With crazy stock market volatility and wide price swings, having a trading plan couldn’t be more important for a day like Wednesday.

At around 10:20 am ET the stock market began to sell off rapidly, turning into a large drop.

Though the stock market rebounded, such large price swings could have easily gotten traders out of the market if they panicked and sold. See the S&P 500 ETF (SPY) chart below.

No matter what type of trader you are, you should have a plan for every trade or position you have on.

For day traders this is especially important, as a day like this could easily create some nasty losses.

Additionally, these are the types of days where emotions love to jump in and make big decisions for you. There is a common misconception that trading takes nerves of steel. But nerves of steel are far from needed if you have a trading plan.

All the main decisions to trade successfully can be made before entering the position/trade. Decisions like, how much money am I going to risk on a trade and how much will I expect to make from this trade if it works in my favor?

At MarketGauge, we like to risk anywhere from 1-2% of our total portfolio or account size on a single trade.

For example, if you have an account size of $10,000 and you risk 2%, that will equal $200.

Here is quick breakdown of what to do next once you know your risk per trade. Say you decide to buy a stock at $10 with risk to $8. If the price goes to $8 you will exit the trade for a $2 loss per share.

Knowing this, how many shares can you buy?

Well, if you are only risking a maximum of $200 on a trade then you can buy (200/2 = 100 shares)

100 shares X $10 (entry price) uses $1000 of your $10,000.

This is a great way to help plan out trades to manage how much you are will lose if the trade goes against you.

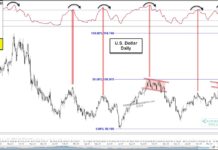

S&P 500 (SPY) 385 support.

Russell 2000 (IWM) Support 218

Dow (DIA) 312 support area.

Nasdaq (QQQ) Held 330 support area.

KRE (Regional Banks) Needs to hold $60.00 as new support.

SMH (Semiconductors) 246.79 resistance. Support 232

IYT (Transportation) support 223 the 50-DMA. 233 resistance.

IBB (Biotechnology) 168 support area.

XRT (Retail) 75.28 support. 80.28 resistance.

Twitter: @marketminute

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.