All fifty states have now allowed some businesses to re-open and this has added fuel to the stock market rally last week.

The S&P 500 Index INDEXSP: .INX is within striking distance of the 3000 mark and its 200-day moving average.

News of a potential vaccine for the COVID-19 virus by year-end or early 2021 also helped to propel the equity markets higher.

The Virus

As of this writing, the coronavirus appears to be coming under control. Lockdowns have been relaxed and we have not seen a resurgence in the virus.

Memorial Day weekend should prove to be a good test as we hope that small gatherings of people do not increase virus outbreaks.

Analysis and insights by Bruce Bittles and Willie Delwiche.

The Economy and the Stock Market

A return to a bull market in stocks and a return to economic growth are dependent in large part upon the containment of the virus which will allow businesses to re-open and consumers to resume their spending habits.

The market seems to be pricing in a quick economic recovery (V-shape) which would help explain the recent rally. The stock market is a forward-looking mechanism and investors are looking forward to the opening up of economies, possible treatments for the virus or a vaccine and a return of earnings growth by year-end or early next year.

However, risks remain. We don’t know yet if we will see second waves of the virus in various areas of the country. We don’t know what the path to economic recovery will look like. It will take weeks, probably months for businesses to re-open and get their staff, inventories and safety protocols in working order. Additionally, consumers are not likely to rush out and return to their pre-virus spending habits.

Stock Market Logic Is Not Logical

Stocks are pricing in an optimistic outcome and seem to have looked past the severe downturn in GDP, the massive unemployment and the risk of the economy not returning to levels of growth any time soon. According to Ned Davis, “the stock market is not disconnected from the economy but it does discount and thus market logic is something contrary to regular logic.”

Improvement in the Broad Market

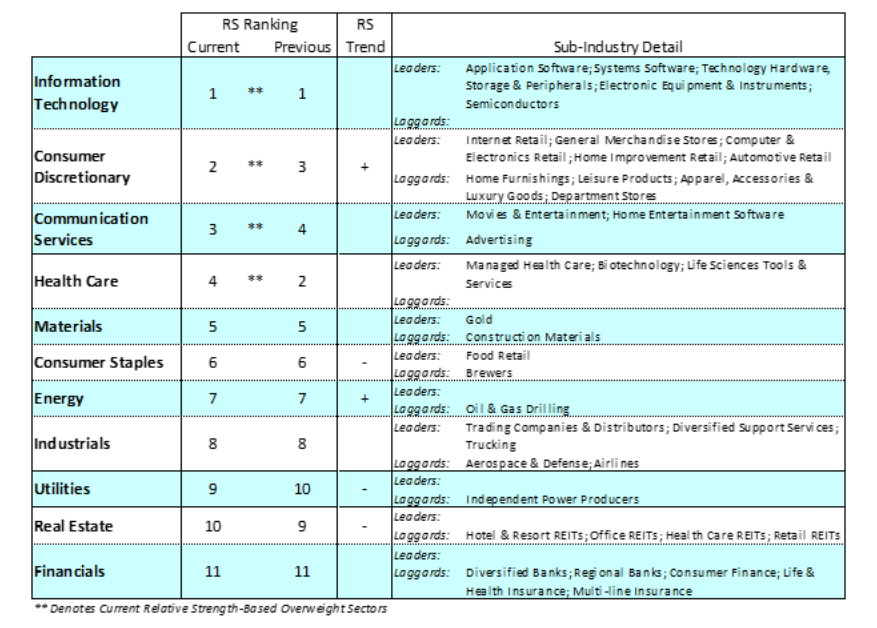

Over the past month, the rally in the stock market has been concentrated in the mega-cap growth and tech stocks. But we are beginning to see signs of cyclical leadership emerging with the financials sector recently outperforming the utilities sector and the materials sector leapfrogging the staples sector. This improvement in the broad market is necessary for a sustainable rally to continue.

Additionally, a demand for small- and mid-cap stocks is beginning to emerge. The median stock in the S&P 500 Index, which measures the largest companies on the exchange, is down 23% below its 52-week high. The S&P 600 Index of small-cap stocks is down nearly 40% from its 52-week peak.

Small-cap stocks are often the first group that investors sell during a downturn because they are perceived as more risky. But the group tends to outperform the large-caps in a rebound. The small-cap groups are seeing improving trends and may be getting in gear to catch up to the large-caps.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.