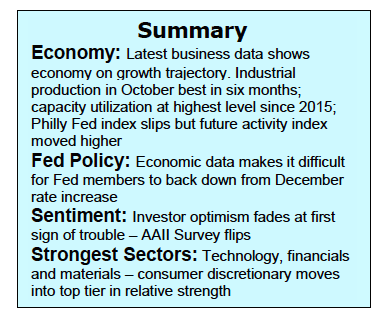

The Dow Jones Industrials (INDEXDJX:.DJI) and S&P 500 Index (INDEXDJX:.DJI) ended marginally lower for the second week in a row last week. But the bulls are back at it again this week, with stocks rising Monday and set to rally again today.

The equity markets staved off a pullback attempt last week on a report that inflation pressures remain dormant.

This helped keep the benchmark 10-year Treasury Note Yield (INDEXCBOE:TNX) anchored at 2.35%, which is close to the levels found in early January. It is likely that the yield on the 10-year T-note would need to climb above 2.65% to be a threat to the equity markets. A move above 2.65% would surpass the March 2017 high and also threaten a 35-year downtrend in rates that has been in force since 1982.

Bull markets often end with the Fed aggressively raising interest rates. This is not the case in the present example as long-term rates remain below the rate of growth in the U.S. economy. Although the Fed is expected to raise short-term interest rates in December this is likely to be a non-event for stocks. Interest rates are rising but from very low levels and Fed Chief Janet Yellen has done a good job of preparing the markets for an end-of-the-year rate hike.

Very near-term, stocks face cross currents associated with year-end tax-related strategies as well as a potential postponement in tax reform legislation that could cause the pause in the rally to linger. But any weakness that does develop is anticipated to be limited in both time and price.

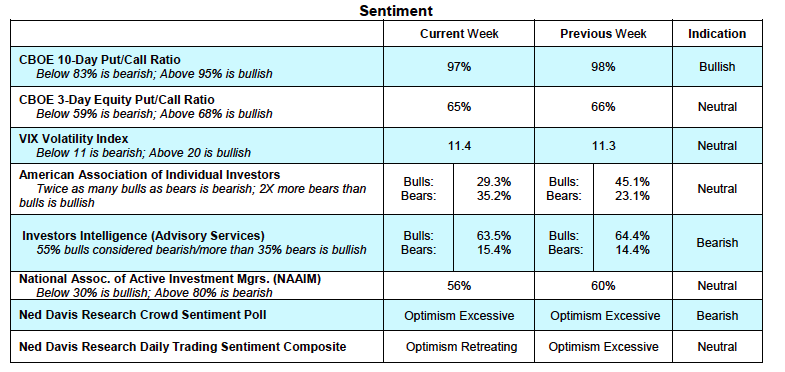

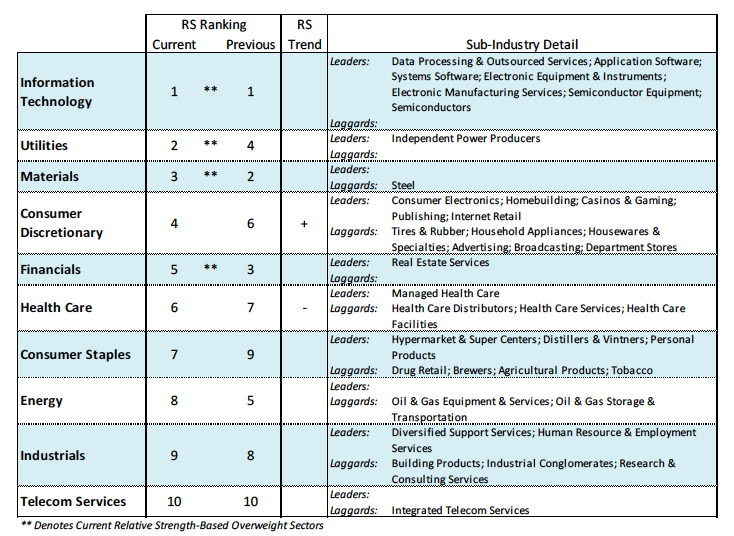

The short-term technical backdrop improved last week. The Dow Industrials and S&P 500 fell less than 1.00% the past two weeks but that was apparently enough to cool investor optimism. This was readily seen in the weekly survey from the American Association of Individual Investors (AAII). The AAII data showed a 180 degree turnaround from last week with the bearish camp outnumbering the bulls. Although the AAII survey covers a relatively small sample, the data has been very accurate in portraying the negative psychology of the individual investor for most of the year. The swing in sentiment found in the AAII numbers was confirmed by data from the National Association of Active Investment Managers (NAAIM) which showed a drop in the portfolio allocation to equities of 56% from 95% in early October.

Reports from the Chicago Board of Options Exchange (CBOE) also showed skepticism with the demand for put options strong for the third week in a row. Put options are used by investors anticipating a stock market decline. There is an inverse relationship between sentiment and liquidity. The fact that investors have become more cautious suggests that sufficient liquidity is building on the sidelines to support the prospects for a December rally. The stock market also enjoys a seasonal tailwind. Historically, December is one of the strongest months for stocks, particularly small caps. Technical support is anticipated to be in the vicinity of 2510 to 2530 using the S&P 500 Index.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.