Stocks traded lower last week, with resistance near 2075 on the S&P 500 remaining a hurdle. The rally off of the February lows looks tired and there is not yet evidence that the stock market uptrend is ready to re-assert itself.

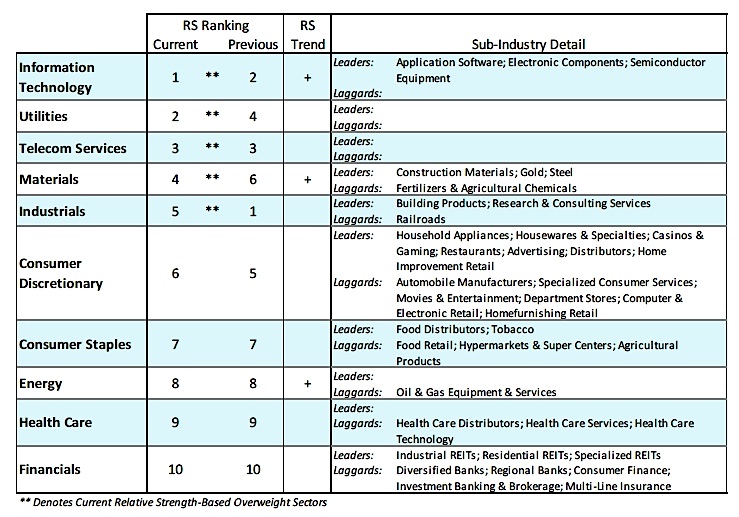

Sector-level price trends are starting to cool and upside momentum is waning. Combined with well-advertised seasonal headwinds that are in place for the second quarter, this could set up a test of support near 2000.

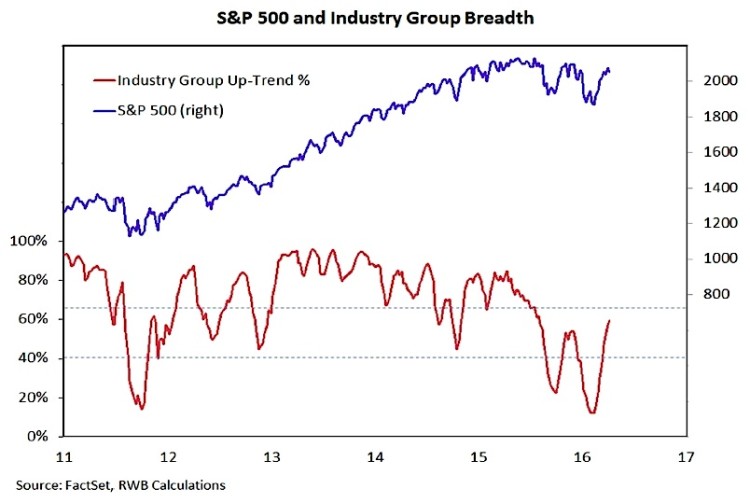

Broad Market Continues To Heal

On the positive side, we continue to see evidence of accumulated market breadth gains. The number of issues making new highs, while still relatively small by historical standards, has started to drift higher, and the percentage of industry groups in up-trends continues to expand. While these breadth improvements do not preclude near-term price consolidation, they could be a source of support if a more significant pullback emerges.

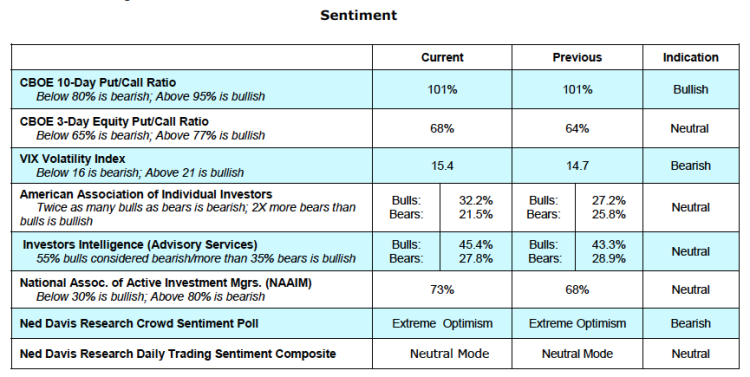

On the more cautious side, equity funds are again seeing inflows and there is evidence that active investors are becoming less skeptical of the rally in stocks.

The NAAIM exposure index increased last week, moving above its November peak and reaching at its highest level in almost a year. While we are not seeing strong evidence of the type of excessive optimism that spells trouble for rallies, the excessive pessimism that fueled this bounce has been unwound. Longer-term, exposure to stocks remains elevated and investor liquidity is constrained.

Actual and perceived central bank communication continues to rile financial markets, but this week this could take a back seat to corporate news as the first-quarter earnings reporting season heats up. The good news is that estimates of Q1 earnings growth have been slashed since the start of the year. This provides a much lower bar for companies to get over.

Corporate results could be helped as the earnings headwind caused by strength in the U.S. dollar starts to diminish. It could actually become a tailwind to earnings as we move through 2016. Better earnings growth over the course of the year could be crucial if stocks are going to enjoy another leg higher as valuations are already excessive across many metrics. To gain confidence that we are seeing a sustained rebound in earnings (and not just the effect of currency volatility), better top-line growth will have to emerge.

Thanks for reading.

Further reading from Willie: Stock Market Outlook: Waiting For Confirmation

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.