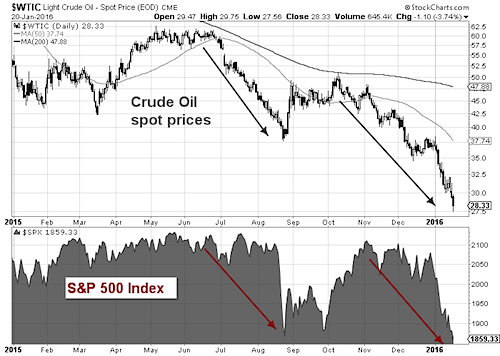

A new 12-year low in oil prices has caused stocks to fall to levels last seen in 2014. The correlation between oil and stocks has never been higher. This is likely due to the large amount of oil related debt accumulated over the past five years.

There has never been a recession in the U.S. that was caused by declining energy prices but never before has this much debt been accumulated by the oil patch. The concern is that defaults will rise significantly in the oil industry perhaps causing problems for some banks and other lenders.

As a result, stocks are likely to remain hostage to crude oil. So declining energy prices should remain on investors radars. Stocks are deeply oversold and pessimism has reached excessive levels but the trend and momentum are overwhelmingly biased to the downside. This requires that the downside momentum be broken before attempting to navigate a tradable low. We would need to see at least one day where upside volume overwhelms downside volume by a ratio of 10-to-1 or more to halt the downside momentum in the stock market. Two sessions of strong upside volume would argue that an intermediate investment low has been reached.

Stocks opened lower yesterday, which offers the market a better opportunity to recover as opposed to strong openings that invite sellers. Pessimism is mounting globally, which is helpful using contrary opinion. Although this could support a short-term rally, investors should remain cautious. Since 2010, it has been rewarding to buy stocks on market weakness.

That was because investors had two important elements on their side, the primary trend was bullish and the Federal Reserve was very friendly. We now have a negative trend and less than friendly Fed. Given the oversold condition in both stocks and crude oil and rising fear, some near-term relief should not be ruled out.

Looking further out, this is the third year in a row that stocks have suffered in January. Prior to 2014, January had historically been one of the strongest months of the year for stocks. The past two years the poor performance at the start of the year was blamed on the weather and the impact it had on the economy.

The weakness in the stock market the opening month of the year, however, could be a direct result of corporations delaying the initiation of stock buyback plans. Corporate buybacks have become very important to the demand side of the equation for stocks. In 2014 and 2015 after a down January, stocks turned in strong performances in February and were at new highs by May. Given the breakdown of the broad market, new highs are very unlikely any time soon but a good rally in February is a possibility as corporations potentially initiate new stock buyback programs.

Bottom Line: Margin debt at near record highs and likely playing a role as some investors face margin calls. Should stocks make a bottom soon, it would likely be followed by a test of the low. Therefore, no need to get aggressive toward stocks until the prospects of sustainable rally improves.

This post was written with Bruce Bittles, Chief Investment Strategist at Robert W. Baird & Co.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.