The equity markets escaped through a minefield of potentially damaging economic and geopolitical news and events last week to finish the period little changed. Note that the S&P 500 (INDEXSP:.INX) finished down just -0.3%.

So Where Are We Now?

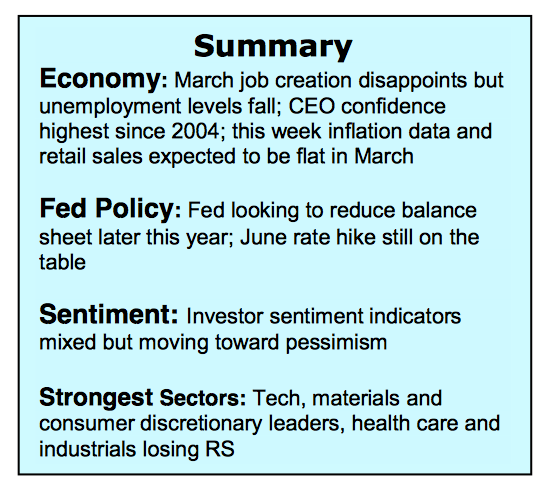

Business activity and job creation slowed in March. The fact that stocks absorbed the news with little damage is considered a victory for the bullish case. Entering the new week, the most important factors for the market include early first quarter earnings reports, that are expected to rise appreciably, and tax reform legislation.

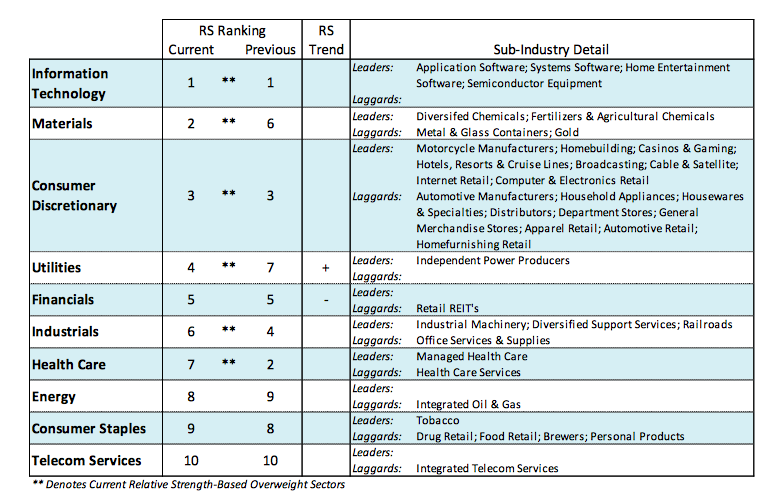

The geopolitical developments add a level of uncertainty but could serve the markets well by keeping investor confidence from gaining too strong a foothold. It is anticipated that first quarter GDP growth will print at less than 1.00%. The fact that that the Fed remains committed to raising interest rates two more times this year is an indication that Janet Yellen is confident that business conditions will improve as the year unfolds. The strongest sectors in the market are information technology, materials and consumer discretionary. These sectors are most closely tied to the performance of the economy. The fact that these areas are leading the market supports the assumption that business activity will accelerate in the second half of the year.

The weight of the technical indicators that focus on trend, momentum, breadth and sentiment argue that stocks will remain in a consolidation/correction mode as we move deeper into the second quarter. Since the peak in the averages on March 1, stocks have moved sidewise. The loss of upside momentum was accompanied by a deterioration in stock market breadth. This is seen in the decline in the percentage of S&P 500 industry groups in uptrends from 82% to 72% and the sharp reduction in the number of issues hitting new 52-week highs. The fact that the new low list has failed to expand suggests the consolidation/correction phase will be limited in time and price.

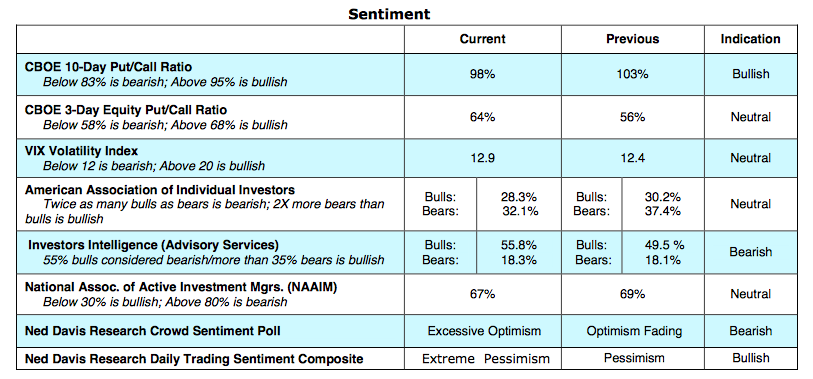

Further evidence that stocks will likely trade defensively short term, is the development of some negative divergences. This would include small-cap stocks underperforming large-caps and the Dow Transports underperforming the Dow Industrials. From a sentiment perspective, there has been some positive movement from the excessive optimism found earlier in the year to caution and skepticism as uncertainty over the timing and effectiveness of fiscal policies. For the past three years, the best rallies have followed investor sentiment reaching extremes in pessimism. The fact that the CBOE Volatility Index (VIX) appears to be making a series of higher lows and is close to breaking above its 200-day moving average could be an indication that stock market volatility is poised to rise. Historically, a jump in volatility is often associated with a market low. Support for the S&P 500 is seen at 2275.

Thanks for reading.

ALSO READ: S&P 500 Weekly Outlook: This Rally Could Use A Reset

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.