The downside momentum continues to build and until such time that this is reversed, the sidelines with new cash is best place. Buying dips the past seven years has worked because the trend and the Fed were favorable to stocks.

In the current environment, the trend has turned down and the Fed is less friendly than in previous years. Stocks were negatively impacted in 2010 when QE1 expired and again in 2011 when QE2 rolled off. QE3 was allowed to expire in the fourth quarter of 2014 and stocks struggled in 2015. This has lead to more stock market weakness.

News on Friday of lower-than-expected retail sales likely upset some investors. Any weakness in retail sales, however, has more to do with the fact that prices are generally lower and sales at gas stations have plunged. A report from New York has manufacturing activity slowing but that is not new news. The service sector of the U.S. economy remains firm.

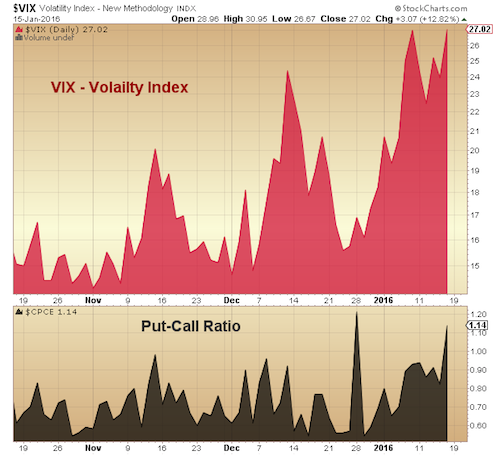

Technically, encouragement is found in the area of investor psychology as pessimism reaches new highs. This will not matter if stocks are in waterfall-type decline but fear is always present at a good stock market bottom. The CBOE Volatility Index soared to 30 today raising the likelihood that a trading rally is close. The CBOE put/call ratio climbed to 134%, an usually high number and a sign that fear has reached an extreme.

Friday’s sharply down opening was also encouraging as this often is a sign of capitulation. Recently, we have had a series of higher openings or early morning rallies. Early strength is nearly always a signal that pockets of optimism remain and have to be diminished before a sustainable rally is forthcoming. Another sign that investors were in a throw-way mode today, the TRIN indicator that tracks selling pressure soared above 3 early today, a spot where oversold markets often find a beginning.

We are concerned, however, that the number of issues hitting new lows is expanding within the stock market weakness. Historically, at a good market low the number of issues making new 52-week lows is contracting.

Investors should consider that stocks are likely to experience a basing phase once a bottom is identified. This can take several weeks to months and also includes a testing of the lows soon after the initial bottom. Asset allocation is very important given the weak trend and less friendly monetary environment. Before a more aggressive approach can be recommended, the downside momentum of the market must reverse. To identify a bullish momentum change, stocks should experience at least one session where upside volume overwhelms downside volume by a ratio of 10 to 1 or more.

Technically, the 1850 area on the S&P 500 is important. A close below that level is technically significant and would signify that nearly all areas of the market are in gear on the downside.

Bottom Line: We must have a reversal in momentum before entering. Stocks are likely to go through a testing phase after finding a bottom.

This post was written with Bruce Bittles, a fellow strategist at Robert W. Baird & Co.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.