The equity markets have been trading mixed of late. However, the best performance of late has been turned in by the Dow Jones Industrials (INDEXDJX:.DJI), which continue to make new record highs.

Most of the stock market indices showed modest declines over last week’s five-day stretch, including the Dow Transports, which declined 2.50%. The S&P 500 (INDEXSP:.INX) continues to grind sideways. That said, several stock indices are still hovering near all-time highs on a strong spate of stock market earnings.

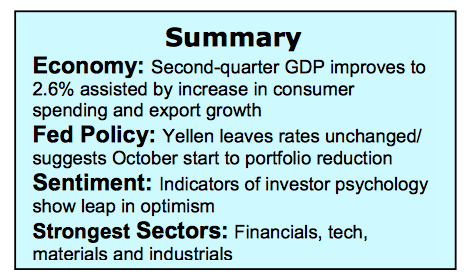

The markets received favorable news on the economy with a report showing second-quarter GDP climbed to 2.6% from an adjusted 1.2% in the first quarter. Stocks have also been supported by strong second-quarter earnings reports.

It is now anticipated that S&P 500 profits grew by more than 10%. The effect of improving economic growth was also seen in reports of stronger top-line numbers from many CFOs. A weaker dollar in the first six months of 2017 continues to be a contributing factor. This is more important for U.S. multinationals than domestic companies and a likely reason large-cap averages are outperforming small-caps.

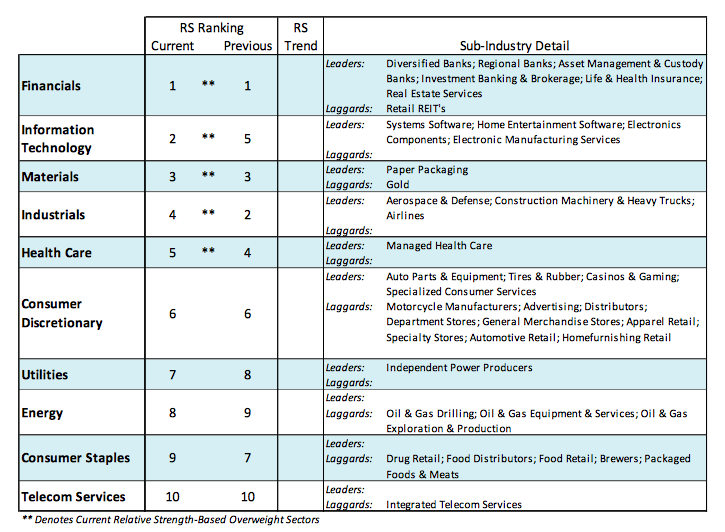

Further evidence that business conditions are improving is seen in the rise of commodity prices. Commodity prices are a reliable indicator of the future strength in the global and domestic economy. This includes copper prices that are sitting on top of a two-year high as of Friday’s close. Additionally, the strongest S&P 500 sectors are those most closely associated with the economy including the financials, industrials and materials.

This week the focus of attention will be on a number of second-quarter earnings reports and a host of economic data that are anticipated to add confidence that the economy is on firm footing. Among the economic data to be released this week includes the July Employment Report due Friday. Consensus opinion is that the economy generated 180,000 new jobs last month with the unemployment rate falling to 4.3% from 4.4% the previous month.

The favorable economic fundamentals are offset by the technical backdrop, which argues for near-term caution. The markets are entering a historically weak seasonal period accompanied by rising investor optimism. Historically, the period from August through October has seen stocks struggle and a period when corrections have tended to occur most often. This does not take place every year but nevertheless raises our alert level.

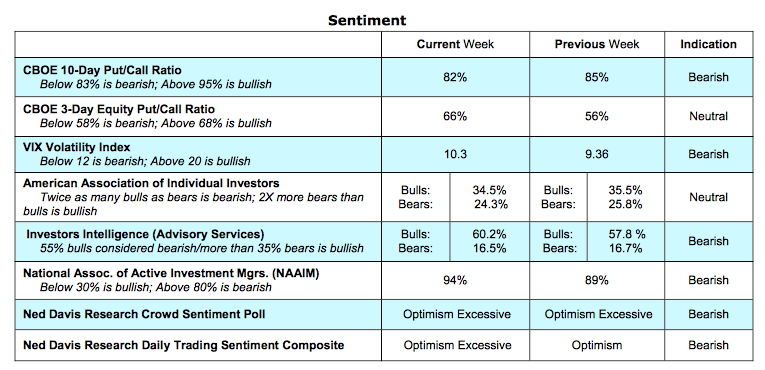

Indicators of investor psychology show the complacency seen earlier in the year has given way to optimism. The latest report from Investors Intelligence (II) shows more than 60% bulls, a rare occurrence. The latest allocation survey from the American Association of Individual Investors (AAII) shows nearly a 69% allotment to stocks, similar to what was seen in 2007. Additionally, the Chicago Board of Options Exchange (CBOE) reports a sudden drop in the demand for put options. Put options are purchased in anticipation of a market decline. As a result, the CBOE 10-day put/call ratio has fallen to the lowest level of the year. Additionally, the increase in confidence is not confined to Wall Street but also stretches to Main Street. The latest report from the Conference Board shows consumer confidence at the second- highest level since 2000. Using contrary opinion and allowing for seasonal tendencies, the technical data suggests caution.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.