From a cyclical growth perspective, it’s always nice to have the Energy sector and small cap stocks participating in a move higher, whether it be an uptrend… or a bull market.

So when these two areas began to underperform late summer, it was a warning sign.

Seemingly ever-rising bond yields probably didn’t help. And perhaps higher yields spooked the growth crowd and sparked the latest leg down of the stock market correction.

Momo names, tech stocks, energy, and small caps have all been taken out to the woodshed.

Earlier today, I shared a tweet looking at the chart of the Energy Sector (XLE).

Warning: it’s pretty ugly.

In short, the chart shows a waterfall decline that is currently at -15% from the highs. XLE is very oversold on the daily chart and two bars past a DeMark buy setup.

We should see a bounce soon. But that’s just playing on a trading probability… waterfall declines don’t always behave well.

I highlighted the $65/$66 area in my tweet. XLE closed near $66 today.

$64/$65 also marks a yearly pivot support according to fellow contributor Jeff York (@Pivotal_Pivots). So if we fail to gather much of a bounce tomorrow, then look to the $61/$62 level.

Venky Srinivasan (@sssvenky), another fellow contributor pointed out that the 200 week moving average is around $60 as well.

$XLE Energy sector showing extreme weakness. #IBDpartner

Break of support initially targets $65/$66. Stronger support at $61/62. @MarketSmith — https://t.co/zm4F25Sd39 pic.twitter.com/6j3dNX0iXP

— Andy Nyquist (@andrewnyquist) October 24, 2018

For the correction to lighten up and begin to turn a corner, bulls need to see sectors like tech, small caps and energy slow their descent and begin to consolidate.

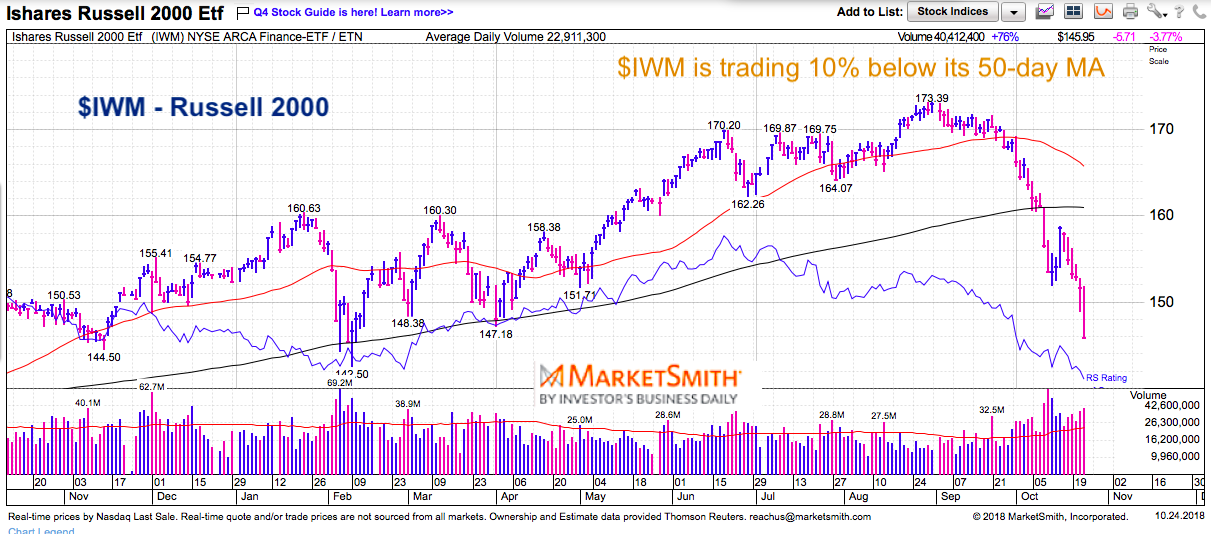

Here’s a look at the Russell 2000 (IWM)… it’s also not a pretty sight.

When these areas stop going down, then we’ll begin the process of forming a viable, tradable bottom. Maybe not “the” bottom… but a tradable one.

The chart above was built with Investors Business Daily’s product suite. I’m also an Investors Business Daily (IBD) partner – you can gain access here.

Twitter: @andrewnyquist

The author has a position in XLE at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.