I think “hazy” would be the best word to describe the current market (but “crazy” would work, too).

Investors are weighing positive economic news and an announcement of a promising trial vaccine for COVID-19 against a resurgence in virus cases.

Last week the S&P 500 Index INDEXSP: .INX moved higher for the third consecutive week gaining 1.20% leaving it virtually unchanged for the year.

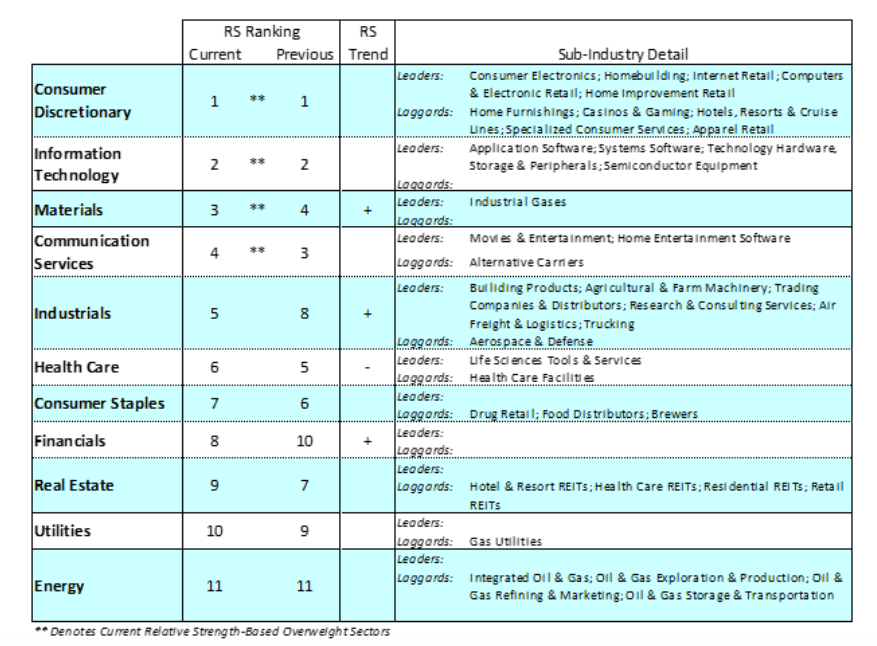

Industrials was the best performing sector of last week gaining 5.75%. Tech stocks lagged and pulled the NASDAQ down 1% for the week. Gold was up for the sixth straight week and the yield on the benchmark 10-year Treasury was little changed at 64 basis points.

We have recently seen strong economic data in the housing numbers, retail sales, and industrial production which was led by a 7.2% gain in the manufacturing sector. Unemployment claims are down for the 15th straight week.

The economic rebound has been based on pent-up consumer demand and massive amounts of fiscal and monetary stimulus.

The key question is how much will the resurgence in virus cases impact consumer spending which is the engine for growth. The increased outbreak of the virus and lockdowns in hotspots will likely be a setback for the economic recovery but this should be offset by continued monetary and fiscal stimulus.

The National Economic Council is forecasting 20% growth in the third quarter and 20% in the fourth quarter. But new outbreaks of the virus could alter their third-quarter projection.

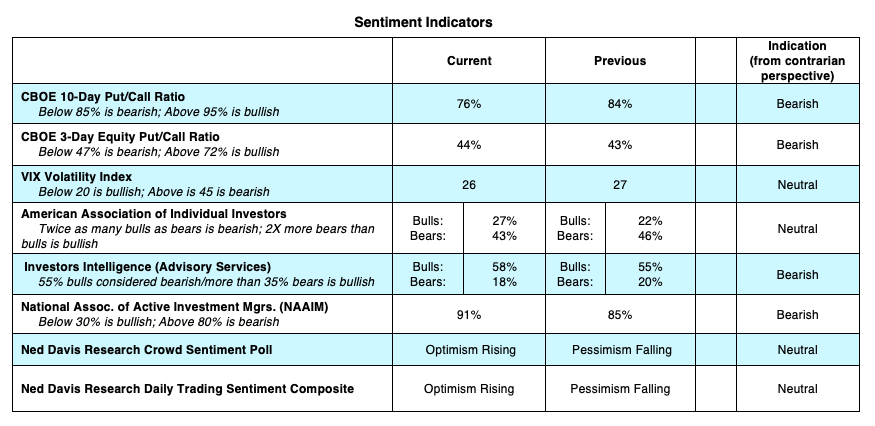

Measures of investor psychology are moving in the direction of extreme optimism which, from a contrarian standpoint, suggests a pullback in the market.

The Chicago Board of Options Exchange volume statistics show an unusual overweight to call buying. Optimism can also be found in a record number of IPOs and secondary offerings which are uncommon at a market bottom. Investors Intelligence (II), which tracks the opinion of Wall Street letter writers, shows 58% are bullish. A reading above 60% has often led to short-term market corrections.

Additionally, a declining number of stocks within the S&P 500 Index are trading above their 50- and 200-day moving averages. When fewer stocks participate in the rally, the rally is often not sustainable.

The technology sector led the stock market higher in the second quarter of the year. Facebook, Amazon, Microsoft, Google and Apple are at or close to their all-time highs. History has shown that precipitous moves up in a concentrated sector eventually lead to dramatic pullbacks. Growth in technology has soared since the onset of the pandemic and work-from-home trends, virtual business meetings, live streaming events and eCommerce will likely become a permanent part of our lives.

The technology sector is appropriate for a portion of an individual’s portfolio but one should be mindful of how much exposure they want to devote to the sector. We continue to encourage investment in cyclical sectors as the economy improves as well as health care where there will be increased attention and spending. We like utilities as a defensive sector and gold or gold mining stocks which tend to be a resilient asset and provide diversification during times of uncertainty.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.