S&P 500 Trading Outlook: (2-3 Days)

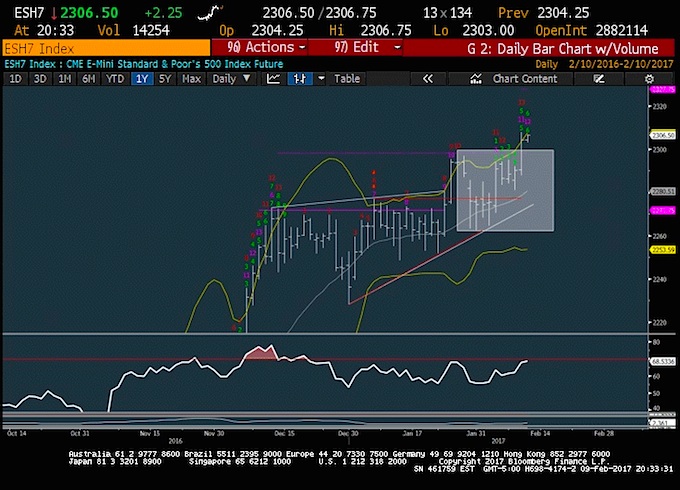

I’m mildly bullish into early next week, but I’m looking to sell rallies at 2315 stretching up to 2325 (and flatten out). I’m awaiting signs of a reversal, which should be in place by early next week. The S&P 500 (INDEXSP:.INX) is now up to within 10 points of targets, and risk/reward is not ideal for new longs.

While this could take another 2-3 days before prices turn down, it’s probably prudent to consider taking profits from a trading perspective today and into early next week.

Technical Trading Thoughts

Yesterday brought about fairly pronounced reversals in Treasury yields along with an abrupt about-face in Gold. This action has coincided with a sharp breakout in the S&P 500 above 2300. Technically, the breakout in the S&P 500 looks to be a final push higher in the rally off the late December lows. The S&P 500 and Dow Jones Industrial Average (INDEXDJX:.DJI) are back to new all-time highs, while the NASDAQ has continued even higher. Market breadth came in at roughly 2/1 positive yesterday, a bit disappointing on such a good technical breakout. Financials were the sole sector to turn in better than 1% gains while both Utilities and Materials fell. However, Energy Industrials and Discretionary all returned better than 0.50%

KEY TO NOTE: Stocks at current levels aren’t likely to continue up throughout the balance of February. Prices have now reached the upper edge of 2% Standard Deviation Bollinger Bands while signs of upside exhaustion per Demark indicators are now in place. Additionally, investor sentiment has begun to swing back bullish, as markets have ignored POTUS Rhetoric and concentrated on the positives of possible tax cuts – optimism seems to be on the rise globally. While the intermediate-term patterns remain in good shape, the near-term upside seems limited given some of these warnings. Coupled with overbought conditions and lackluster breadth thrust in the last couple weeks, and it appears the market is limping through the finish line. While a move up to 2327 can’t be ruled out, and we haven’t seen any real evidence of trend reversals, aggressive traders should look to sell into this rally in the next 2-3 days into next week, thinking that trend reversals are near.

Sector-wise, Biotech and Health Care are showing evidence of breaking out and may lead to higher prices. Retailing also looks to have bottomed out in the short run after a steep decline. For now, one sector that has NOT yet broken out again is Financials – this should be watched carefully for evidence of this emerging and moving to new highs, along with the Small-caps, which have underperformed since December. The chart of IWM looks not too dissimilar from Financials, both of which have trended sideways in the last couple months.

Overall, its thought to be doubtful that the market can experience any real peak without Financials and the Russell 2000 joining the rally to some extent first. The patterns aren’t conducive to tops, so Financials in particular can be overweighted as yields turn back higher, which looks to have begun Thursday.

S&P 500 Futures

Thursday’s rally helped the S&P 500 breakout, though also reach the upper limits of its rally off the late December 2016 lows. While certainly a bullish technical move, momentum has gotten stretched, while prices have reached the upper border of the Bollinger Bands, suggesting that additional rallies from here into early next week should be sold. For now, the trend is bullish, but looks to have limited upside in the short run. Therefore, trends remain mildly bullish, but the risk/reward has gotten much worse for trading longs, and gains should be used to sell.

Note that you can catch more trading ideas and market insights over at Newton Advisor. Thanks for reading.

Twitter: @MarkNewtonCMT

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.