Call will increase if the security price rises. But the time value portion of the option premium will go to zero at expiration – remember Theta loss. Lastly, Call options can be sold as easily as being bought (Sell to Open paired with Buy to Close instead of the normal order flow Buy to Open with Sell to Close).

Now we have enough information to begin assembly of these pieces into the Covered Call strategy. For each 100 shares of a stock you own, you could sell 1 Call contract against your shares. You as the option seller collect the option premium in exchange for giving the buyer the right to purchase your shares at the strike at expiration. Once you have sold or “written” the call, your long stock and short option positions are collectively known as a Covered Call. A Buy-Write is when you purchase the security shares and sell the call option at the same time.

After you have initiated the covered call and pocketed the option premium, these are your outcomes:

• Stock Price is above strike price at expiration. Your stock shares will be called away and sold for the strike price.

• Stock Price is below strike price at expiration. The sold call option expires worthless and you still own the shares.

Tradeoff – Income but Limited Downside Protection and Limited Upside Gain.

The covered call only provides downside protection to the extent of the total collected option premium. That isn’t much in contrast to a purchased Put option which protects in case your stock falls all the way down to 0. At the same time, your stock gain upside is capped at the call strike price. Knowing this, the best scenario in which to use covered calls would be when you expect a period of slow stock appreciation and you would not regret selling your stock shares at the call strike.

For me, an ideal stock candidate for covered calls is a large and stable US company that is in a long term uptrend. ETF’s can be viable Covered Call holdings too. In that regard, I would suggest steady growing sectors of the Goldilocks variety – not too hot, not too cold. Also look to be sure there is plenty of liquidity trading the options and that the bid/ask spreads aren’t outrageously wide.

Watch the Covered Call Work

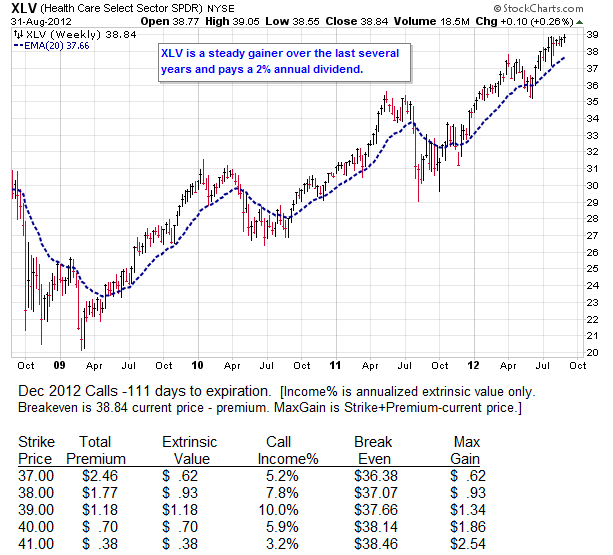

As with any strategy, it is easier to understand how it works via a specific example. Look below at the Health Care Sector [symbol XLV] chart moving steadily up and to the right. I’ve also included XLV Dec 2012 Call pricing and display some of the covered call math.

What should stick out is the rich call income percentages calculated using the extrinsic or time value portion of the call premium that would be collected in return for allowing someone to buy your shares at the various strike prices. Who among us wouldn’t like to boost their portfolio performance by simply selling out of the money call options against longer term holdings? When you are more bullish, sell calls farther out of the money which allow for larger total gains. And when slightly bearish and anticipating a correction, sell calls that are at or slightly in the money which give more protection.

It is slightly over simplifying, but another angle to understand Covered Calls would be to view them in the context of being paid to enter a date specific limit order to sell your security shares. Realize that your call premium income earnings come at the expense of limiting your stock upside appreciation. And don’t forget to provide for downside protection below your breakeven levels. In terms of advanced risk management, your homework assignment is to research a more sophisticated option strategy called a Collar where the income from sold calls is used to buy puts. Under the right circumstances, the Collar can be initiated for a net credit (you collect more selling the call than it costs for the protective put) which results in a situation where you can provide ample risk protection and get paid to do it. What a deal!

Overall, the Covered Call strategy can work to reduce volatility in your portfolio and increase returns during flat or slowly rising market periods. As with any new strategy, you will be well served to paper trade first and then stay small until you get comfortable with the dynamics. Trade well.

See Also: Introduction to Trading Options, Trading a Put

———————————————————

Twitter: @BBTompkins and @seeitmarket Facebook: See It Market

No position in any of the securities mentioned at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.