After 2 days with major sell-offs, the stock market bounced late Friday into the close. The bounce came from the 50-day moving average.

Coincidence?

First, why do we care about the 50-day moving average?

The most common inputs for the Moving Average used by traders and market analysts are the 50, 100, and the 200 day moving averages.

Knowing a large amount of people and institutions watch these levels, makes for a self-fulfilling prophecy when price reacts to these moving averages.

While there are plenty of times moving averages are broken and phases change as a result, Friday’s test of the 50-day moving average in many instruments has weight.

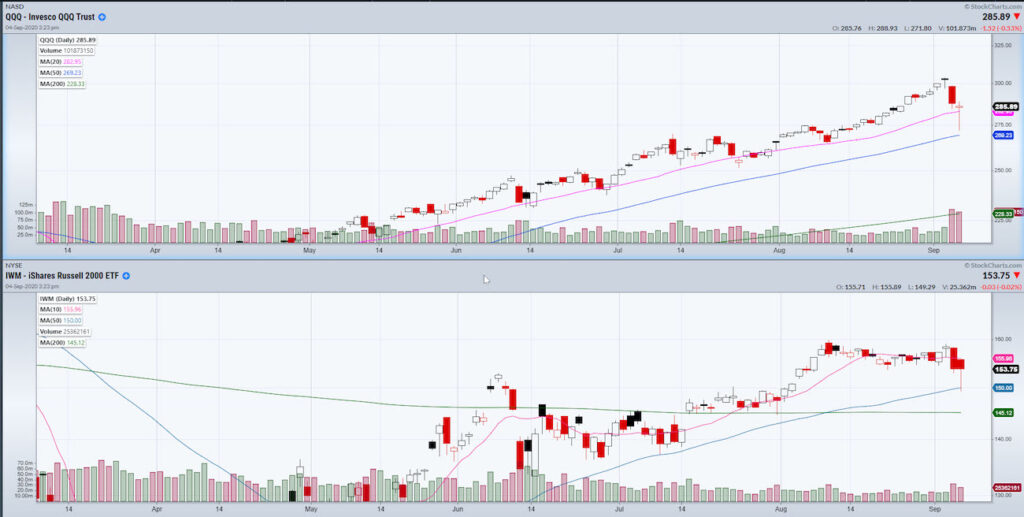

Here we have the Nasdaq 100 ETF (QQQ) and the Russell 2000 ETF (IWM) both pulling back after Thursday and Friday’s large sell-off.

Did the 50-Day Moving Average Stop the Decline?

IWM touched its 50 day moving average and the QQQs only came close. That said, I use the 50-day moving average price more as a range looking for “confirmation” over the course of two days.

If the Nasdaq 100 and Russell 2000 ETFs hold Friday’s low, we not only had a perfect 10% correction, but we also did not see a phase change from bullish to caution.

Now if these symbols are not making enough of a convincing point then let us look further!

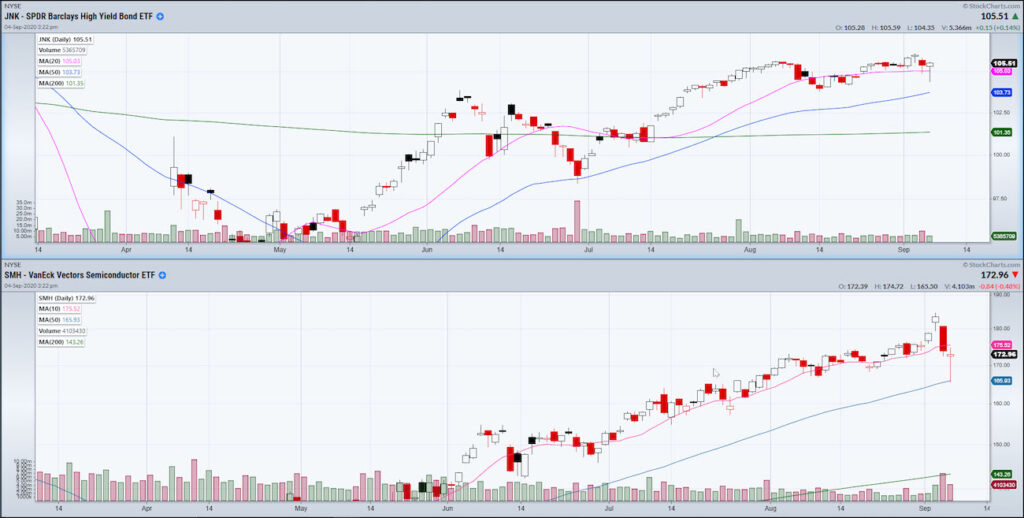

Next chart… here we have the High Yield Bond ETF (JNK) and Semiconductors ETF (SMH).

It is the riskier type of debt that might keep you up at night. Even so, look at how high it has gone. More importantly, it never crashed with the market, holding up way better.

Apparently, there is still good appetite for buying Junk Bonds (JNK).

Now SMH almost perfectly touched the 50-day moving average and bounced off of it to close near where the day opened.

With the great rise in tech stocks since 2012, SMH (semiconductors) has been a good one to keep eyes on.

With these major symbols coming so close to the 50-day moving average and finding buyers and support, they have created a good sense of what we should look for next week depending on if they hold or break through the moving averages.

Watch for the 50-DMA to become a place of support with an expectation that the markets will move higher.

Or, watch to see if we head back towards the 50-DMA for a potential break and a larger correction in the market.

Either way, it has created a level for us to watch closely, helping us to better control risk in these volatile times.

Check out my StockchartsTV segment from last week where I cover the macro showing you that the market’s sell off, although volatile, is not necessarily spelling a top yet. I also take you through the evidence of what would make the market rise or fall from here as we head closer to the election. Plus, I show you why the stagflation theory is still relevant

S&P 500 (SPY) 329 support 348 resistance

Russell 2000 (IWM) 149 support 160 resistance

Dow (DIA) 275 support 292 key resistance

Nasdaq (QQQ) 269 key support

KRE (Regional Banks) 38 key support 40 pivotal.

SMH (Semiconductors) 165 new support 50-DMA 178 resistance

IYT (Transportation) Watching for a run back over the 10 DMA with resistance at 203 support at 198

IBB (Biotechnology) Close pullback from 200-DMA Look for a move back to 130-136 range

XRT (Retail) Next support at 50-DMA 48.00 if 50 cannot hold

Volatility Index (VXX) Watching support at the 50 and 200 DMA level around 28.00

Junk Bonds (JNK) 104-105 support range

LQD (iShs iBoxx High yield Bonds) 134.56 next support

GLD (Gold Trust) Held 180 support perfectly

GDX (Gold Miners) Closed over 50-DMA Looking to continue up over 10-DMA

Twitter: @marketminute

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.