Some people are calling Wednesday’s stock market rally the Biden bump.

Others call it the obvious bounce after extreme investor fear and volatility.

Some call it a bottom.

Still others call it a rally into price resistance.

I call it Love in the Time of Coronavirus, after one of my favorite books, Love in the Time of Cholera.

In Gabriel Garcia Marquez’s book, forbidden love endures through telegraphs.

However, in time the female ends the long-distance relationship believing it to be but a dream.

At her father’s urging, she weds a practical doctor committed to curing Cholera.

Yet, after his death, she returns to her original love and after five decades apart, they finally get to grow old together.

Does this have anything to do with the stock market?

After the bull market became verboden from the economic impact of the virus, buyers have held steadfast in their love, using any correction to load up in equities.

The Fed if you will, became the telegraph or the mode of the love relationship, as bulls believe low rates will boost the stock market.

Like a dream though, these same bulls abandon that love on sell offs, and look for a more practical solution for making money, such as bonds, gold, and consumer staples.

Now we wonder should the practical investments die, will the bulls go back to their original love of stocks and happily grow old together?

That’s the romantic version of the market’s story.

The reality is that even with the up day, the inside weeks thus far, hold firm.

Perhaps you too will see the irony that the only Family member that took out last week’s high today of 121.13 is Biotechnology IBB. Sounds practical enough, right?

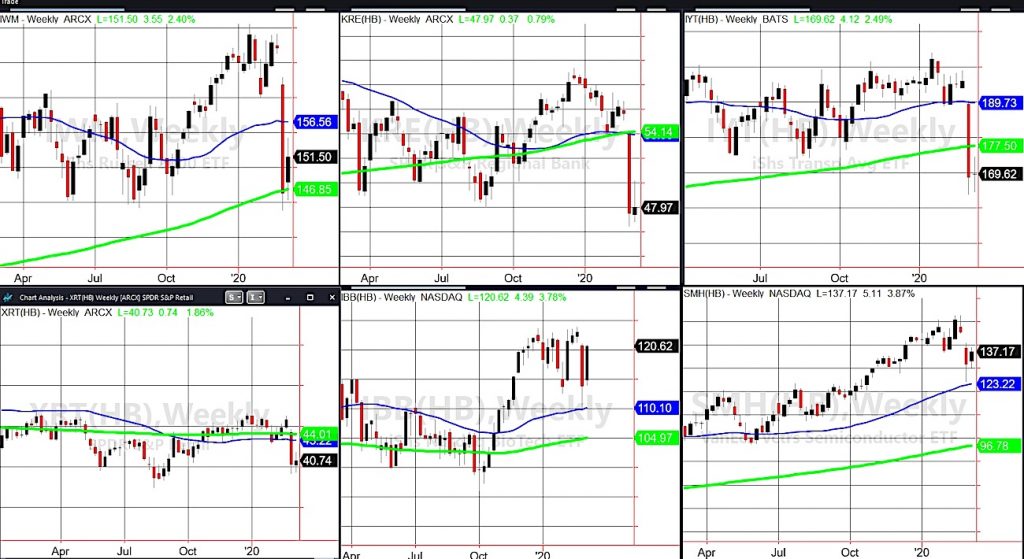

Now, with two more days left to the week, we need to see Semiconductors SMH take out 140.04 or its high from last week.

As for the others, Russell 2000 IWM, Transportation IYT, Regional Banks KRE, and Retail XRT, they are so far away from last week’s highs.

Hence, we seem to find ourselves once again in the same situation. Investors and corporations are buying the big stocks, while the “inside” of the market or the real glimpse into the economy, struggles.

For now, I would not expect IWM, IYT, KRE or XRT to get anywhere near their highs from last week.

But, I would consider buying the NASDAQ or tech stocks for more active trades as long as the aforementioned at least hold up.

Then, if any of those weaker more realistic or “inside the market” sectors begin to die, unlike Marquez’s book, I expect the bulls will not have their old bull market love to go back to.

Rather, in the market version of Love in the Time of Coronavirus, they will die as well.

S&P 500 (SPY) Inside day and inside week-Has to at least clear 313.84 and hold 306

Russell 2000 (IWM) Inside day and inside week-Has to at least clear 154.20 and hold 147

Dow Jones Industrials (DIA) Inside week. Has to clear 271.35 at least and hold 265.

Nasdaq (QQQ) Inside day and inside week-Has to at least clear 219.61 and hold 209.

KRE (Regional Banks) 48.00 pivotal-50 resistance 47 support

SMH (Semiconductors) 135 should hold if good and must clear 140.94

IYT (Transportation) Inside day and inside week-Has to at least clear 174.46 and hold 169.00

IBB (Biotechnology) 120 pivotal with 117.50 key support

XRT (Retail) Inside day and inside week-Has to at least clear 41.82 and hold 40.00

Volatility Index (VXX) Inside day-over 25.00 more upside

Junk Bonds (JNK) 108.53 resistance to clear.

Twitter: @marketminute

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.