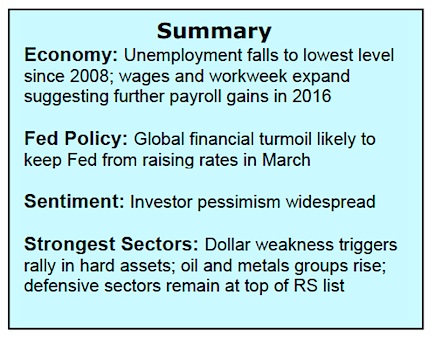

The stock market indices renewed their downtrend last week with most of the damage occurring in NASDAQ and small-cap issues. And defensive sectors continued to outperform.

LinkedIn Corporation (LNKD) fell 44% after a disappointing earnings report. Other tech stocks followed suit after job growth in January was reported weaker than expected. The familiar themes of a continued decline in oil prices, worries about global economic problems and slower corporate earnings growth continued to contribute to investor concerns.

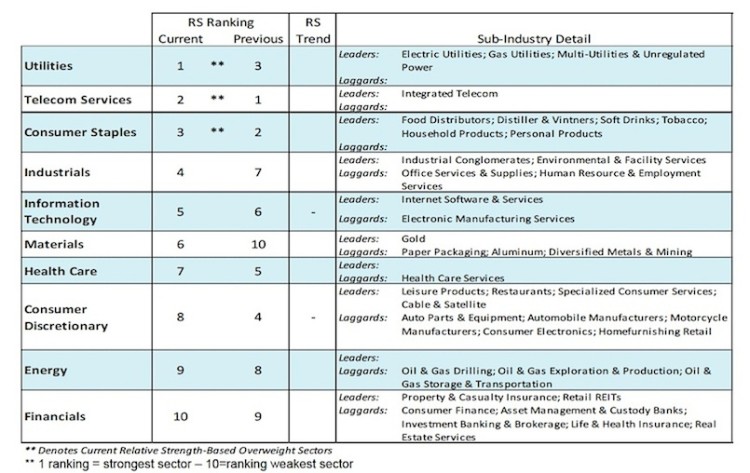

The US Dollar suffered a sharp decline last week triggering rallies in previously out of favor sectors including oil, metals and gold mining. It would be premature, however, to conclude a change in leadership is underway.

Investors should continue to focus on defensive sectors that are outperforming which include utilities, telecom and consumer staples. Defensive sectors continue to show relative strength at present. Fed Chief Janet Yellen appears before Congress this week. It is anticipated that the weak economic growth and global concerns will cause the Fed to reconsider its intentions to raise rates four times this year.

Short term, stocks again found support at the 1870 level on the S&P 500 last Friday. A close below this level would argue that a full test of the intraday low on January 20 at 1812 is likely. Encouraging is the fact the number of issues making new 52-week lows last week was much smaller than in mid-January when the S&P 500 closed at 1880. This is thin evidence that a short-term low has occurred but when coupled with excessive investor pessimism and selling on Friday in the former market leaders, the prospects improve.

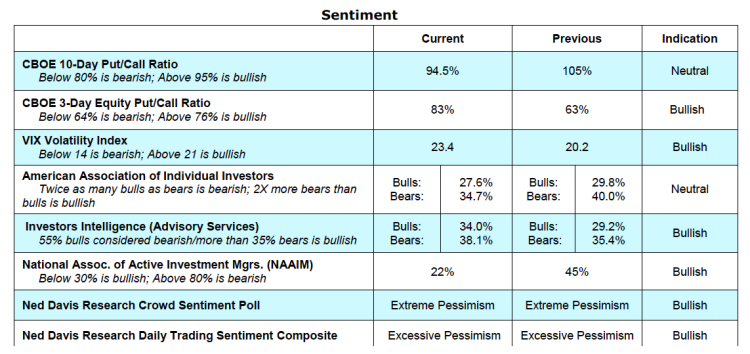

Of particular note is the latest report from the National Association of Active Investment Managers (NAAIM) that shows aggressive money managers reduced their exposure to the stock market to just 22%. This is in sharp contrast with their 95% exposure to stocks at the peak in late 2014. In the past, this group of investors has been wrong at important turning points in the stock market. The trend in the popular stock market averages remains the largest negative but some positive divergences have recently surfaced.

Of particular note is the latest report from the National Association of Active Investment Managers (NAAIM) that shows aggressive money managers reduced their exposure to the stock market to just 22%. This is in sharp contrast with their 95% exposure to stocks at the peak in late 2014. In the past, this group of investors has been wrong at important turning points in the stock market. The trend in the popular stock market averages remains the largest negative but some positive divergences have recently surfaced.

In addition to the reduction of stocks hitting new lows, the Russell 2000 Index fell below levels last seen in 2013 but the S&P 500 and Dow Industrials have not made a new low.

For evidence that a sustainable low for stocks is in place, we are looking at four indicators. From a longer-term perspective, we would expect excessive valuations to be meaningfully relieved. Investor sentiment should show excessive pessimism, upside momentum should replace downside momentum and market breadth trends should show meaningful expansion in a rally phase. Of these, we do have investors turning fearful and downside momentum has been interrupted but upside momentum has not yet emerged. Absent at present is significant improvement in valuation and market breadth. As a result, a cautious approach remains appropriate.

Thanks for reading.

This post was written with Bruce Bittles, Chief Investment Strategist at Robert W. Baird & Co.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.