This week’s sharp decline in the stock market and spike in volatility has many wondering what’s next.

Fear and uncertainty are in the air and have many wondering how far the stock market will decline.

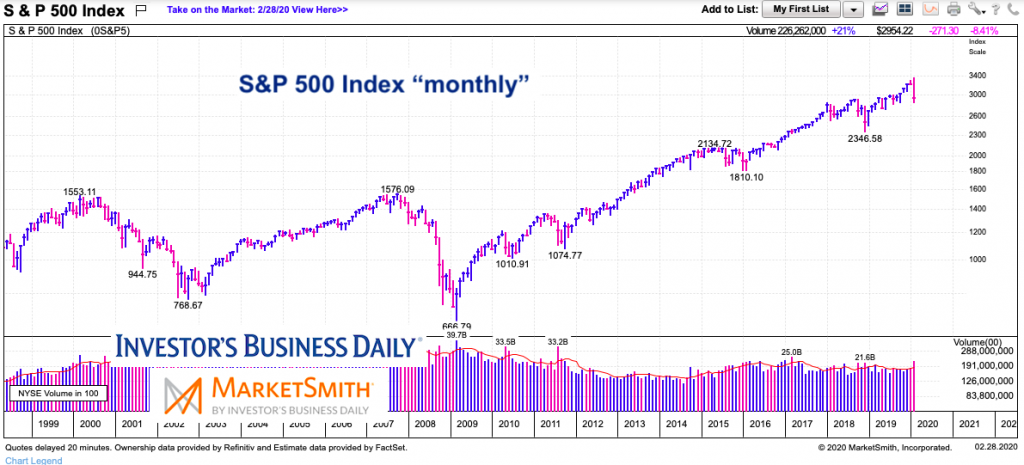

That’s a big question better suited for each investor to answer for themselves based on their given timeframe (and type of investor) and investing/trading plan. Less than a week ago, I shared some key intermediate-term Fibonacci retracement levels for the S&P 500 Index. That wasn’t a prediction, but simply some potential areas where the market may find support across timeframes.

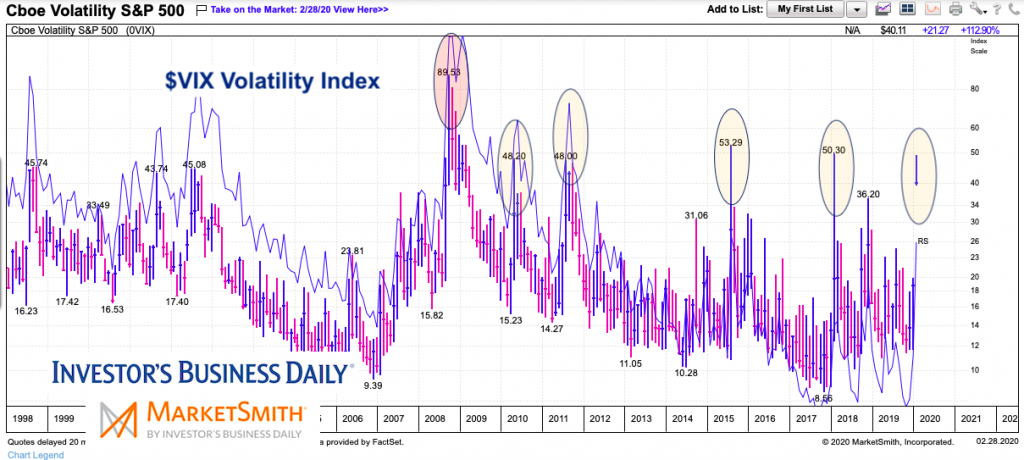

Today we look at the VIX Volatility Index to highlight rising fear in the markets and what it may mean for the equity markets.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of technical and fundamental data and education.

VIX Volatility Index and S&P 500 Index “monthly” Charts

These are “monthly” charts so the view is on a longer term timeframe.

Observationally, two takeaways are quite simple. One is that fear has arrived in the stock market. And two is that several stock market bottoms formed in/around this area on the Volatility Index. Those spikes that came during a broad-based bull market bottomed within days/weeks of that spike. And those spikes that came during bear markets 2001-2002 and 2008-2009 came months before the eventual bottom.

The last takeaway, is that this spike (and decline) have occurred within one monthly bar. This is unique and points to how quickly the markets have become unglued. Be sure to understand your given timeframe and follow your plan. Risk happens fast – no need to be a hero.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.