The stock market pushed forward last week in a performance that made more headlines, but can best be described as mixed. And this week is seeing more of the same, with a big start Monday that gave back gains today.

The Dow Jones Industrial Average (INDEXDJX:.DJI) and S&P 500 (INDEXSP:.INX) hit new highs along with the Dow Utilities but the NASDAQ and Russell 2000 Indexes suffered declines. Utility stocks are benefiting from a drop in long-term interest rates and reduced expectations for inflation.

Federal Reserve Chief Janet Yellen raised the fed funds level to a range of 1.00% to 1.25% last week. Although this was fully anticipated, the Federal Reserve’s decision occurred against a backdrop of slower economic growth and unexpected weakness in the Consumer Price Index (CPI). The CPI declined for the second time in the past three months. This helps explain the weakness in some areas of the stock market and the narrowing of the yield curve.

The concern is that the Federal Reserve could be acting too aggressively in an economy that has yet to strengthen. Last week it was reported that industrial production was flat in May. Housing starts and building permits declined and retail sales were weak. The Fed argues that the weak economic data and low inflation numbers are temporary. But sufficient uncertainty has been created with short-rates going up and the economy hitting a slow patch that stocks will likely slip into a consolidation mode as the first half of the year expires. If the Fed’s analysis of business conditions is on target, the stock market should head higher in the second half of the year.

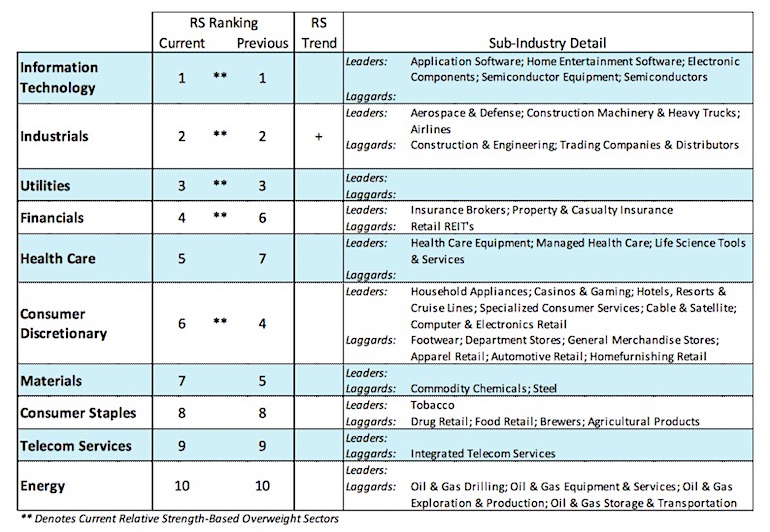

The factors weighing on the market as we move into the third quarter include the absence of upside momentum, investor complacency and lost leadership. The breakdown in the technology sector has yet to be replaced with new leadership.

This has resulted in a loss of momentum that was previously being provided almost exclusively by a handful of mega-cap growth stocks.

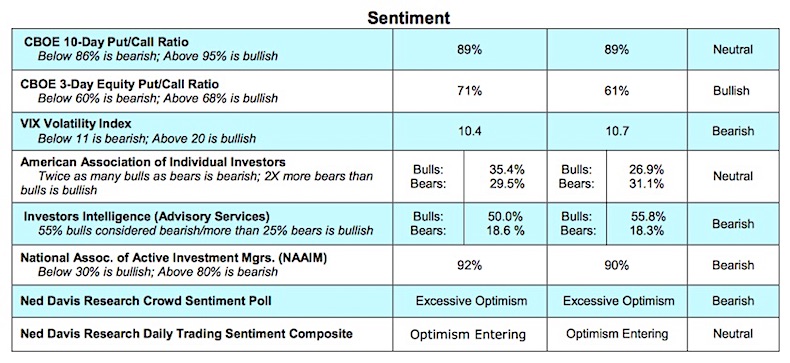

Despite a host of negative economic and geopolitical news, investor complacency remains deep-seated and widespread. The most recent reports and surveys shows investor confidence near the top end of the spectrum. This can be seen in the largest weekly inflows to the financial markets since the November election. It is estimated that more than $24 billion flowed into stocks and $9 billion into bonds (ETFs received most of the new money). Despite the weakness in the 2017 market leaders, the broad market is improving below the surface. Over the past four weeks, the percentage of stocks in the S&P 500 trading above their 50-day and 200-day moving averages has expanded. The fact that the market is less dependent on a handful of issues is bullish over the intermediate term. Although there may be limited upside potential as the second quarter unwinds, the potential for a summer rally beginning early in the third quarter remains on the drawing board.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.